- In recent days, Phinia (PHIN) received a Momentum Style Score of B and was assigned a Zacks Rank of #1, reflecting increasing analyst confidence and upgraded earnings estimates for the company. This positive shift in sentiment follows a period of outperformance versus industry peers, highlighting rising expectations for Phinia's future profitability.

- Upward revisions in earnings estimates and a favorable analyst outlook have contributed to a strong market response, signaling greater confidence in management’s ability to execute its growth strategy.

- We’ll now explore how renewed analyst confidence and increased earnings projections may influence Phinia’s overall investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

PHINIA Investment Narrative Recap

To be a long-term shareholder in PHINIA, you need faith in the company’s ability to execute a transition from its core internal combustion engine (ICE) segments to more diversified technologies, particularly alternative fuels and aerospace. The recent earnings momentum and analyst upgrades are encouraging for sentiment, but these do not fundamentally change the short-term catalyst: whether PHINIA’s growing presence in alternative fuel systems can offset its ICE dependence. The most immediate risk remains customer concentration, especially exposure to legacy automotive OEMs and related product recalls.

One relevant recent announcement is PHINIA’s revised 2025 earnings guidance, projecting net sales between US$3.33 billion and US$3.43 billion and net earnings of US$140 million to US$170 million. This upgraded guidance reflects increased optimism around operational execution and solidifies the importance of new business wins and margin expansion efforts as key short-term drivers. While analyst momentum supports confidence, the pace of revenue diversification will remain critical to PHINIA’s story.

By contrast, investors should be aware of the outsized impact a major OEM recall or shift away from ICE could have on...

Read the full narrative on PHINIA (it's free!)

PHINIA's outlook anticipates $3.6 billion in revenue and $246.8 million in earnings by 2028. This is based on a projected 2.3% annual revenue growth rate and a $138.8 million increase in earnings from the current $108.0 million.

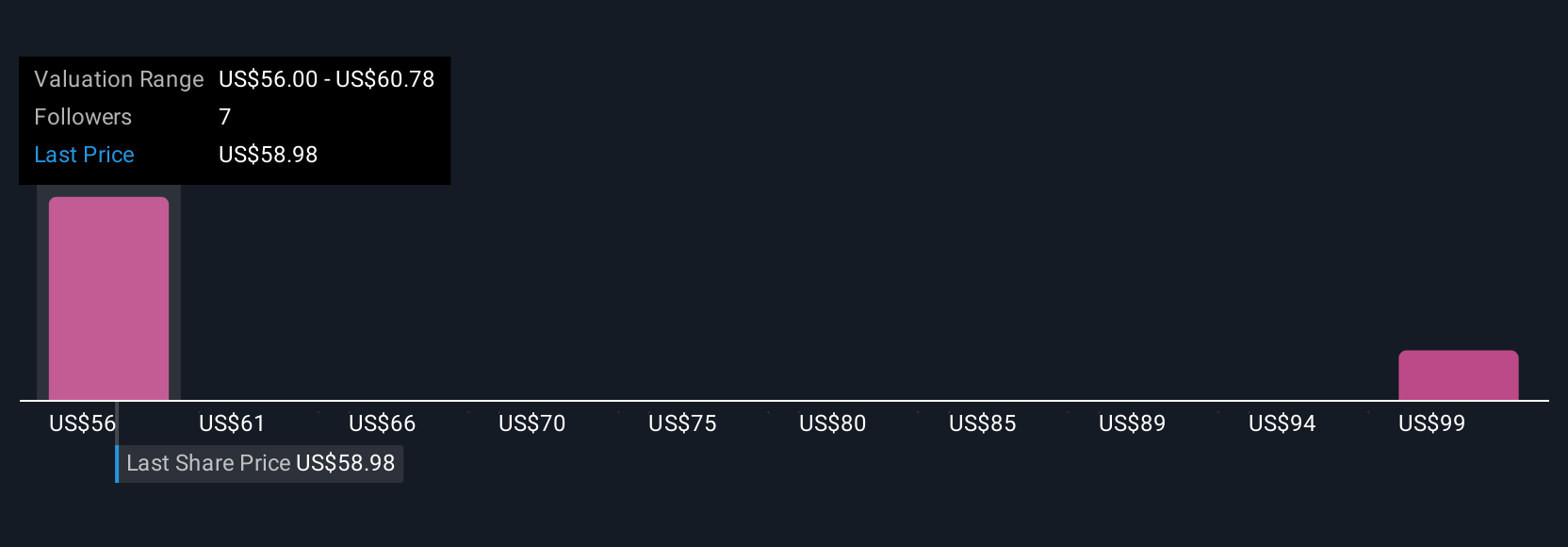

Uncover how PHINIA's forecasts yield a $56.00 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from 2 Simply Wall St Community members span a wide range, from US$56.00 to US$103.36. With PHINIA’s operational momentum drawing attention, consider how customer dependence could shape future results before deciding for yourself.

Explore 2 other fair value estimates on PHINIA - why the stock might be worth as much as 84% more than the current price!

Build Your Own PHINIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PHINIA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PHINIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PHINIA's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com