- Expedia Group recently garnered heightened attention after analysts revised earnings estimates upward for fiscal 2025, citing strong underlying financial momentum.

- This shift has positioned Expedia as an appealing choice for momentum-oriented investors, reflecting a convergence of analyst optimism and robust earnings fundamentals.

- We'll explore how these upward analyst revisions and momentum in fundamentals may influence Expedia Group's long-term investment thesis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Expedia Group Investment Narrative Recap

To be a shareholder in Expedia Group, you need conviction in the continued global shift toward digital travel bookings and faith in the company’s ability to grow both its B2C and B2B franchises, especially as travel demand recovers. The recent analyst upgrades and momentum in earnings estimates could reinforce positive investor sentiment, yet they don’t immediately address the biggest near-term risk: lingering softness in the US market, where lower-end consumer demand and price sensitivity could challenge margin expansion.

Among Expedia’s recent announcements, the August 2025 upward revision of fiscal year revenue guidance stands out as most relevant to the earnings estimate upgrades. Management’s boosted outlook for 3% to 5% sales growth directly ties to the catalysts underpinning analyst optimism and supports the case for positive short-term momentum, even as cyclical risk in key consumer segments persists.

On the other hand, investors should not overlook the continuing exposure to price sensitivity and promotional pressures in the US which could...

Read the full narrative on Expedia Group (it's free!)

Expedia Group's outlook anticipates $16.9 billion in revenue and $2.1 billion in earnings by 2028. This implies 6.4% annual revenue growth and a $1.0 billion increase in earnings from the current $1.1 billion.

Uncover how Expedia Group's forecasts yield a $222.45 fair value, a 4% upside to its current price.

Exploring Other Perspectives

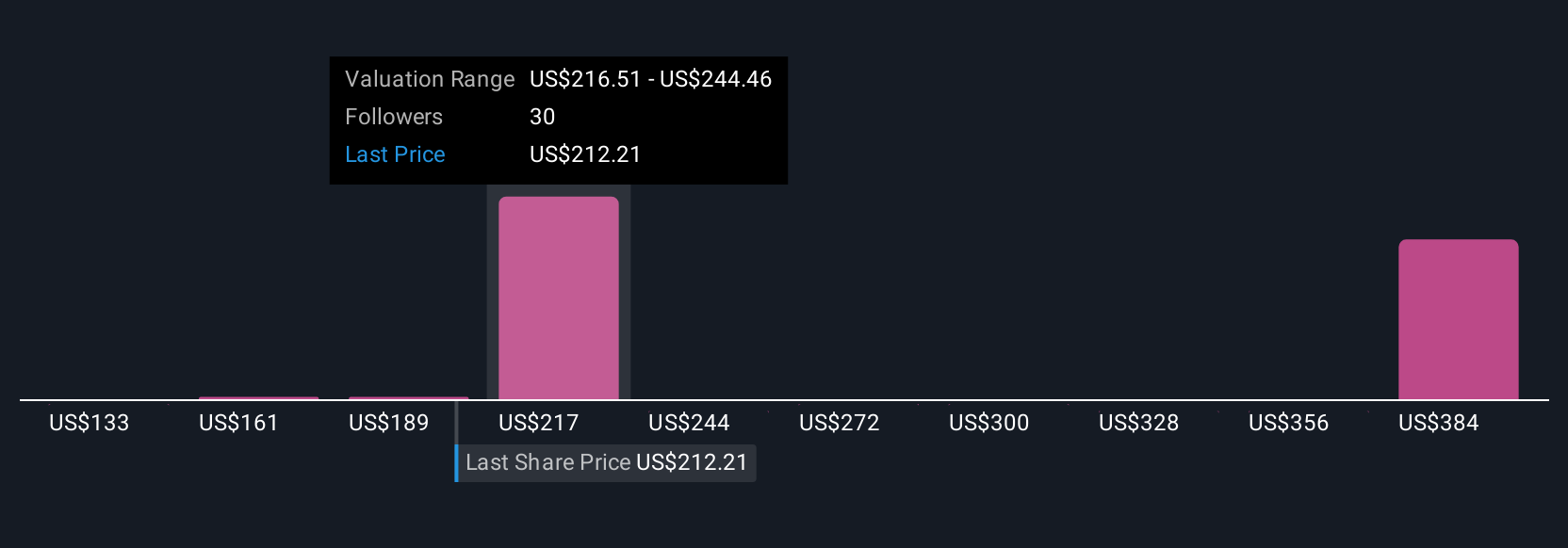

Simply Wall St Community members place Expedia’s fair value between US$132.67 and US$415.84, based on 10 individual forecasts. While many foresee upside, ongoing pressure from US consumer softness could influence performance for those tracking margin trends, explore how others frame these risks and opportunities.

Explore 10 other fair value estimates on Expedia Group - why the stock might be worth 38% less than the current price!

Build Your Own Expedia Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expedia Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Expedia Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expedia Group's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com