This week, Travel + Leisure (TNL) made a noteworthy move in its balance sheet playbook by issuing $500 million in senior secured notes, set to mature in 2033 with an interest rate just below 6.2%. The fresh capital is earmarked primarily to retire older 6.6% notes due next year and reduce borrowing from existing credit facilities. For investors, these steps suggest management is working to lower the company’s interest expenses and stretch out repayment timelines. This approach may free up extra cash flow for other business needs and potential growth initiatives.

The market’s response has been positive, though not exuberant. Travel + Leisure’s shares are up almost 49% over the past year, and more than 25% since January. Recent performance shows continued upward momentum, with a 31% gain in the past three months even as news of the debt offering surfaced. Combined with the steady dividend, these moves indicate the company is balancing shareholder returns while also seeking to fortify its financial position.

The key question now is whether this momentum opens up a real value opportunity or if the market has already priced in a brighter future for Travel + Leisure.

Most Popular Narrative: 7.7% Undervalued, According to Community Narrative

Based on the latest analyst consensus and projected financials, Travel + Leisure is considered undervalued by 7.7%, using a discount rate of 12.32% to estimate fair value.

The expansion into new brands (Accor, Sports Illustrated Resorts, Margaritaville) and international markets, particularly with support from leading global hospitality partners, is expected to broaden Travel + Leisure's customer base and diversify revenue streams. This could position the company for sustained long-term top-line growth.

Wondering what’s fueling this discount? This narrative focuses on accelerated growth from new partnerships and expanding technology. The real story centers on future profitability assumptions and a profit multiple that is uncommon outside of some high-growth sectors. Interested in how analysts reach a price target well above today’s levels? Read the full narrative to see why the company’s next chapter is capturing attention.

Result: Fair Value of $67.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks linger, including overreliance on US-centric vacation ownership and potential industry disruption from changing consumer preferences or digital-first competitors, which could challenge growth assumptions.

Find out about the key risks to this Travel + Leisure narrative.Another View: What Does Our DCF Model Say?

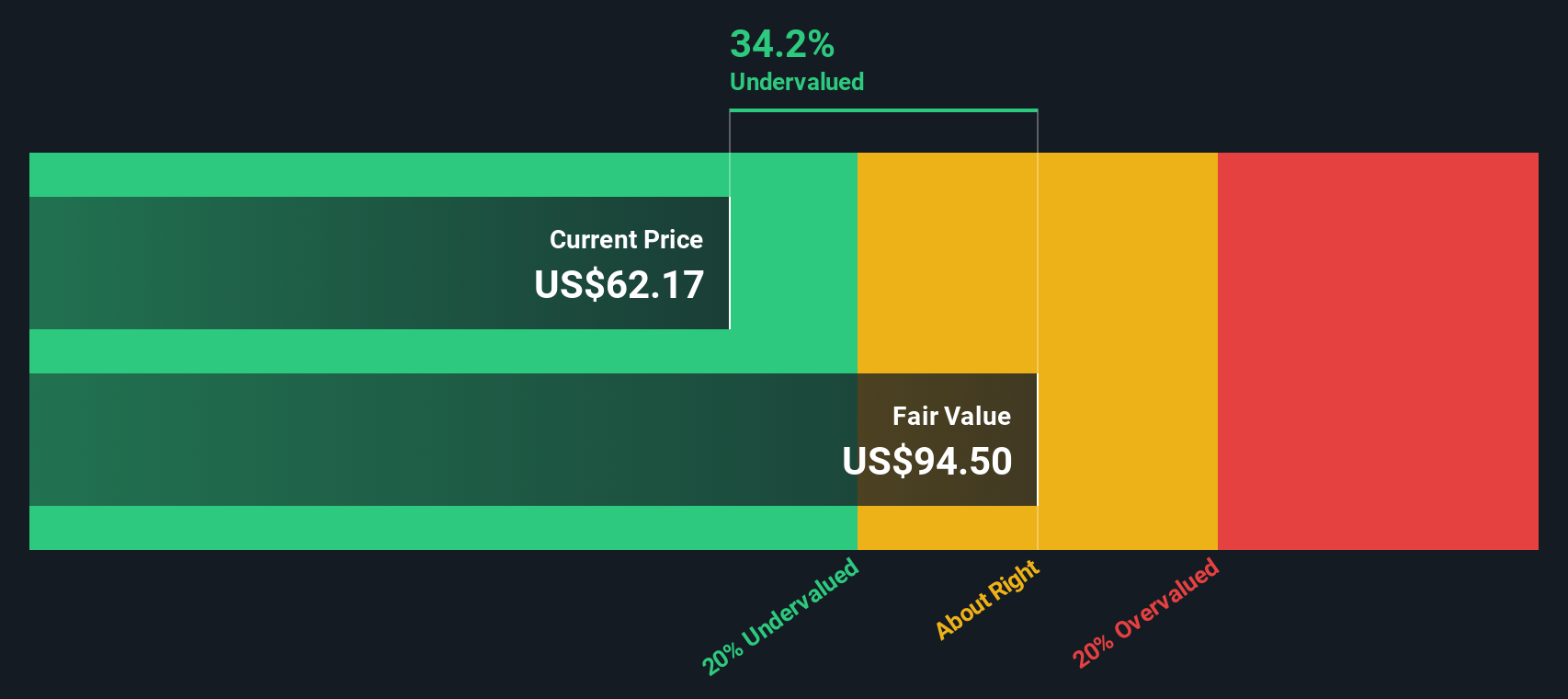

Looking from a different angle, the Simply Wall St DCF model also points to Travel + Leisure being undervalued. This method weighs future cash flows against today’s price. However, does it capture everything the market sees?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Travel + Leisure Narrative

If you have a different outlook or want to investigate the numbers personally, you can quickly develop your own narrative in a matter of minutes. So why not do it your way?

A great starting point for your Travel + Leisure research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Don’t limit yourself to just one company when a world of potential is a click away. Get ahead of the curve by seeking out stocks with strong financials, cutting-edge innovation, or reliable yields. Other investors are jumping on these opportunities, so make sure you’re not left behind.

- Spot companies offering reliable income streams when you check out stocks boasting dividend stocks with yields > 3%.

- Unlock rapid growth possibilities by targeting AI penny stocks dominating the artificial intelligence landscape.

- Find tomorrow’s market leaders with robust finances through our penny stocks with strong financials spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com