Life Time Group Holdings (LTH) just rolled out LTH Dream, a magnesium-based, melatonin-free sleep support powder. This new product fits right in with Life Time’s push to offer wellness solutions that address real consumer concerns, in this case, better sleep without side effects. It lands alongside another sign of growth, as Life Time opens a sleek new athletic country club in Atlanta that caters to health-focused professionals and families looking for community, fitness, and recovery, all under one roof.

These moves come at a time when momentum in Life Time’s stock has caught some attention. Shares are up 26% so far this year and gained nearly 20% over the past twelve months, but very recent performance has softened, with a slight dip over the past month and flat returns for the past quarter. The company’s revenue and net income have grown at healthy rates. With a long three-year return above 100%, it is fair to wonder if the market is still willing to reward the company’s expanding portfolio and footprint.

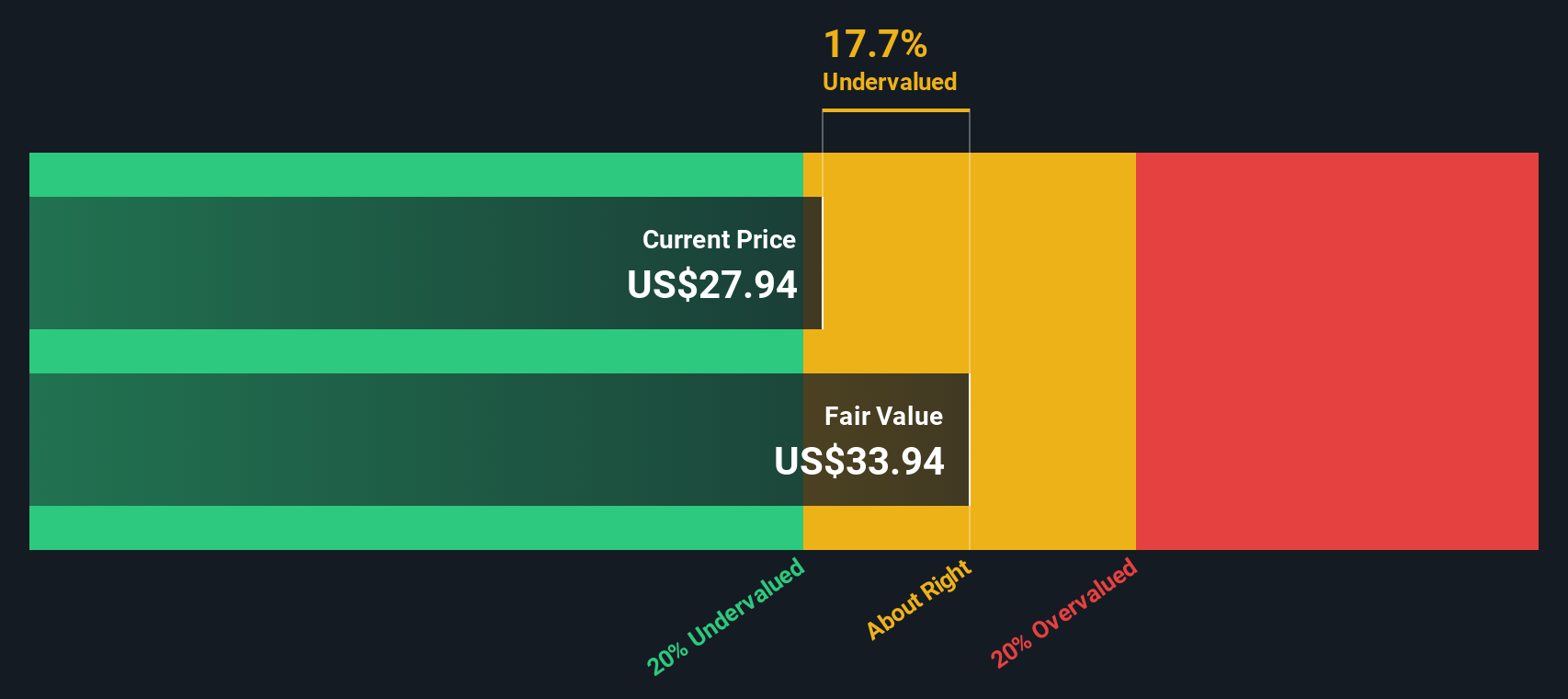

After this year’s upward climb and new launches, investors may be asking whether Life Time’s current price represents a bargain for future growth or if the market has already priced in these ambitions.

Most Popular Narrative: 27.6% Undervalued

According to community narrative, Life Time Group Holdings is considered significantly undervalued, with its fair value estimated well above the current share price. The valuation is based on the company's growth strategy, premium positioning, and ambitious future financial targets.

The expanding pipeline of new and larger club openings in affluent and high-density markets positions Life Time for sustained membership and top-line revenue growth. This is supported by the growing consumer demand for premium health, wellness, and lifestyle experiences.

Curious why analysts are calling for a price surge? The factors behind their target involve bold forecasts in revenue growth, margin expansion, and an earnings increase that investors might not expect. Want to see which ambitious predictions are convincing analysts? Discover the full narrative to find out.

Result: Fair Value of $39.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained club expansion relies on continued access to capital, and the premium strategy could face challenges if an economic downturn affects member spending.

Find out about the key risks to this Life Time Group Holdings narrative.Another View: SWS DCF Model Suggests Undervaluation

While a price-to-earnings approach points to value in the shares, our SWS DCF model also shows the stock appears undervalued compared to its estimated cash flow. Would these two methods agree for every business?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Life Time Group Holdings Narrative

If you have your own perspective or want to dive into the numbers yourself, it's easy to craft your own view using our tools in just minutes. do it your way.

A great starting point for your Life Time Group Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to just one opportunity. Now is the perfect moment to scan the market for other compelling stocks that match your goals and risk appetite. Stay a step ahead with these powerful screening tools, because your next big winner could be just a click away:

- Boost your portfolio with reliable income when you check out companies offering dividend stocks with yields > 3% that continue to deliver strong yields.

- Uncover innovative healthcare giants transforming the industry by exploring healthcare AI stocks with leading-edge medical AI solutions.

- Gain an edge in the rapidly growing tech sector by spotting AI penny stocks set to benefit from advances in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com