- Spa Monarch, part of Monarch Casino Resort Spa, was ranked the #2 Best Hotel Spa in the United States for the second consecutive year by USA Today's 10Best Readers' Choice Awards, marking its third consecutive year of top rankings.

- This continued national recognition underscores Monarch's growing reputation as a leader in luxury wellness experiences and hospitality excellence.

- We'll explore how Spa Monarch's elevated brand recognition through these awards could further strengthen Monarch Casino & Resort's investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

What Is Monarch Casino & Resort's Investment Narrative?

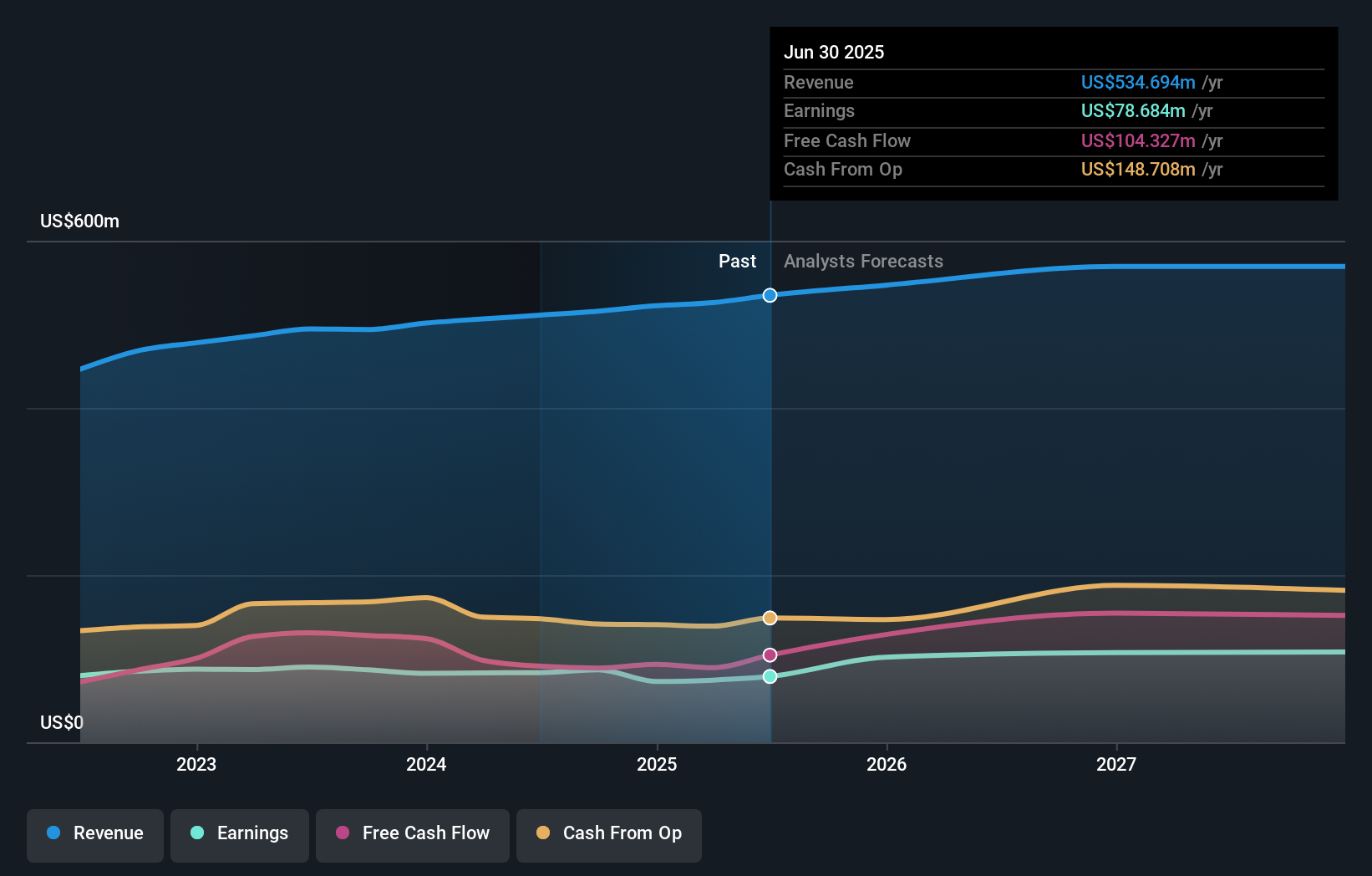

For shareholders of Monarch Casino & Resort, continued earnings growth, strong cash flow, and a clear focus on shareholder returns have shaped the company’s core story. The renewed national spotlight on Spa Monarch, recognized as a top hotel spa for the second straight year, could support short-term operating catalysts by drawing premium visitors and anchoring the brand further in the luxury wellness segment. While the recent accolade enhances Monarch’s reputation, the company’s most immediate drivers, expansion, disciplined cost control, and robust capital returns through dividends and buybacks, remain unchanged. The top-tier spa recognition is unlikely to significantly alter the key risks weighed by investors, such as moderated revenue and earnings growth forecasts, high price-to-earnings multiples, and recent insider selling. However, sustained positive press could provide incremental support to valuation, especially as market sentiment becomes increasingly important to near-term price action.

But while brand momentum strengthens, not all risk factors have faded from the spotlight. Monarch Casino & Resort's shares have been on the rise but are still potentially undervalued by 26%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Monarch Casino & Resort - why the stock might be worth as much as 35% more than the current price!

Build Your Own Monarch Casino & Resort Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monarch Casino & Resort research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Monarch Casino & Resort research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monarch Casino & Resort's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com