If you are watching Booking Holdings stock right now, you are probably wondering if it is still worth the lofty price tag or if the market has already baked in all its growth potential. The company has put up strong numbers, with the share price climbing roughly 53% over the last year and outperforming both the broader travel sector and many peers. Even more impressive is the long-term picture, with the stock up more than 200% over the past five years. This kind of performance inevitably attracts more eyes and higher expectations.

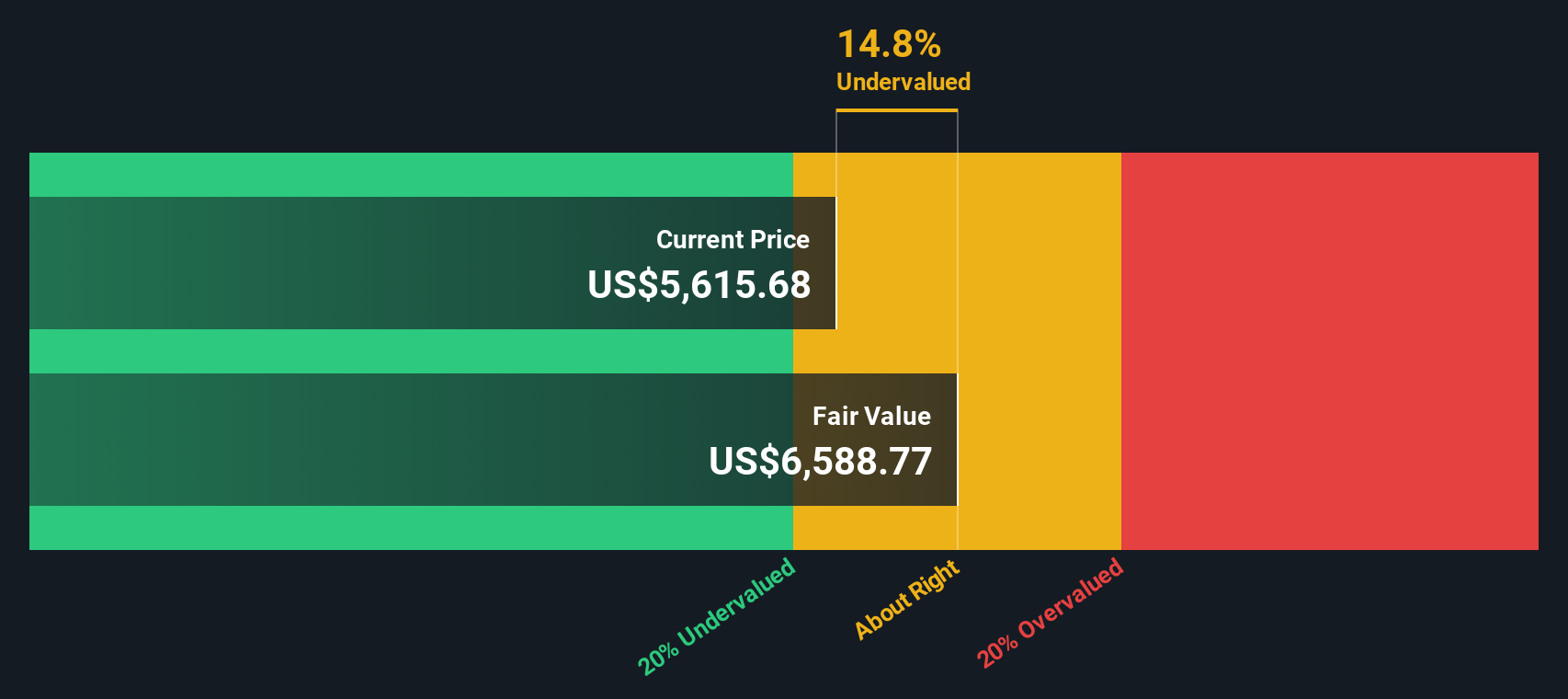

Recently, the stock has seen short-term ups and downs. It dipped a bit over the last month, but over the past quarter, shares recovered momentum and showed a healthy 7% rise. Some of this volatility can be attributed to wider market swings, but news headlines have also played a role. For example, reports of Dutch consumer groups preparing a legal claim against Booking.com may have influenced risk perceptions, even if the case’s direct impact is still unclear. Despite these ripples, analysts continue raising their price targets, and the stock still sits about 14% below what some believe is its true intrinsic value.

If you dig into valuation metrics, however, Booking only scores a 1 out of 6 on our undervaluation checks. On the surface, it looks expensive. But as you know, value is not always about numbers alone. Stick around as we break down each valuation method and, in the end, share a way to think about Booking’s real worth that you may not have considered before.

Booking Holdings delivered 52.7% returns over the last year. See how this stacks up to the rest of the Hospitality industry.Approach 1: Booking Holdings Cash Flows

The Discounted Cash Flow (DCF) model works by projecting future cash flows a company is expected to generate, and then discounting them back to today’s value. This approach helps estimate what the business is truly worth now based on its ability to produce cash over time.

For Booking Holdings, the latest twelve months of Free Cash Flow came in at $9.15 billion. Analysts expect this to keep growing, with projections showing Free Cash Flow reaching $16.4 billion a decade from now. These upward trends are factored into a two-stage DCF model, which accounts for both near-term and longer-term growth rates.

After calculating and discounting these future cash flows, the DCF model delivers an estimated intrinsic value of $6,652 per share. Compared to the current share price, this suggests Booking Holdings is trading at roughly 14.2% below its estimated value; in other words, it appears 14.2% undervalued on a cash flow basis.

Result: UNDERVALUED

Approach 2: Booking Holdings Price vs Earnings

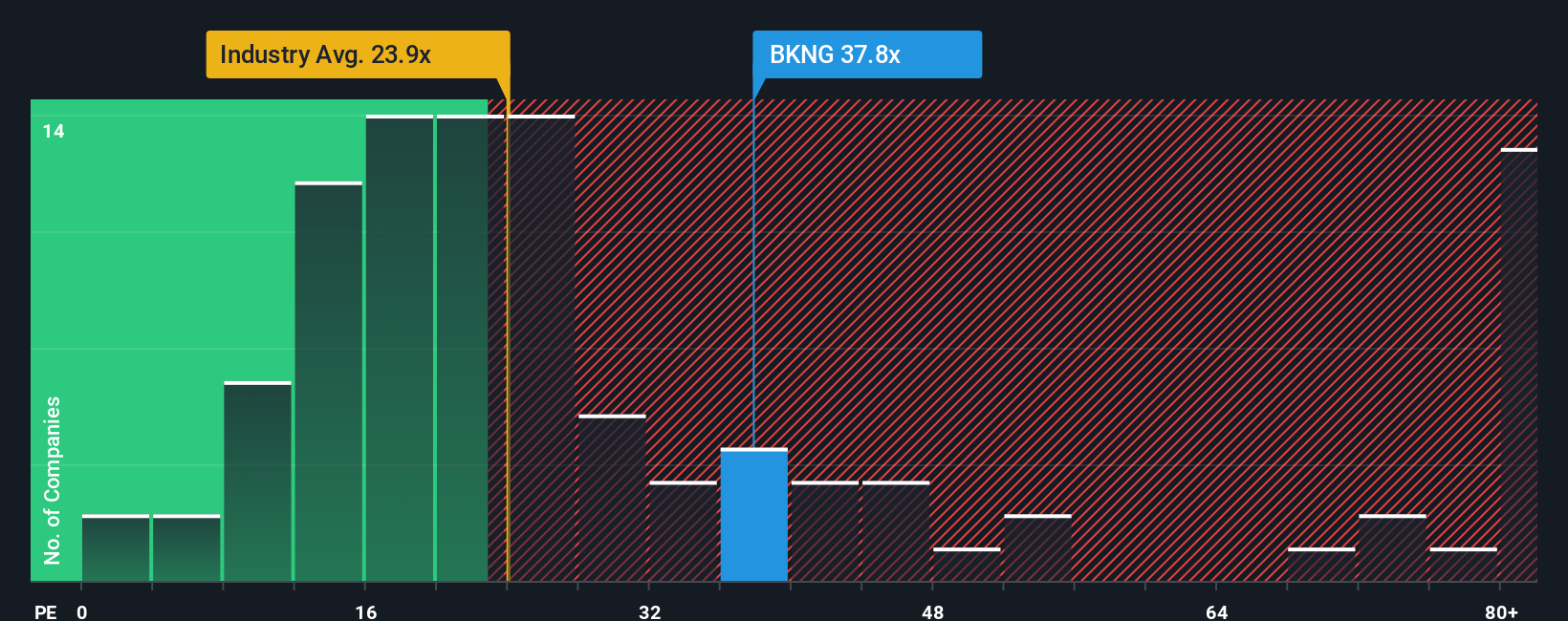

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies because it tells you how much investors are willing to pay today for each dollar of earnings. For mature, consistently profitable businesses like Booking Holdings, the PE ratio provides a straightforward way to compare value across similar firms and industries.

Growth expectations and risk are important factors in determining what is considered a “normal” or “fair” PE ratio. Companies with faster earnings growth or lower perceived risk generally deserve a higher multiple, while slower-growing or riskier firms typically trade at lower ratios. Investors also take broader industry trends and competition into account when evaluating what counts as a fair PE for any particular stock.

Currently, Booking Holdings trades at a PE ratio of 38.5x. This is higher than the hospitality industry average of 23.2x and also above the peer group average of 30.7x, which could suggest at first glance that the stock is expensive compared to similar companies. However, Simply Wall St's Fair Ratio model—which considers Booking's unique growth rate, profitability, industry dynamics, size, and risk profile—indicates a Fair PE of 38.4x. With Booking's PE nearly matching the Fair Ratio, the market appears to be pricing the stock appropriately for its prospects and risk profile.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Booking Holdings Narrative

A Narrative is your unique story about a company, connecting what you believe about its future—such as revenue, earnings, and strategy—to a personalized fair value and forecast. Narratives move beyond simple numbers by allowing you to bring your view of key business drivers and risks into your investment decision. This makes it easier to see how a company’s journey relates directly to what its shares might be worth.

Simply Wall St empowers millions of investors to use Narratives in this way, turning headlines and financial updates into dynamic, actionable insights. Narratives update in real time when news or earnings reports arrive, helping you keep your analysis relevant. This feature can make investment decisions clearer by directly comparing your Fair Value with the company’s Price, so you can act when the gap matches your strategy and risk appetite.

For example, one investor might build a Narrative around Booking Holdings’ rapid AI adoption and global partnerships, forecasting robust growth and assigning a fair value close to $7,218 per share. Another investor, focusing on economic uncertainty and rising acquisition costs, might see a fair value near $5,200. Narratives give every investor an accessible, structured way to reflect their perspective, stay adaptable, and make smarter, more confident decisions.

Do you think there's more to the story for Booking Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com