- Brightstar Lottery PLC recently announced that it secured a seven-year contract to deploy its Aurora™ retail central system and advanced cloud-based software for Sachsische Lotto-GmbH in Saxony, Germany, following a competitive public procurement process.

- This European win further strengthens Brightstar's reputation as a global lottery technology provider, now serving nearly 90 lottery clients across six continents and supporting many of the world's largest lotteries.

- We’ll examine how the new Saxony agreement and Aurora system expansion could influence Brightstar’s investment narrative and revenue outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Brightstar Lottery Investment Narrative Recap

To be a shareholder in Brightstar Lottery, one must believe in the long-term expansion of digital lottery technology, steady contract renewals, and successful global deployments like the new Saxony agreement. While the contract strengthens Brightstar’s pan-European presence and reinforces client diversification, it does not significantly alter the most important near-term catalyst, the company’s ability to return to consistent profitability, or the key risk of regulatory challenges, especially in core markets such as Italy and the US.

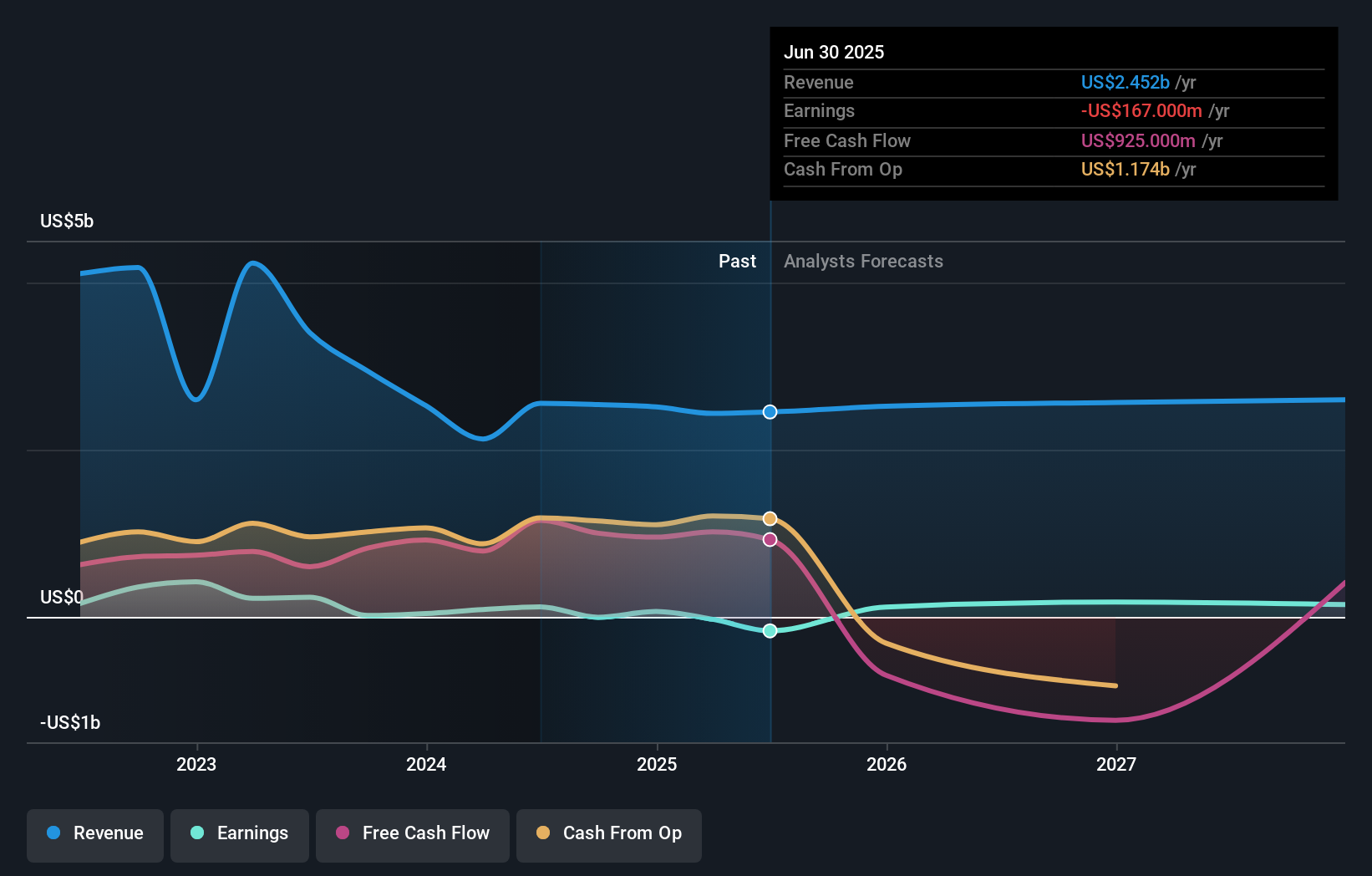

The recent quarterly earnings report is especially relevant in this context, as it underscores the company’s challenge of growing revenues while managing losses. Despite the high-profile contract win in Germany, Brightstar reported a net loss for the quarter, highlighting that steady contract flow will need to be matched by careful expense management and successful adaptation to shifting profit cycles for the investment thesis to remain intact.

Yet, as Brightstar seeks new international footholds, investors should be mindful that periods without large jackpots continue to bring...

Read the full narrative on Brightstar Lottery (it's free!)

Brightstar Lottery's outlook anticipates $2.6 billion in revenue and $295.9 million in earnings by 2028. This is based on a projected 2.5% annual revenue growth and an increase in earnings of $462.9 million from the current $-167.0 million.

Uncover how Brightstar Lottery's forecasts yield a $18.52 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Brightstar Lottery range widely, from US$6.73 to US$18.52 per share across two analyses. While many see upside tied to digital adoption and contract renewals, the reality of recent earnings losses suggests there are multiple ways to view Brightstar’s future prospects, encouraging you to explore diverse perspectives.

Explore 2 other fair value estimates on Brightstar Lottery - why the stock might be worth less than half the current price!

Build Your Own Brightstar Lottery Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Brightstar Lottery research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brightstar Lottery's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com