Thinking about what to do with Deere stock right now? You are not alone. Investors have watched Deere ride out both the ups and downs in recent months, with shares recently closing just below $493. On a day-to-day basis, the stock has been fairly stable, but over the last year, Deere has delivered an impressive 32.5% total return. With a five-year total return close to 149%, it is no wonder people are questioning whether there is still runway left for growth.

Much of the discussion around Deere has focused on larger market trends and global demand for agricultural equipment. Investors seem to have repositioned their expectations several times this year. After a modest pullback in the last quarter, sentiment has shifted, likely reflecting both optimistic revenue signals and evolving views on risk.

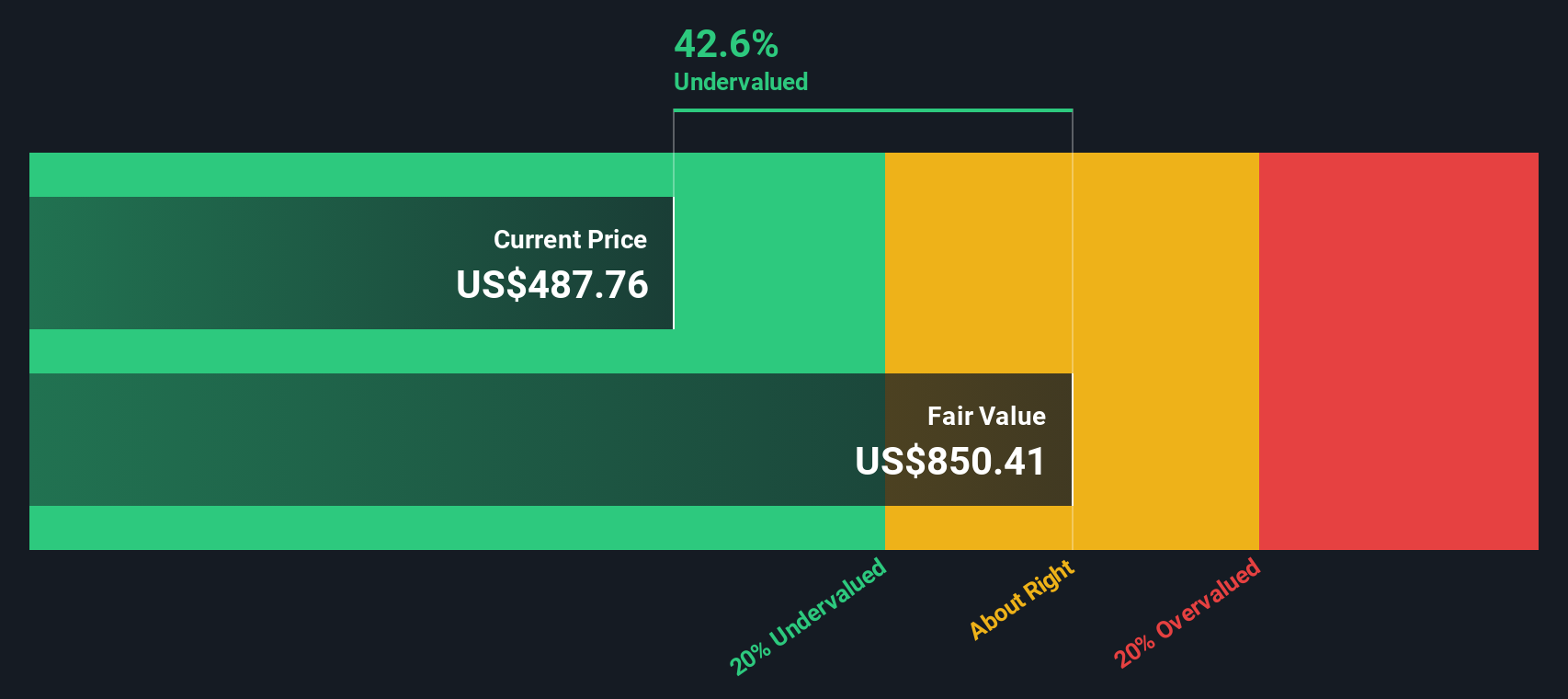

But let us get to what really matters: Is Deere undervalued or has all that positive news already been priced in? A look at the numbers gives some hope. Deere checks the box for being undervalued on 4 out of 6 standard valuation methods, giving it a value score of 4. There is even a significant 42.2% discount to the company’s intrinsic value estimate, and the current price is still about 8.6% below the average analyst target. So, how did we arrive at that score? Let us dive into the standard valuation approaches. There may even be a deeper way to look at value that can change how you see Deere entirely.

Deere delivered 32.5% returns over the last year. See how this stacks up to the rest of the Machinery industry.Approach 1: Deere Cash Flows

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future free cash flows and then discounting those streams back to today's dollars. This method gives a sense of what Deere is fundamentally worth, regardless of current market volatility.

For Deere, the latest trailing twelve months produced free cash flow of $4.83 billion. Analysts, projecting steady business momentum, expect that number to climb over time, with a forecasted free cash flow of $21.3 billion by 2035. By modeling Deere’s future growth using a two-stage DCF and discounting all those flows back to the present, the estimated intrinsic value per share is calculated at $852.32.

Compared to today’s market price of about $493, this implies Deere stock is trading at a 42.2% discount according to the DCF approach. This substantial difference suggests the market might be overlooking the long-term cash-generating potential in Deere’s business.

Result: UNDERVALUED

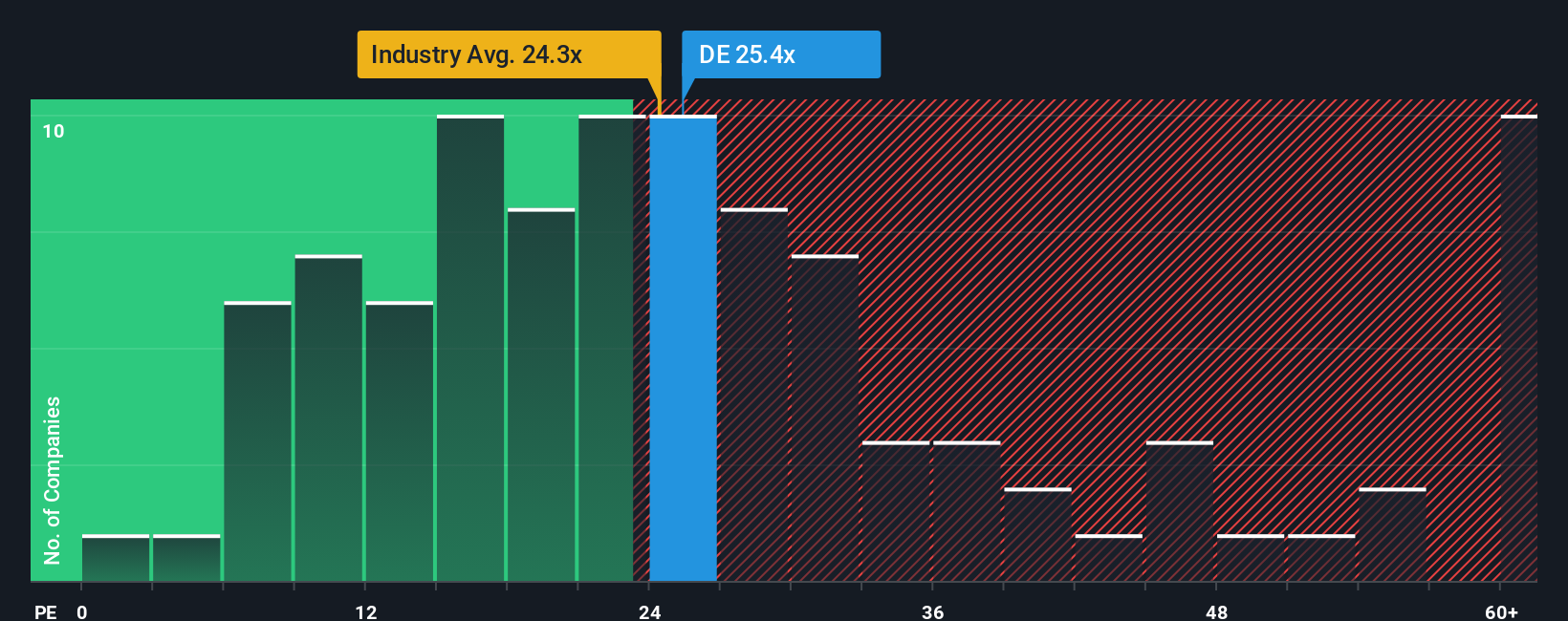

Approach 2: Deere Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used tool for valuing profitable companies because it connects a company's share price directly to its underlying earnings. A lower PE can signal that the stock is trading at a discount relative to its earnings power, while a higher PE can reflect strong anticipated growth or a willingness by investors to pay more for future performance.

However, what counts as a "normal" or "fair" PE ratio can vary a lot depending on how rapidly a company is expected to grow and how much risk investors are willing to take. If a company is seen as a steady grower in a stable industry, a lower PE might make sense. For a fast-growing or highly profitable company, the market can justify a higher PE.

Right now, Deere trades at a PE of 25.6x. That is higher than the Machinery industry average of 23.9x, but below the average of its peers at 36.0x. Simply Wall St’s proprietary "Fair Ratio" takes into account specific details about Deere, such as its earnings growth, profit margins, market cap, and risks. Based on this assessment, a fair PE for this stock would be 34.3x. Since Deere’s PE is notably below this fair value benchmark, it suggests the shares may actually be undervalued based on earnings, despite being above the industry average.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Deere Narrative

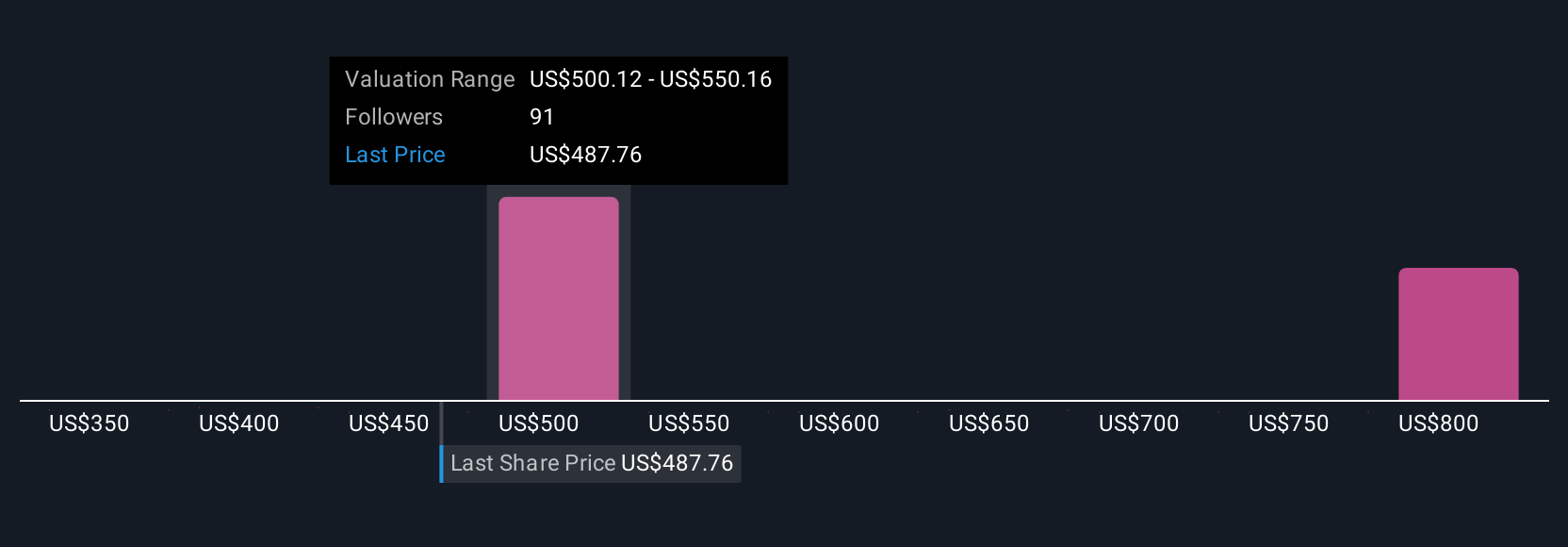

A Narrative is a clear story you create about a company, connecting your personal perspective on its business outlook with the numbers you believe in, such as fair value estimates, future revenue, earnings, and margins. Narratives link the “why” behind your investment thesis directly to a financial forecast and then to an actionable estimate of what a stock should be worth.

On Simply Wall St, Narratives make sophisticated investing more accessible for everyone by allowing you to easily adopt, customize, or build your own view within a community of millions. You can then compare fair value to the latest share price to decide when to buy or sell. Narratives update automatically with each key event, such as news or earnings releases, so your outlook always stays relevant.

For example, while some investors may expect Deere’s earnings to reach $9.8 billion in the coming years (seeing potential for much higher value), others foresee just $5.9 billion (favoring a more cautious fair value). This illustrates how Narratives help users quickly frame and act on different possible futures for the same stock.

Do you think there's more to the story for Deere? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com