So, you are keeping an eye on Cummins stock and wondering whether it should find a place in your portfolio, or if it is time to lock in gains. You are not alone. Cummins has caught plenty of attention lately, both for its steady performance and for the market noise swirling around industrial names. In just the past year, the stock has soared roughly 32% higher, a move that has left some investors impressed and others hesitant, asking whether the run can continue.

The most recent momentum is hard to ignore. In the past 90 days alone, Cummins has climbed a remarkable 24%. Looking further back, the five-year total return stands at an impressive 115%. It's no wonder investors are re-evaluating their stance, especially as overall market sentiment toward industrials strengthens based on expectations for infrastructure spending and the company’s ability to adapt quickly to economic shifts.

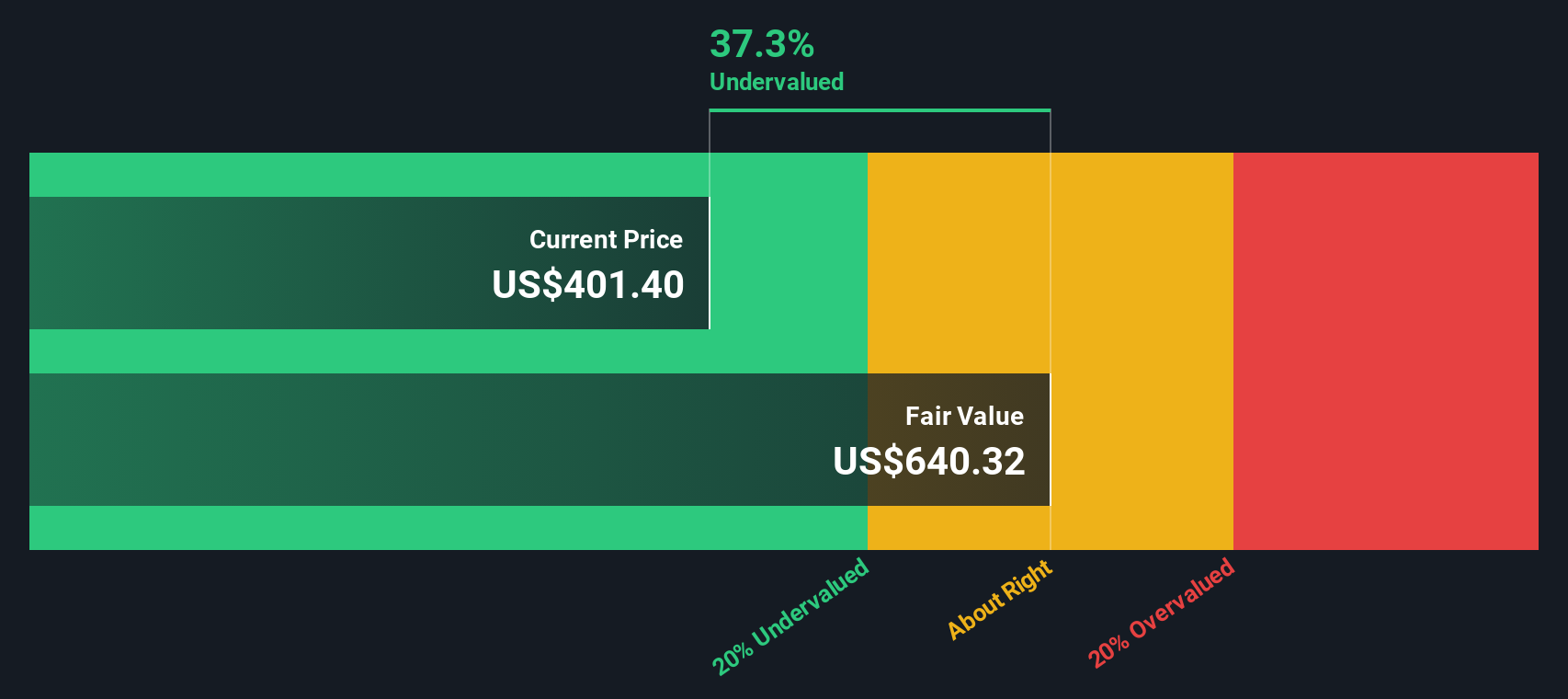

With all that in mind, valuation becomes the deciding factor: is Cummins still undervalued, or is it time to be cautious? Our value score for Cummins lands at 5 out of 6, meaning it meets five of six criteria for being undervalued. That is a compelling result, especially when you consider there is still a 38.6% discount implied by the most conservative intrinsic value calculations. In the sections ahead, we will break down each valuation approach and explore how Cummins measures up, before finishing with a fresh perspective on what really goes into valuing a stock like this.

Cummins delivered 32.3% returns over the last year. See how this stacks up to the rest of the Machinery industry.Approach 1: Cummins Cash Flows

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future free cash flows and discounting them back to present value. For Cummins, this involves analyzing what the company currently generates and is expected to generate in free cash flow over the next decade.

Cummins currently delivers $1.67 billion in Free Cash Flow, and analysts expect robust growth ahead. By 2029, projected Free Cash Flow is estimated to reach $4.63 billion, with forecasts supported by several years of increasing cash generation. Ten-year projections indicate a steady climb, with expectations of more than $6.4 billion in annual Free Cash Flow by 2035.

Using a two-stage model, Cummins’ intrinsic value is calculated at $642.22 per share. When compared to the current trading price, this suggests a 38.6% undervaluation. In other words, the market is offering shares at a significant discount to what long-term cash flows indicate the company may be worth.

Result: UNDERVALUED

Approach 2: Cummins Price vs Earnings

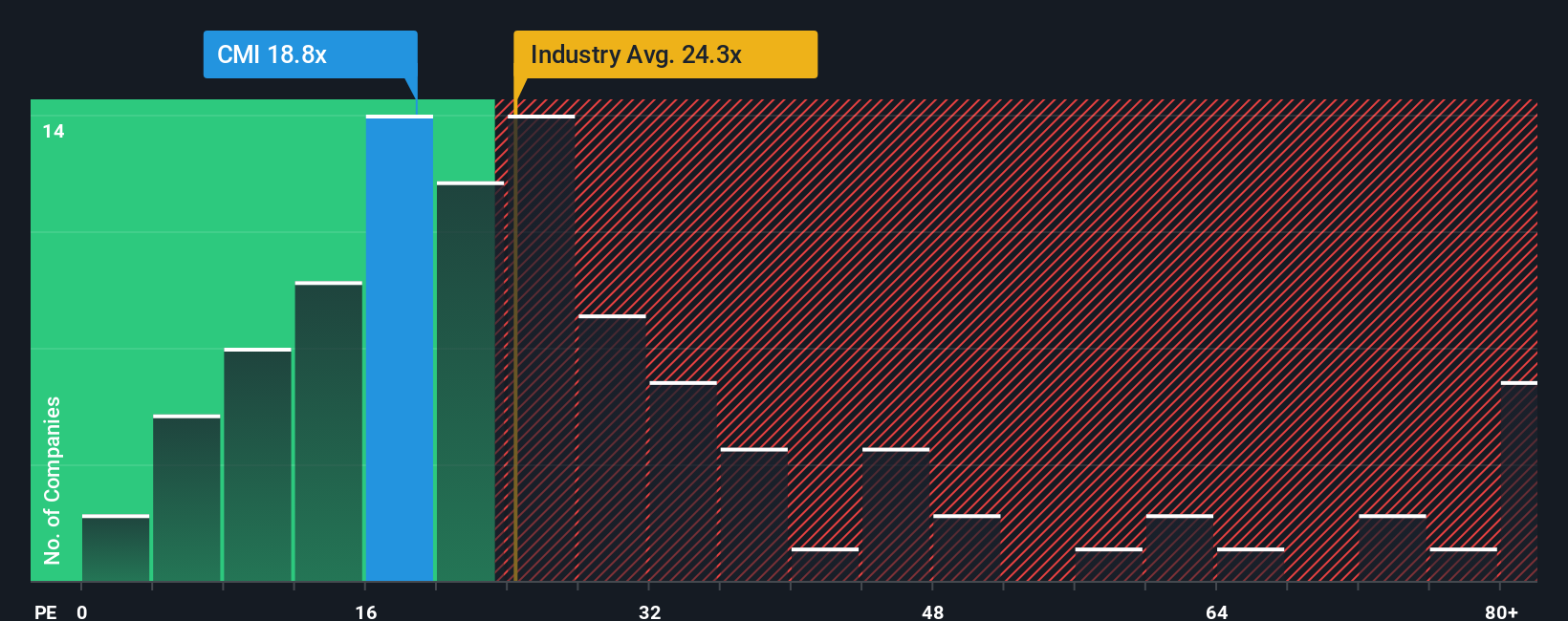

The Price-to-Earnings (PE) ratio is widely regarded as the go-to valuation tool for established, profitable businesses like Cummins. It reflects how much investors are willing to pay for every dollar of earnings, making it especially relevant when a company consistently generates solid profits year after year.

In general, higher growth expectations and lower perceived risk will drive a "normal" or "fair" PE ratio higher. Investors may anticipate more future earnings or feel more confident in the company’s prospects. Conversely, slower growth or greater risk typically results in a lower PE valuation.

Cummins currently trades at an 18.5x PE ratio. When compared to the machinery industry average of 23.7x and its direct peer average of 19.8x, the stock sits below both benchmarks, suggesting a modest discount. For additional context, Simply Wall St’s proprietary Fair Ratio for Cummins is 28.9x. This figure incorporates factors like Cummins’ profit margins, industry dynamics, and growth outlook, and suggests investors could reasonably expect to pay a higher multiple for these earnings.

Since Cummins’ current multiple is well below its Fair Ratio, the stock appears undervalued using this approach.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Cummins Narrative

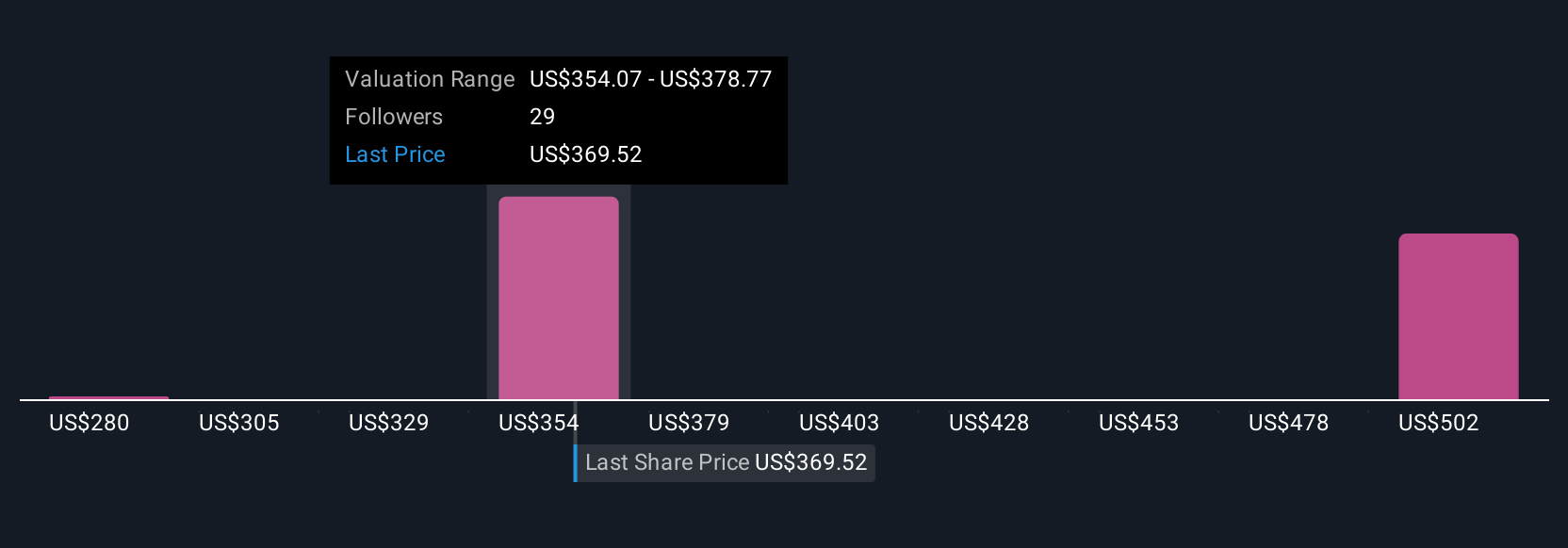

A Narrative is your unique story or perspective about a company, offering a way to explain not just what you think Cummins is worth, but why you think that way, based on your views of its future revenue, earnings, and profit margins.

Unlike a static estimate, a Narrative links a company’s business story, such as growth in clean energy, upcoming regulations, or global expansion, directly to a tailored financial forecast, which then drives your sense of fair value.

With Simply Wall St, Narratives are easy for anyone to use and share. This lets you join a broad community of investors who build and compare their own stories about companies like Cummins.

Narratives make investing decisions more dynamic by highlighting the gap between a company’s estimated Fair Value and its current share price. This approach clarifies when you might consider buying, selling, or holding.

Even better, Narratives update automatically whenever new information reaches the market, whether that is an earnings announcement or major industry news. This keeps your investment thesis current.

For example, some Cummins Narratives might see future earnings as high as $4.3 billion in 2028 and value the shares at $480, while more cautious ones might expect only $3.3 billion and a $350 fair value. This shows how different perspectives can lead to very different investment decisions.

Do you think there's more to the story for Cummins? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com