- Deere & Company recently reported a decline in third quarter revenue and net income, and lowered its earnings guidance for fiscal 2025 to a range of US$4.75 billion to US$5.25 billion.

- These results reflect ongoing headwinds in the agricultural equipment market and downward momentum in Deere’s business growth, prompting adjustments in market expectations.

- With Deere lowering its earnings outlook, we'll examine how current agricultural demand challenges could affect the company's long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Deere Investment Narrative Recap

To own Deere shares, an investor needs to have confidence in a long-term rebound for the global agricultural equipment market and in Deere’s ability to drive margins through technology and innovation. The recent cuts to fiscal 2025 guidance reflect that soft North American demand remains the biggest near-term risk, while rapid adoption of precision ag remains the key catalyst. In this context, the lowered outlook is material and keeps near-term pressure on both revenue growth and sentiment.

Among recent company announcements, Deere’s Q3 earnings stood out, showing a year-over-year drop in both sales and net income. This performance, which led to the revised guidance, ties directly to the current uncertainty and volatility across Deere’s largest markets and highlights the immediate challenges to the company’s growth narrative.

In contrast, investors should be aware that sustained incentive use and financial services support...

Read the full narrative on Deere (it's free!)

Deere's narrative projects $45.2 billion revenue and $8.6 billion earnings by 2028. This requires a 0.7% yearly revenue decline and a $3.4 billion earnings increase from $5.2 billion today.

Uncover how Deere's forecasts yield a $534.85 fair value, a 8% upside to its current price.

Exploring Other Perspectives

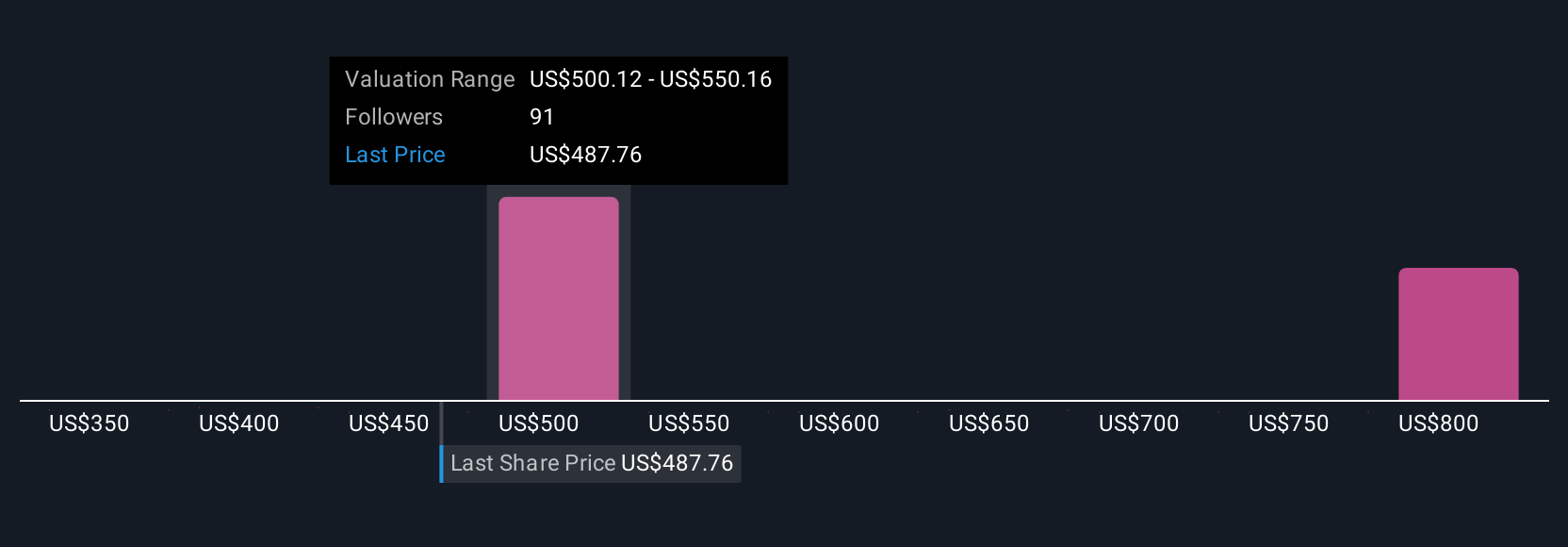

Seven fair value estimates from the Simply Wall St Community cluster between US$350 and US$853 per share, underscoring diverse investor outlooks. As many weigh Deere’s exposure to North American ag volatility, you can explore these alternative views firsthand.

Explore 7 other fair value estimates on Deere - why the stock might be worth as much as 72% more than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com