- Six Flags Entertainment recently unveiled expanded Halloween events with new premium interactive horror experiences across 25 parks, alongside second quarter earnings and leadership transition announcements.

- The rollout of The Conjuring: Beyond Fear and exclusive season pass offerings signals an emphasis on immersive attractions to boost guest engagement and potential revenue streams.

- We’ll examine how the launch of new premium Halloween experiences influences Six Flags’ future growth and investment outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Six Flags Entertainment Investment Narrative Recap

To be a shareholder in Six Flags Entertainment, you have to believe that new premium experiences and an expanded all-park pass strategy can offset persistent headwinds from high debt, attendance volatility, and competition. The headline launch of premium Halloween attractions is designed to convert guest excitement into greater per-capita spending, but it does not change the primary near-term challenge: high net leverage and continued net losses, with adverse weather and interest costs still posing the biggest risks for earnings momentum.

Among recent announcements, the $500 million Term B Loan bears directly on the leverage risk, as it was taken on to refinance older debt but also increases gross outstanding borrowings for now. While operational upgrades and new products like The Conjuring: Beyond Fear could aid cash flow, the greater financial burden underscores why attention remains firmly on the company’s ability to handle rising rates and margin pressure.

Yet, if interest costs climb or attendance recovery falls short, investors need to consider how elevated leverage could quickly erode...

Read the full narrative on Six Flags Entertainment (it's free!)

Six Flags Entertainment's outlook points to $3.7 billion in revenue and $275.6 million in earnings by 2028. This scenario assumes 5.3% annual revenue growth and a $759.2 million increase in earnings from the current level of -$483.6 million.

Uncover how Six Flags Entertainment's forecasts yield a $35.31 fair value, a 36% upside to its current price.

Exploring Other Perspectives

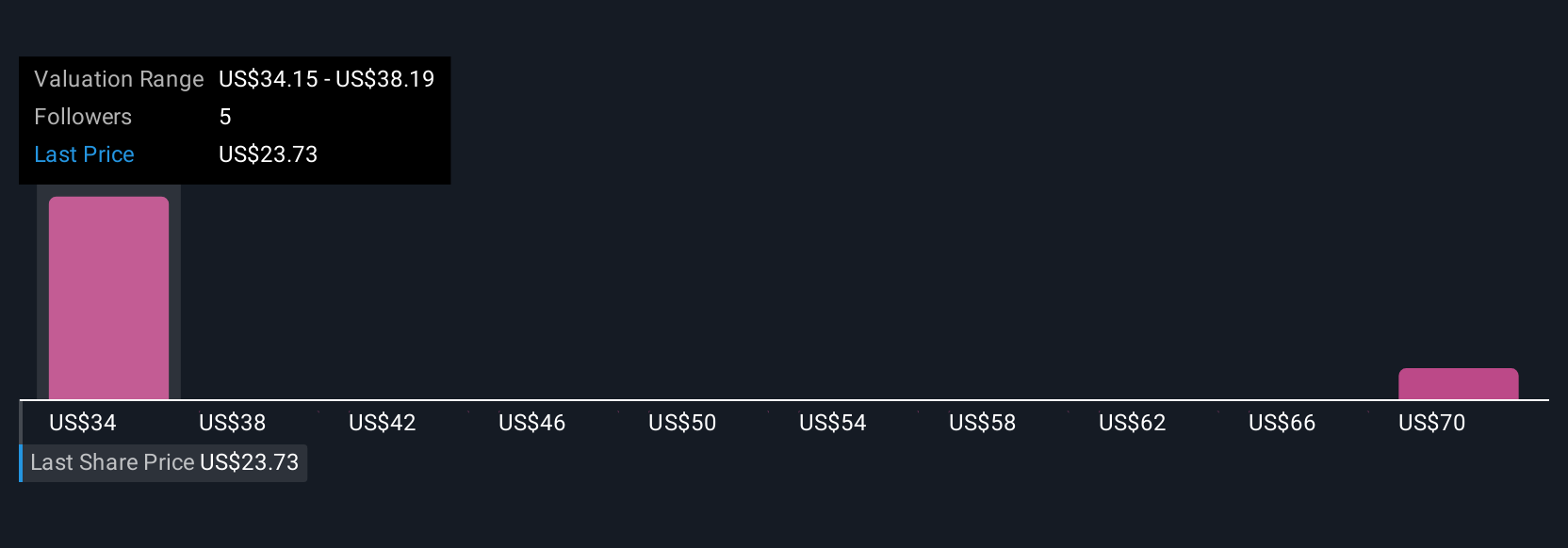

Simply Wall St Community members set Six Flags’ fair value between US$35.31 and US$74.52, drawing on just 2 analyses before recent earnings and attraction launches. Wide valuation ranges reflect how strongly perspectives differ, while persistent high leverage and net losses remain front of mind for those weighing future performance.

Explore 2 other fair value estimates on Six Flags Entertainment - why the stock might be worth just $35.31!

Build Your Own Six Flags Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Six Flags Entertainment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Six Flags Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Six Flags Entertainment's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com