Thinking about Marriott International’s stock and wondering if now’s the time to buy, sell, or just watch? You are definitely not alone. With its latest closing price at $266.78, investors have experienced a bit of a roller coaster. Over the past year, Marriott’s total return climbed 20.4%, fueled by resilient travel demand and consistently strong results. Even looking at a longer horizon, the stock has more than doubled (up 72.9%) over the last three years and nearly tripled (up 178.7%) over five years. It has quietly been one of the market’s steady performers.

Of course, those moves have not all been upward. The last month saw a dip of a little over 2%, and the shares are still down about 2.8% for the year so far, which might give some investors pause. However, signs of healthy revenues and net income growth, together with positive reactions to broader market trends, have kept risk sentiment around Marriott relatively upbeat. The current price still sits roughly 5% below analysts’ average target, suggesting some optimism remains.

If you want to know how attractively Marriott is priced right now, there is a handy valuation score to consider: out of six checks for potential undervaluation, Marriott currently passes only one. This is a quick summary and maybe not the whole picture, but it does suggest that the stock might not be particularly cheap at the moment.

Next, we will dig into the key valuation methods. Plus, stay tuned for what could be the most insightful way yet to put the numbers in perspective.

Marriott International delivered 20.4% returns over the last year. See how this stacks up to the rest of the Hospitality industry.Approach 1: Marriott International Cash Flows

A Discounted Cash Flow (DCF) model aims to estimate a company’s true value by projecting its future cash flows and then discounting those flows back to today’s dollars. This approach helps investors gauge what the business is really worth compared to the current stock price.

For Marriott International, the most recent Free Cash Flow is $1.84 billion. Analysts expect this figure to steadily grow, with projections reaching about $5.3 billion by 2035. This growth is outlined in a ten-year outlook, showing annual increases and a robust trend in the company’s underlying cash generation.

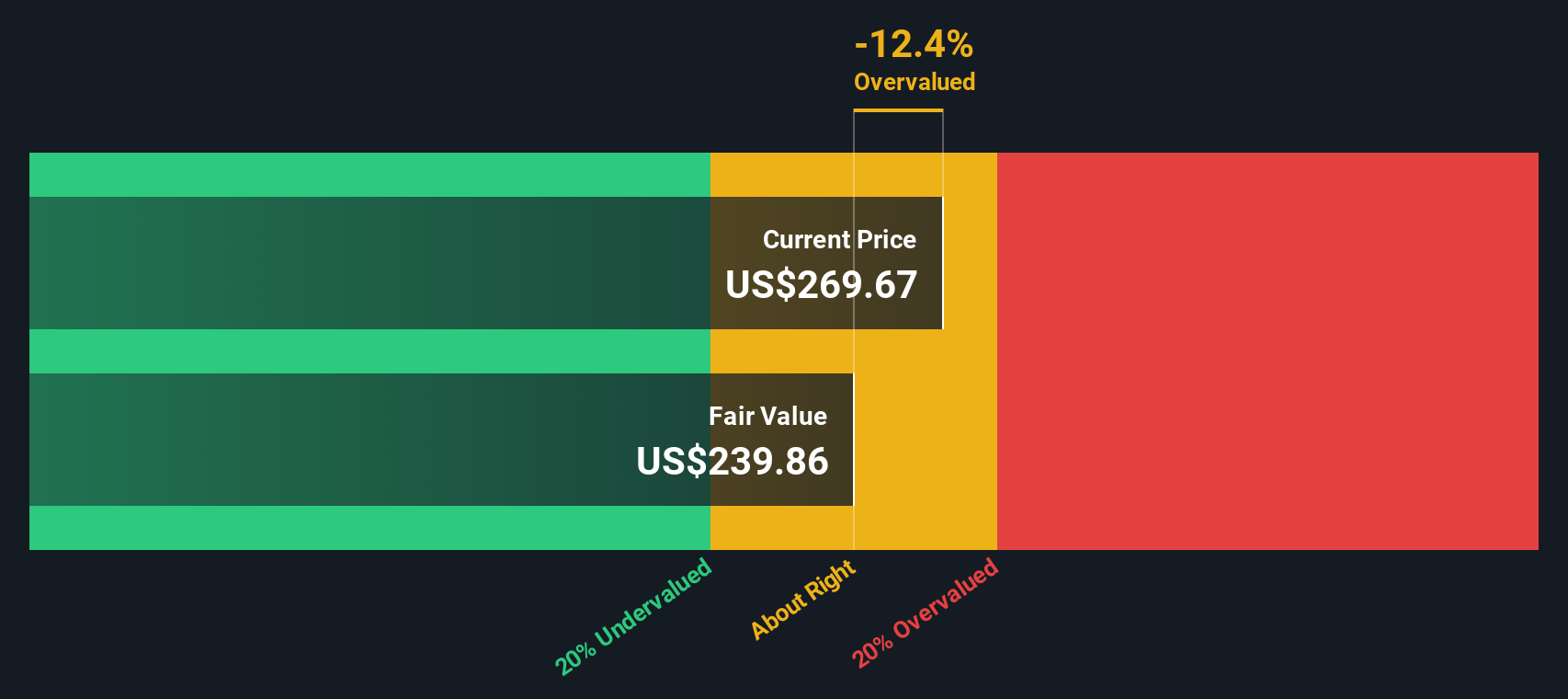

By using these projections, the DCF analysis assigns Marriott an intrinsic value of $241.74 per share. With the stock currently trading at $266.78, this suggests the company is approximately 10.4% overvalued according to the DCF model. In summary, the stock’s price appears somewhat higher than what the cash flows alone would support.

Result: ABOUT RIGHT

Approach 2: Marriott International Price vs Earnings

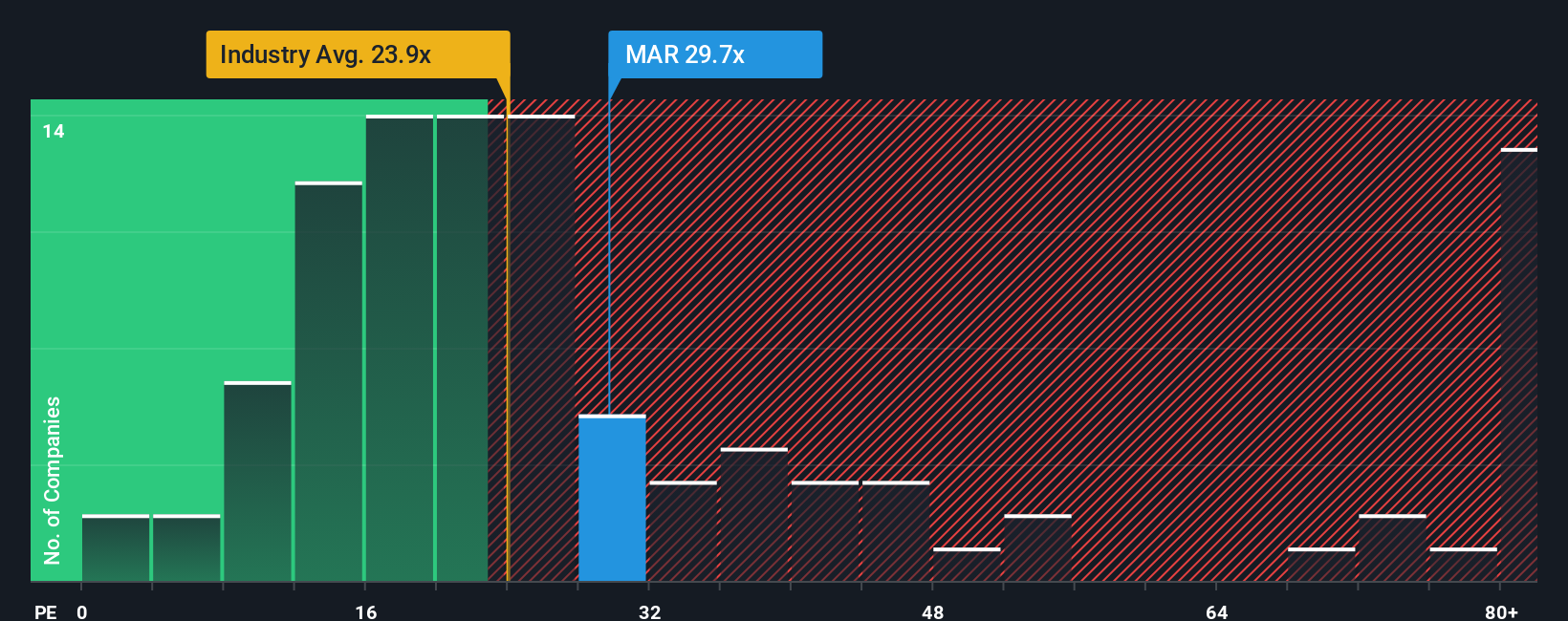

The Price-to-Earnings (PE) ratio is often the go-to metric for evaluating profitable companies like Marriott International, as it directly relates the price of the stock to the company's earnings power. This makes it a straightforward way to assess how much investors are paying for each dollar of earnings today.

Typically, a "normal" or "fair" PE ratio depends on expectations for future growth and risk. Higher growth prospects usually justify a higher PE ratio, while greater risks tend to bring the ratio down. Comparing Marriott’s current PE of 29.4x to the hospitality industry average of 23.1x and its peer group average of 33.0x, Marriott is valued slightly above the industry but modestly below its peer group.

Simply Wall St’s proprietary Fair Ratio for Marriott comes in at 29.2x, which factors in earnings growth, margins, company size, and sector risk. Since this figure is almost identical to Marriott's current PE ratio, the stock appears to be trading in line with what would be considered fair value based on its earnings and fundamentals.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Marriott International Narrative

Rather than just looking at ratios and numbers in isolation, smart investors can use Narratives, which are a simple, story-based way to describe their perspective on a company’s future opportunities and risks, and how those beliefs shape estimates of revenue, earnings, and fair value.

A Narrative connects your big-picture view of Marriott International, such as global expansion, loyalty program growth, and evolving travel trends, to concrete financial forecasts. This connection helps translate your perspective directly into what you think the shares are really worth. Narratives are easy to build and compare on Simply Wall St’s platform, where millions of investors share their thinking, update their assumptions, and see how changing news or results can impact fair value in real time.

This approach makes it straightforward to decide if Marriott aligns with your investment goals by comparing your fair value estimate (based on your Narrative) to today’s price, and instantly spot when new information could change your view. For example, one investor may see Marriott’s fair value as high as $332 by focusing on international growth and technology gains, while another might set it at $205 if concerned about regional risks and margin pressures.

Do you think there's more to the story for Marriott International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com