The Toro Company (TTC) is turning heads this week following the appointment of Edric C. Funk as its new president and chief operating officer. With nearly three decades at Toro, Funk’s track record, ranging from driving technology acquisitions to leading key business segments, signals the company’s continued push into smart solutions and innovation. For investors, leadership shifts like this often act as catalysts, shaking up market sentiment and sparking fresh takes on a company’s growth story.

This executive change comes at an interesting juncture for Toro. While the stock has edged up about 7% over the past three months, it remains down 11% for the past year. That’s despite steady, if modest, annual revenue and net income growth. The longer-term picture is mixed. Momentum has returned recently, but the stock’s performance over the last three years is nearly flat. These crosscurrents point to a company in transition, with the market seemingly reevaluating its future potential in light of both innovation and ongoing financial discipline.

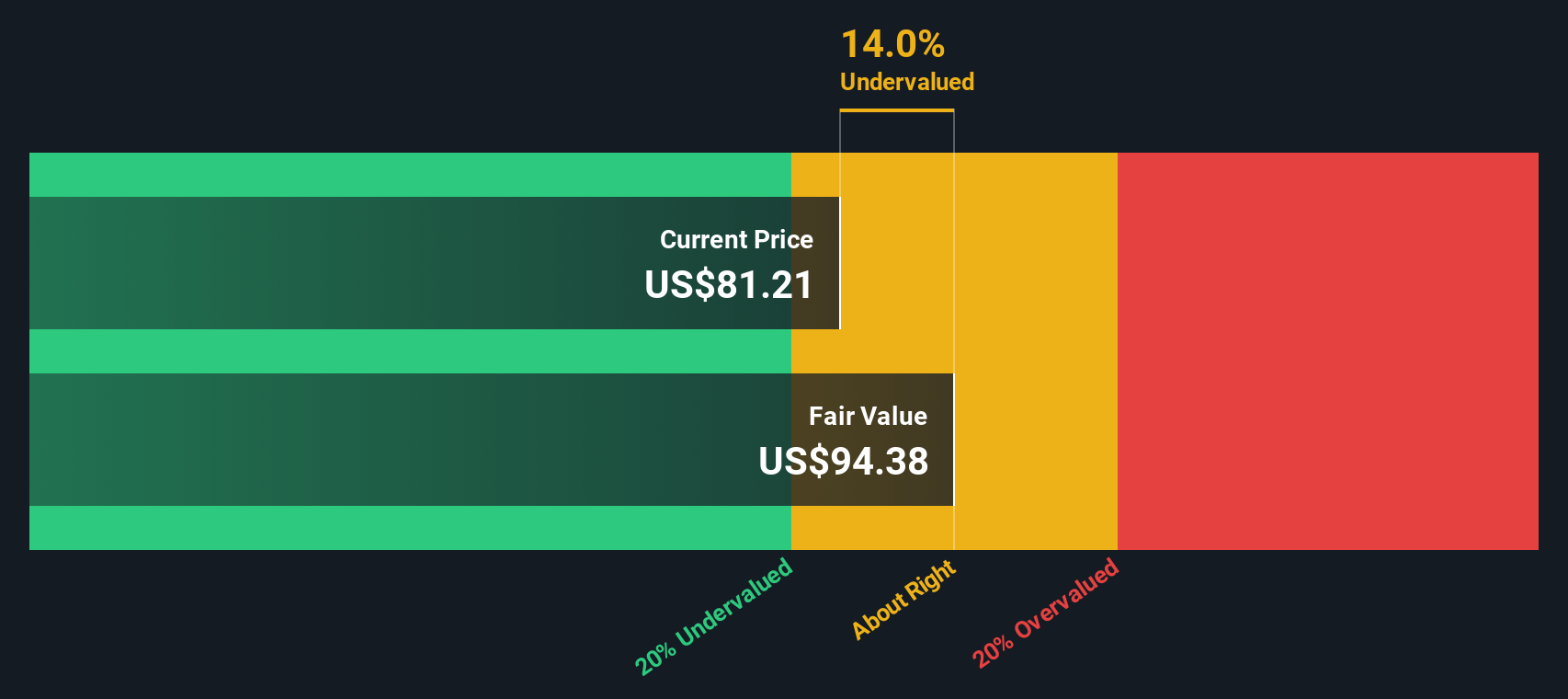

After this recent uptick and major leadership move, is Toro now undervalued, or has the market already factored in Funk’s growth plans and the evolving business strategy?

Most Popular Narrative: 3.5% Undervalued

According to community narrative, Toro is currently trading slightly below what analysts consider its fair value, based on a blend of innovation bets and cautious forecasts for future financial performance.

Toro is prioritizing innovation to address customer needs and align with market growth trends. This approach may support revenue growth. The introduction of cutting-edge products, such as autonomous mowers and smart connected solutions, aims to improve productivity and resource efficiency. These initiatives enhance Toro's competitive position and may contribute to increases in sales and profitability.

Interested in what is driving this positive valuation? The reasoning behind the analyst target combines ambitious product rollouts with evolving profit margins and expectations about future earnings. Want to see how far these projections go? Explore further to learn more about the specific factors analysts consider in setting Toro's fair value above the current market price.

Result: Fair Value of $82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated dealer inventories and exposure to shifting trade policies could quickly challenge these upbeat projections for Toro’s growth and valuation.

Find out about the key risks to this Toro narrative.Another View: DCF Model Says Undervalued Too

Toro’s stock also shows value when tested with our DCF model, which looks at long-term cash flows instead of market multiples. This approach still finds shares undervalued, but it comes with its own set of assumptions. Is this extra margin of safety real, or simply optimistic modeling?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toro Narrative

If you see Toro’s story differently, or want to dig deeper into the numbers yourself, you can build your own narrative in just a few minutes and do it your way.

A great starting point for your Toro research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead in the market means knowing where fresh opportunities are coming from. Don't limit yourself to just one company, when a whole world of standout stocks awaits. Put your investment goals into action and uncover new possibilities using these powerful stock searches:

- Tap into the power of regular income and uncover companies offering yields above 3% through dividend stocks with yields > 3%.

- Spot game-changers riding the artificial intelligence wave with our list of fast-growing AI innovators: AI penny stocks.

- Zero in on tomorrow’s breakthroughs and connect with top quantum computing leaders using quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com