- On August 12, 2025, Roper Technologies completed the issuance and sale of US$2.00 billion in senior unsecured notes, including US$500 million due 2028 at 4.250%, US$500 million due 2030 at 4.450%, and US$1.00 billion due 2035 at 5.100%, with BofA Securities, J.P. Morgan Securities, and Wells Fargo Securities as underwriters.

- This substantial debt financing follows Roper’s second-quarter 2025 results, where strong Application Software performance and recent acquisitions prompted the company to raise its financial outlook for the year.

- We'll explore how Roper’s significant capital raise may influence its approach to acquisitions and organic growth initiatives moving forward.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Roper Technologies Investment Narrative Recap

For me, the core Roper Technologies investment case rests on its ability to drive recurring revenue and margins from niche vertical market software, fueled by organic growth and disciplined acquisitions. The recent US$2.00 billion debt issuance increases financial flexibility and could support upcoming acquisitions, but it does not meaningfully alter the most immediate catalyst, continued strong demand for mission-critical software platforms, or the primary risk surrounding successful integration of acquired businesses.

This capital raise aligns most closely with Roper’s raised guidance for full-year 2025, which now anticipates 13% total revenue growth, reflecting confidence in scaling both through organic execution and M&A. Whether these growth ambitions translate into sustained profit improvement still depends on management’s ability to balance capital deployment with operational discipline.

But investors should also be mindful of the flipside: as the pace of acquisitions accelerates, risks of integration missteps and margin dilution...

Read the full narrative on Roper Technologies (it's free!)

Roper Technologies is projected to reach $10.2 billion in revenue and $2.1 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 10.9% and represents a $0.6 billion increase in earnings from the current $1.5 billion.

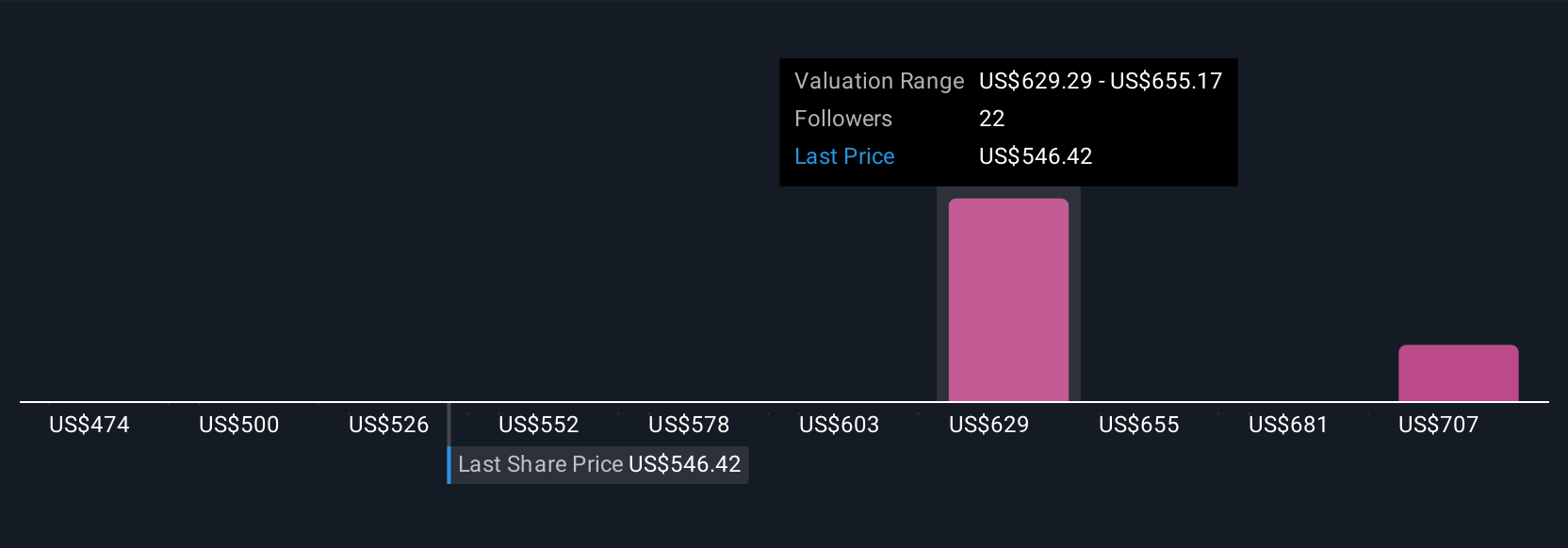

Uncover how Roper Technologies' forecasts yield a $635.83 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members estimate Roper’s fair value from US$474 to US$671.90 a share. As optimism about vertical software demand increases, your own outlook on Roper’s future integration execution may shape your conclusion quite differently.

Explore 4 other fair value estimates on Roper Technologies - why the stock might be worth 12% less than the current price!

Build Your Own Roper Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roper Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Roper Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roper Technologies' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com