- Earlier in August 2025, Travel + Leisure Co. completed a US$500 million offering of 6.125% senior secured notes due 2033, planning to use the proceeds to redeem its existing 6.60% notes due October 2025, pay down credit facility debt, cover offering expenses, and possibly for general corporate purposes.

- This debt refinancing initiative may alter the company's interest obligations and liquidity profile, potentially shaping future financial flexibility and capital allocation decisions.

- We'll consider how this refinancing impacts Travel + Leisure’s balance sheet strength and the investment outlook set by analysts.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Travel + Leisure Investment Narrative Recap

To hold Travel + Leisure shares, an investor should have confidence in the resilience of recurring revenue from vacation ownership and membership, alongside the company’s ability to adapt as travel habits and industry structures shift. The recent US$500 million refinancing marginally lowers interest costs and extends maturities, but does not change the fact that continued pressure in the Travel and Membership segment remains the key short-term catalyst and primary risk; the impact to these business drivers appears modest for now.

The company’s most recent dividend declaration of US$0.56 per share, maintaining a steady payout, stands out as relevant here; despite new debt issuance, management continues to affirm shareholder returns. This consistency reinforces the importance of free cash flow generation and signals confidence in sustaining payouts amid evolving business conditions.

But against these positive signals, investors should not overlook the persistent drag from industry consolidation in travel clubs, which could still pressure revenue if...

Read the full narrative on Travel + Leisure (it's free!)

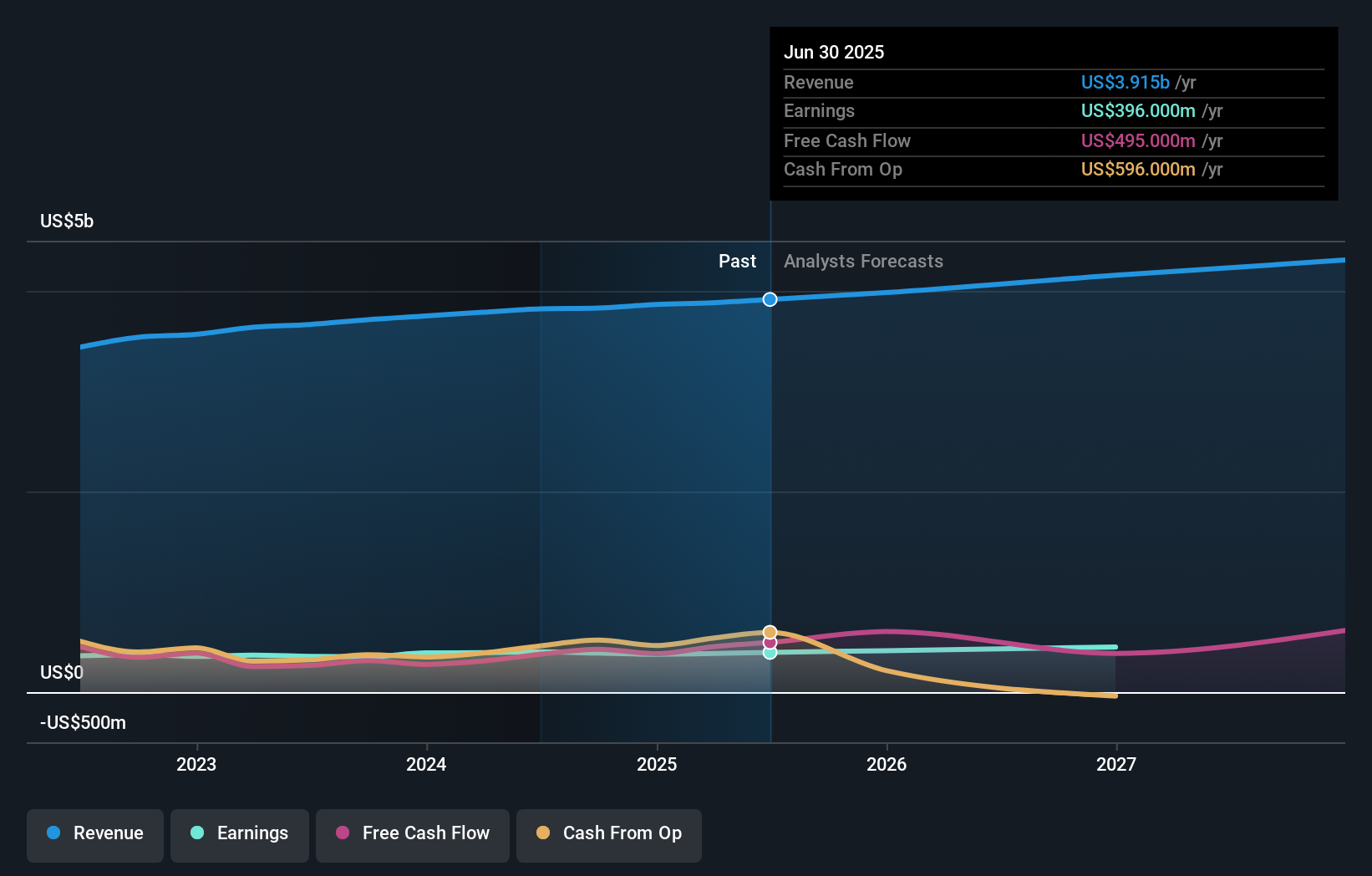

Travel + Leisure's outlook anticipates $4.4 billion in revenue and $509.8 million in earnings by 2028. This assumes a 3.9% annual revenue growth rate and a $113.8 million increase in earnings from the current $396.0 million.

Uncover how Travel + Leisure's forecasts yield a $67.67 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members calculate fair value estimates for Travel + Leisure ranging from US$43.13 to an outlier of US$61,186.95, across four separate analyses. With current refinancing efforts addressing near-term debt obligations, there are still unresolved questions about the company’s exposure to ongoing headwinds in the Travel and Membership segment that you should consider from several viewpoints.

Explore 4 other fair value estimates on Travel + Leisure - why the stock might be a potential multi-bagger!

Build Your Own Travel + Leisure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travel + Leisure research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Travel + Leisure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travel + Leisure's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com