PACCAR (PCAR) just reported its second-quarter 2025 results, and the numbers are certainly getting investor attention, especially if you are weighing the next move for your own portfolio. The company delivered earnings per share of $1.37, topping analyst estimates, but that headline victory masks some softer spots under the hood. Revenues from the key Trucks segment slipped compared to last year, and pre-tax income took a meaningful hit. That combination of outperforming expectations while still posting year-over-year declines is making investors reconsider where PACCAR stands right now.

This earnings update comes at an interesting time for PACCAR. The stock has seen nearly 10% growth over the past year, with a more muted performance in recent months. While PACCAR’s three- and five-year gains remain impressive, short-term momentum has tapered off, likely reflecting shifting sentiment in light of recent estimate downgrades and emerging questions about the outlook for truck demand. The mix of long-term strength and current headwinds is creating a lot of crosscurrents for anyone assessing the share price today.

With earnings beating estimates but operational clouds still hanging overhead, some investors are considering whether PACCAR is trading at a discount to its value or if the current price is already signaling lower growth ahead.

Most Popular Narrative: 2.8% Undervalued

According to community narrative, PACCAR is currently priced just below its fair value, based on expectations of moderate growth in earnings and profit margins over the coming years. This valuation reflects optimism around several industry catalysts and company-specific investments, which are seen as important drivers of future performance.

Ongoing investments in next-generation clean diesel, alternative powertrains, and connected vehicle services position PACCAR to capture future growth as fleets transition towards more efficient and zero-emission vehicles. These efforts support potential long-term top line and margin expansion.

What is just beneath the surface of this “undervalued” call? One part green tech, a measure of heavy-duty demand, and a significant focus on regaining margin power. Want to unlock the financial fundamentals that could influence earnings and share price? Find out what assumptions support this narrative’s value projection.

Result: Fair Value of $104.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff uncertainty and regional economic slowdowns remain wild cards that could disrupt PACCAR’s growth projections sooner than expected.

Find out about the key risks to this PACCAR narrative.Another View: DCF Model Offers a Different Angle

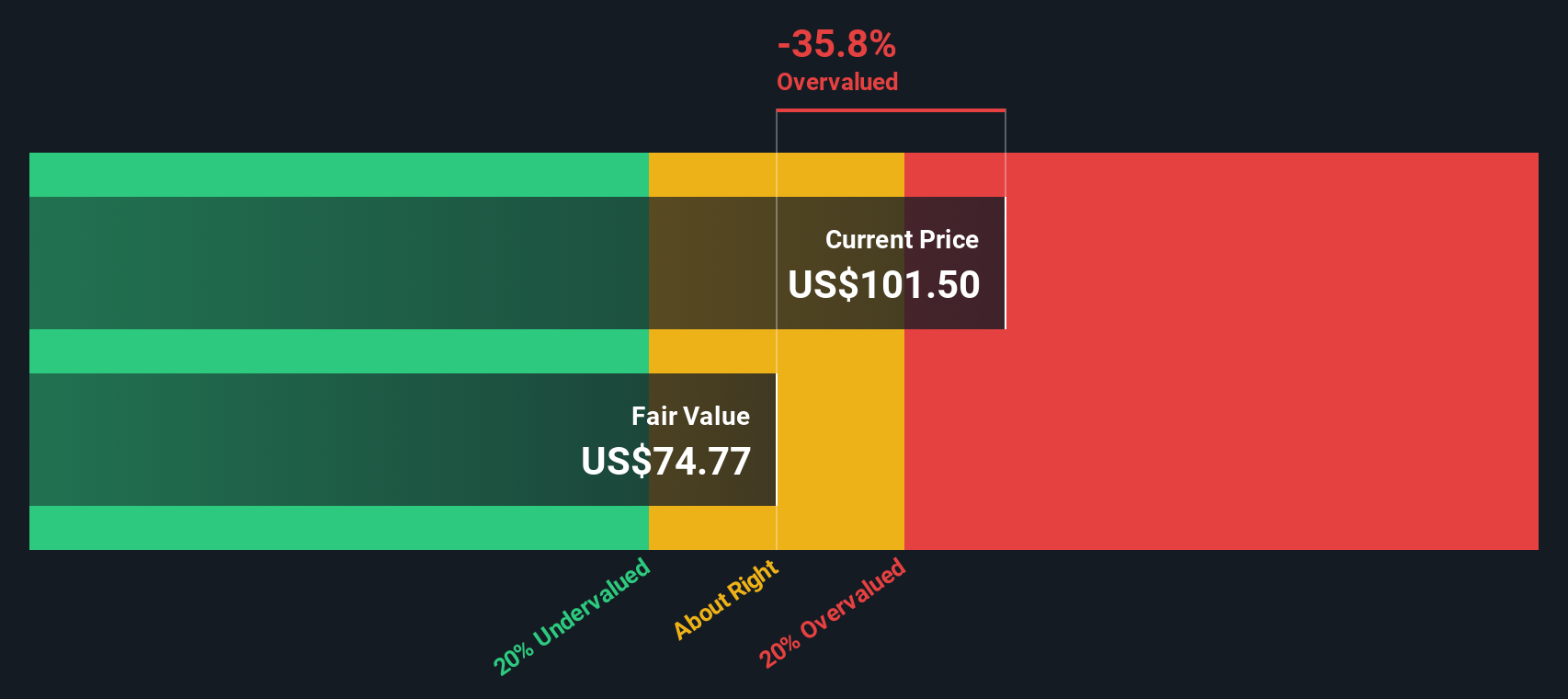

While the community view suggests PACCAR may be undervalued, our DCF model tells a different story altogether. In this approach, the shares appear overvalued when weighing future cash flows. Which perspective best captures the current reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PACCAR Narrative

If you see things differently, or want to dig deeper on your own, you can quickly put together your own story and perspective in just a few minutes. do it your way.

A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Set yourself apart by scanning the market in smarter ways. The Simply Wall Street screener puts a world of investment angles at your fingertips. See where your next edge could come from with these standout strategies:

- Strengthen your income stream by seizing opportunities with dividend stocks with yields > 3% and benefit from stocks offering yields above 3% for reliable returns.

- Jump into tomorrow’s tech by reviewing AI penny stocks and stay ahead as artificial intelligence transforms the investment landscape.

- Maximize value potential by targeting undervalued stocks based on cash flows focused on companies trading below their intrinsic worth based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com