- PENN Entertainment recently completed a repurchase of 6,920,104 shares for US$115.6 million, reported improved second-quarter financial results, issued new revenue guidance, launched the FanCenter feature on ESPN BET, and made changes to its Compliance Committee.

- An important insight is PENN's investments in digital product development and compliance, alongside capital returns, highlight a multifaceted approach to shareholder value and operational growth.

- We'll explore how PENN's new FanCenter sportsbook feature and robust buyback activity could influence its investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

PENN Entertainment Investment Narrative Recap

To be a shareholder in PENN Entertainment, you need to believe in the company's ability to leverage its digital growth initiatives and omni-channel strategies, especially as the sports betting and iCasino arms become more central. While PENN’s robust share buyback and the launch of ESPN BET’s FanCenter reflect ongoing efforts to drive digital engagement and deliver capital returns, these moves do not materially lessen the largest near-term risk: continued pressure on the retail casino segment from new supply in declining markets or losses from its interactive division if digital adoption is slower than needed. Of the recent developments, the rollout of FanCenter within ESPN BET stands out as directly tied to PENN’s biggest near-term catalysts: driving user acquisition, enhancing personalization, and seeking to capture greater share amid intense competition in digital betting and fantasy sports. This feature deepens integration with the ESPN digital ecosystem, reinforcing PENN’s ambition to bridge media, sports, and betting, though investors still face a digital business that remains loss-making as targets approach. Yet, despite these advances in digital, investors should not overlook the persistent risk from ...

Read the full narrative on PENN Entertainment (it's free!)

PENN Entertainment’s outlook anticipates $8.0 billion in revenue and $471.4 million in earnings by 2028. This scenario relies on a 5.9% annual revenue growth rate and represents a $547 million increase in earnings from the current level of -$75.6 million.

Uncover how PENN Entertainment's forecasts yield a $21.89 fair value, a 20% upside to its current price.

Exploring Other Perspectives

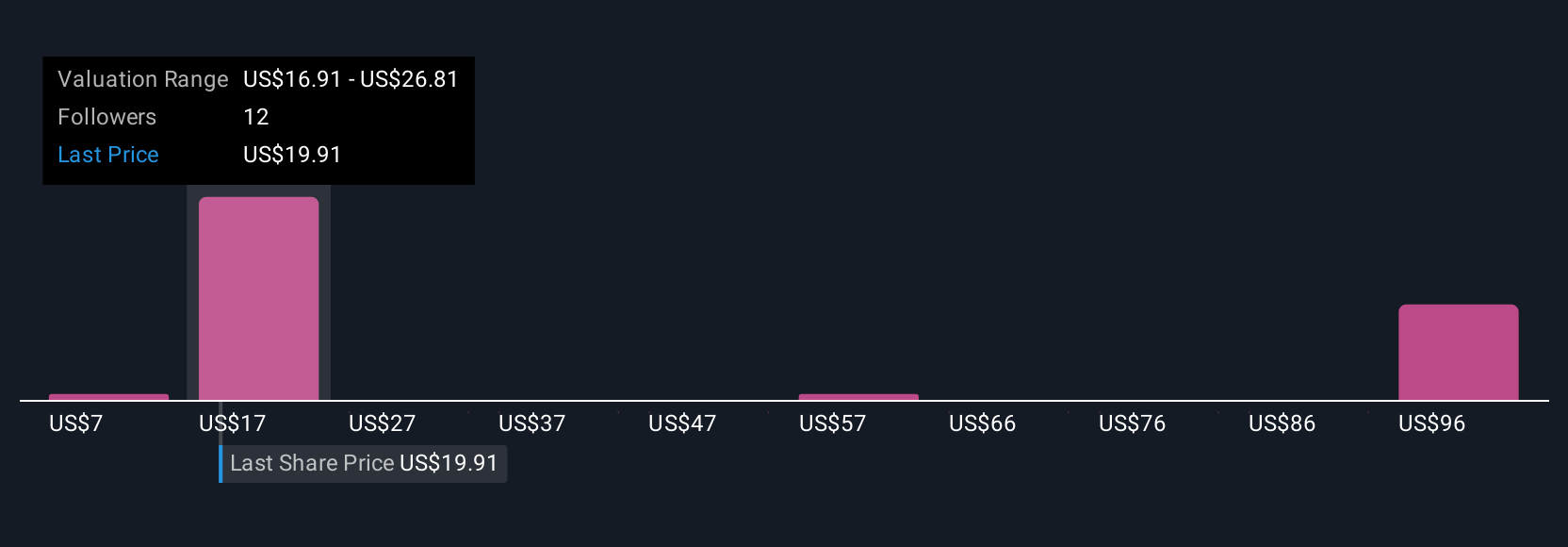

Four fair value estimates from the Simply Wall St Community range widely, from US$7 to over US$106 per share. While PENN’s digital expansion is a key catalyst, opinions on future performance differ greatly, explore several viewpoints to inform your perspective.

Explore 4 other fair value estimates on PENN Entertainment - why the stock might be worth over 5x more than the current price!

Build Your Own PENN Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PENN Entertainment research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PENN Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PENN Entertainment's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com