- In news released prior to today, Federal Signal was recognized for its strong financial performance, including expected earnings per share growth of 19.4% this year and a year-over-year cash flow increase of 24.6%, outpacing industry averages.

- A key insight is that recent upward revisions in earnings estimates and strong cash flow may enable Federal Signal to expand without increased reliance on external financing, supporting ongoing business growth initiatives.

- We'll now explore how Federal Signal's robust earnings growth and positive analyst estimates influence its overall investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Federal Signal Investment Narrative Recap

Federal Signal shareholders have to believe in the company's ability to consistently deliver strong earnings while navigating industry headwinds and maintaining public sector demand. The recent news on earnings growth and robust cash flow further supports this narrative, but does not materially alter the biggest short-term catalyst, continued expansion in public sector and industrial markets, or the largest risk, which remains potential declines in municipal orders due to budget pressures.

The raised guidance for 2025, issued in July, stands out as particularly relevant alongside the recent positive results. It reinforces the current momentum from recent earnings and signals management’s confidence in achieving higher sales targets, supporting the belief that Federal Signal can capitalize on record order intake and an expanding addressable market.

However, investors should also be aware that if municipal budgets tighten unexpectedly, putting pressure on public-sector spending and new orders...

Read the full narrative on Federal Signal (it's free!)

Federal Signal's narrative projects $2.6 billion in revenue and $336.9 million in earnings by 2028. This requires 9.2% yearly revenue growth and a $115.3 million increase in earnings from $221.6 million today.

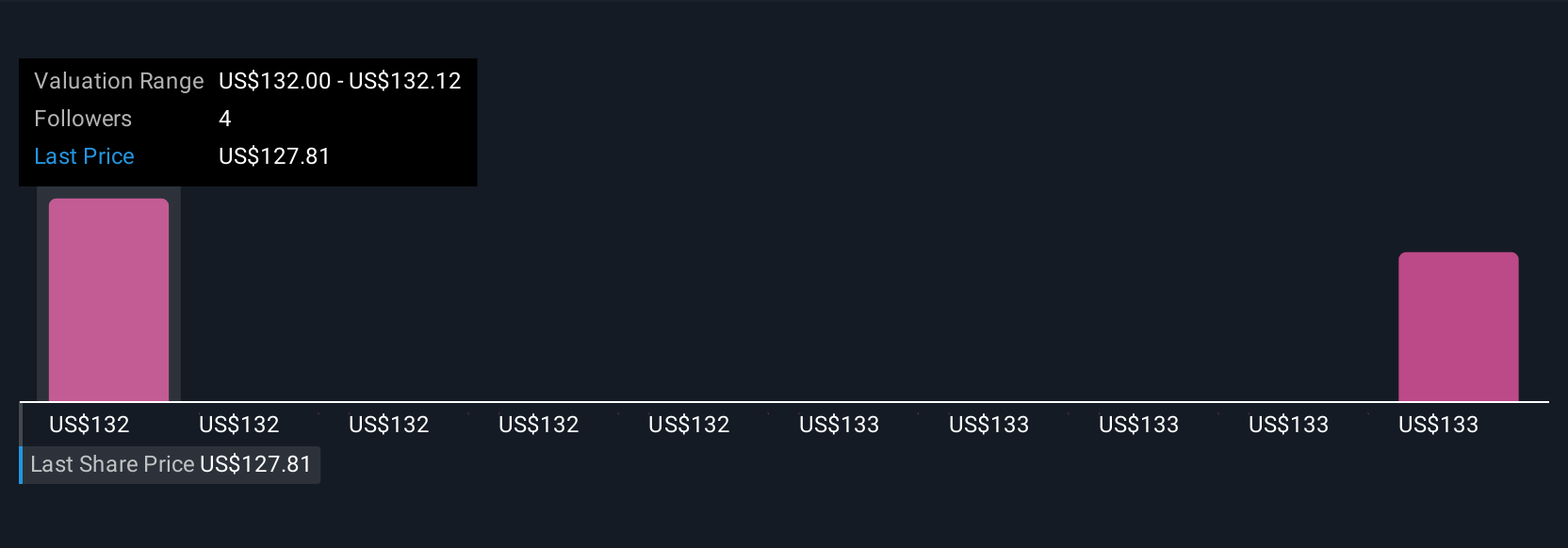

Uncover how Federal Signal's forecasts yield a $132.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimated Federal Signal’s fair value in a narrow US$132 to US$133.71 range. Yet as optimism builds around improved earnings guidance, opinions may shift rapidly, highlighting the value of considering multiple viewpoints on risks and potential upside.

Explore 2 other fair value estimates on Federal Signal - why the stock might be worth as much as $133.71!

Build Your Own Federal Signal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal Signal research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Federal Signal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal Signal's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com