If you have been tracking the industrial sector lately, Westinghouse Air Brake Technologies (NYSE:WAB) might have caught your eye. There is no headline-grabbing event moving the stock this week. However, the recent shift in price action may still spark questions from investors about what the market is signaling. Whenever a well-known name like this strays from its trend, even by a few points, it is worth pausing to consider what might lie beneath the surface value.

Looking more closely, the story of Westinghouse Air Brake Technologies this year has been a mix of modest gains and periodic retracements. The past month’s slide of 8% stands out after a pretty resilient twelve months. The stock is up roughly 20% year over year, continuing a run that has more than doubled investors’ money over five years. While there have not been splashy headlines recently, earnings growth and margin expansion in the last quarter have been in the spotlight and could be influencing how traders are viewing its future prospects.

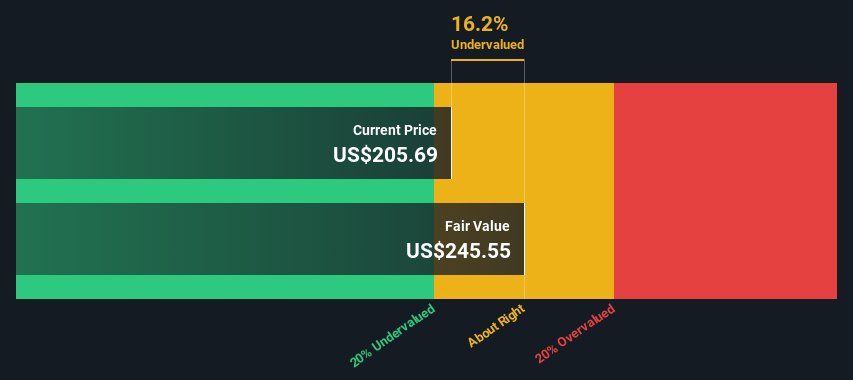

After a year of mostly positive momentum and a recent pullback, is there value left on the table for Westinghouse Air Brake Technologies? Or is the market simply factoring in all the growth that lies ahead?

Most Popular Narrative: 15.5% Undervalued

According to community narrative, Westinghouse Air Brake Technologies is currently priced below its estimated fair value, suggesting a notable disconnect between present market price and the company's projected fundamentals.

Sustained global investment in rail infrastructure and modernization, especially in international markets like Africa, Asia, and Brazil, coupled with increasing passenger transit ridership, is expanding addressable demand for Wabtec's products and services. This trend supports long-term revenue growth and backlog visibility.

Curious about what powers this bullish outlook? One pivotal assumption centers on how fast profits and sales could grow in the years ahead. There are bold projections and some sizable numbers involved. Numbers like these could rewrite the story for this rail tech leader. Want to know the exact catalysts that drive such a sharp upside in fair value? Read on to discover the financial levers analysts are betting on.

Result: Fair Value of $228.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in North American railcar demand or unexpected challenges from recent acquisitions could quickly undermine today's positive growth outlook.

Find out about the key risks to this Westinghouse Air Brake Technologies narrative.Another View: Are The Numbers Too Optimistic?

While fair value estimates highlight upside potential, looking through the lens of our DCF model also points to undervaluation. However, this approach relies on future cash flow projections. Could changing market trends disrupt that outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Westinghouse Air Brake Technologies Narrative

If you have a different take or want to dive into the details yourself, you can craft your own perspective on Westinghouse Air Brake Technologies in just a few minutes. do it your way.

A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next opportunity by checking out hand-picked stock ideas tailored for timely market trends and hidden value. Don’t let your next winner slip by. These screeners connect you to companies with unique strengths and potential for significant performance.

- Tap into steady cash flow with a selection of dividend stocks with yields > 3% and build a resilient portfolio centered around high-yield payers.

- Spot game-changers and future leaders when you browse AI penny stocks. This screener highlights pioneers at the cutting edge of artificial intelligence innovation.

- Supercharge your returns by focusing on undervalued stocks based on cash flows. These companies have share prices that may not reflect the robust cash flows behind them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com