- Choice Hotels International recently announced the opening of four new Cambria Hotels properties in Templeton, California; Tampa, Florida; Plymouth, Massachusetts; and Portland, Oregon, underscoring its ongoing expansion in key U.S. travel markets.

- With sustainability-focused features such as solar-powered designs and curated local experiences, Cambria is targeting both environmentally conscious travelers and guests seeking distinct regional flair.

- We'll examine how Cambria's upscale expansion and emphasis on eco-friendly accommodations could reshape Choice Hotels International's investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Choice Hotels International Investment Narrative Recap

For shareholders in Choice Hotels International, the core belief is that continued portfolio expansion, especially in the upscale segment, can offset softness in government and international travel while driving higher margins and future earnings growth. The recent Cambria Hotels openings, while highlighting upscale and eco-friendly positioning, are unlikely to materially move the needle in the near term for RevPAR trends, which remain challenged by macroeconomic headwinds and persistent drag from slower-recovering travel segments. In context, the announcement of nearly 60 Cambria hotels in the pipeline, along with upcoming flagship openings in Times Square and debut entries in Canada, best reflects management’s commitment to upscale growth as a potential catalyst. However, these developments must overcome industry-wide revenue headwinds and lagging RevPAR to fully deliver the earnings momentum long-term holders expect. Yet, against this expansion, investors should remain mindful that ongoing RevPAR pressures may still...

Read the full narrative on Choice Hotels International (it's free!)

Choice Hotels International's outlook anticipates $1.8 billion in revenue and $354.2 million in earnings by 2028. This is based on a projected annual revenue growth rate of 30.7% and an increase in earnings of $48 million from the current $306.2 million.

Uncover how Choice Hotels International's forecasts yield a $133.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

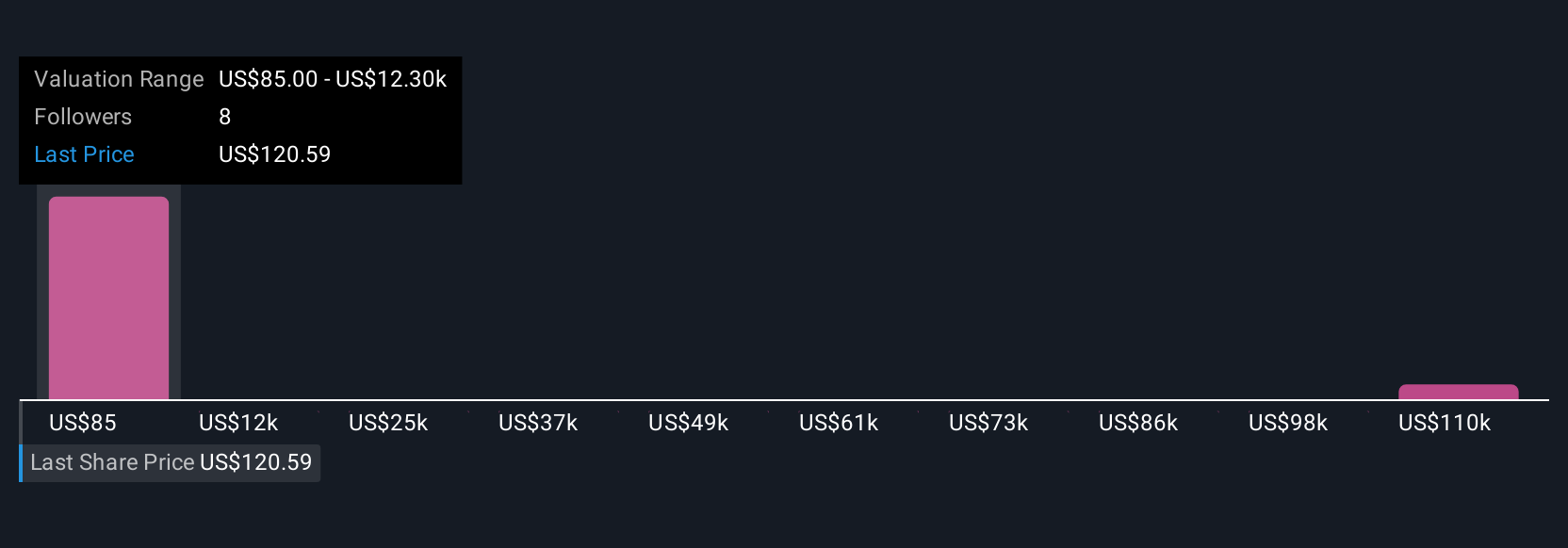

Simply Wall St Community members offered six fair value estimates for Choice Hotels International, spanning from US$85 to an outlier high above US$122,000. As the company pushes upscale expansion, many still see persistent RevPAR pressure as shaping returns ahead, see what your peers are forecasting.

Explore 6 other fair value estimates on Choice Hotels International - why the stock might be worth 29% less than the current price!

Build Your Own Choice Hotels International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Choice Hotels International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Choice Hotels International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Choice Hotels International's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com