- Earlier this month, Life Time Group Holdings reported strong second quarter earnings and raised its full-year revenue guidance, coinciding with the opening of its ninth Atlanta-area club, the 79,000-square-foot Life Time Perimeter in Sandy Springs.

- The newest location reflects the company’s continued focus on combining upscale wellness, fitness, and remote-work amenities in affluent, high-density neighborhoods driven by growing demand for luxury health experiences.

- We'll explore how Life Time's elevated revenue forecast and premium club expansion in Atlanta impact its investment narrative and long-term outlook.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Life Time Group Holdings Investment Narrative Recap

For shareholders in Life Time Group Holdings, the core belief is that premium club expansion in high-density, affluent areas will drive sustained membership and revenue growth. The recent strong earnings and new Atlanta club support this outlook, but do not materially change the key short-term catalyst: continued execution on new club openings. However, the most significant risk remains the company’s heavy reliance on capital markets to fund these growth initiatives, especially if real estate financing tightens or construction costs rise.

Among recent announcements, the raised full-year revenue guidance (to US$2,955 million–US$2,985 million) stands out as the most relevant. It highlights management’s confidence in both new club contributions and member engagement, directly tying recent expansion to near-term financial milestones and the broader revenue growth catalyst.

But while revenue forecasts move higher, investors should also be aware of...

Read the full narrative on Life Time Group Holdings (it's free!)

Life Time Group Holdings is projected to achieve $3.8 billion in revenue and $457.9 million in earnings by 2028. This outlook assumes a 10.3% annual revenue growth rate and an increase in earnings of $231.1 million from current earnings of $226.8 million.

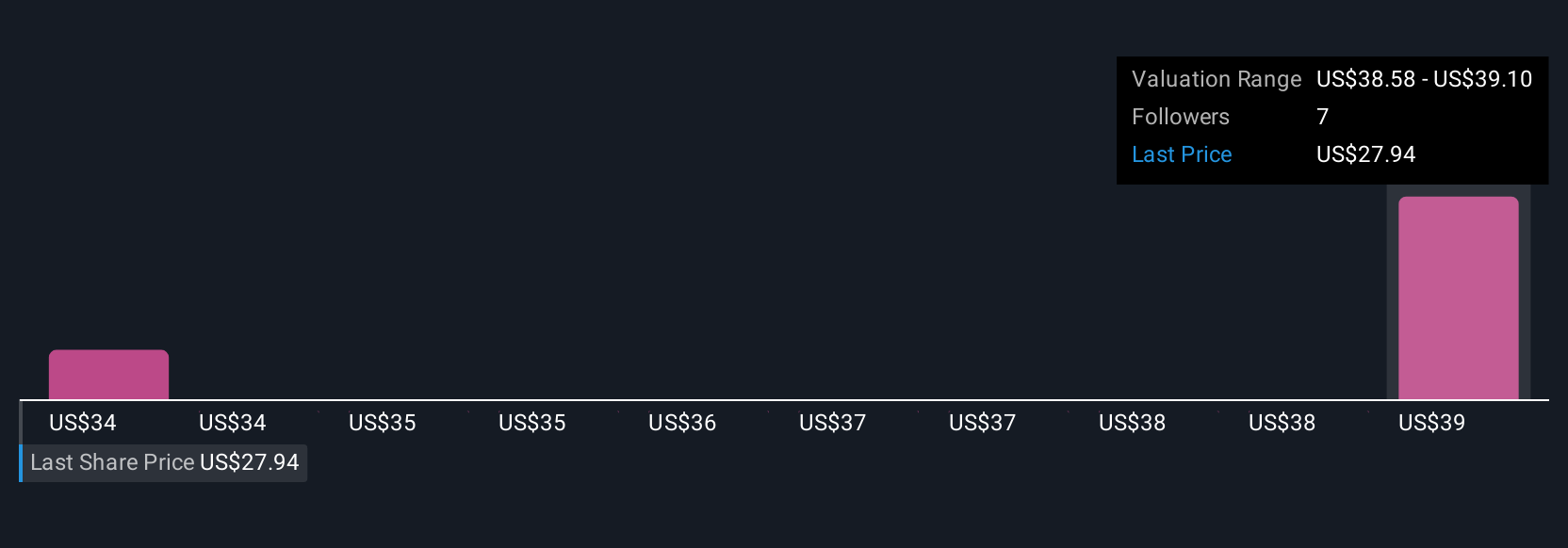

Uncover how Life Time Group Holdings' forecasts yield a $39.10 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span US$34.71 to US$39.10 per share. While the community sees room for upside, Life Time’s growth strategy depends on staying ahead of funding and cost risks, reinforcing the value of considering several viewpoints before making decisions.

Explore 2 other fair value estimates on Life Time Group Holdings - why the stock might be worth as much as 38% more than the current price!

Build Your Own Life Time Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Life Time Group Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Life Time Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Life Time Group Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com