- Delek US Holdings reported second quarter and year-to-date 2025 earnings, showing sales of US$2,764.6 million for the quarter and a net loss of US$106.4 million, both down significantly from the previous year.

- Despite completing a large share repurchase program between April and August 2025, the steep decline in revenue and wider net losses mark a period of financial pressure for the company.

- We'll explore how Delek's higher losses and weaker sales impact the investment narrative centered on operational improvements and infrastructure investments.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Delek US Holdings Investment Narrative Recap

For shareholders in Delek US Holdings, the core narrative has long focused on the hope that operational improvements and infrastructure investments can offset industry headwinds and deliver meaningful progress on margins and cash flow. However, the recent sharp drop in sales and widening losses in the second quarter may weigh on confidence in near-term recovery, with persistent unprofitability and high capital needs now representing the key risk to the outlook.

The just-completed share buyback program stands out in this context, as Delek retired nearly 29.5% of its shares since 2018 despite ongoing net losses. This move highlights the company’s commitment to shareholder returns, but also puts a spotlight on whether free cash flow can be sustained as core results remain pressured by operational weaknesses and sector trends.

In contrast, investors should be aware of the company’s ongoing exposure to regulatory and legal risks around small refinery exemptions, as any unfavorable outcome could...

Read the full narrative on Delek US Holdings (it's free!)

Delek US Holdings' narrative projects $10.3 billion revenue and $1.5 billion earnings by 2028. This requires a 1.5% annual revenue decline and a $2.36 billion earnings increase from current earnings of -$863.6 million.

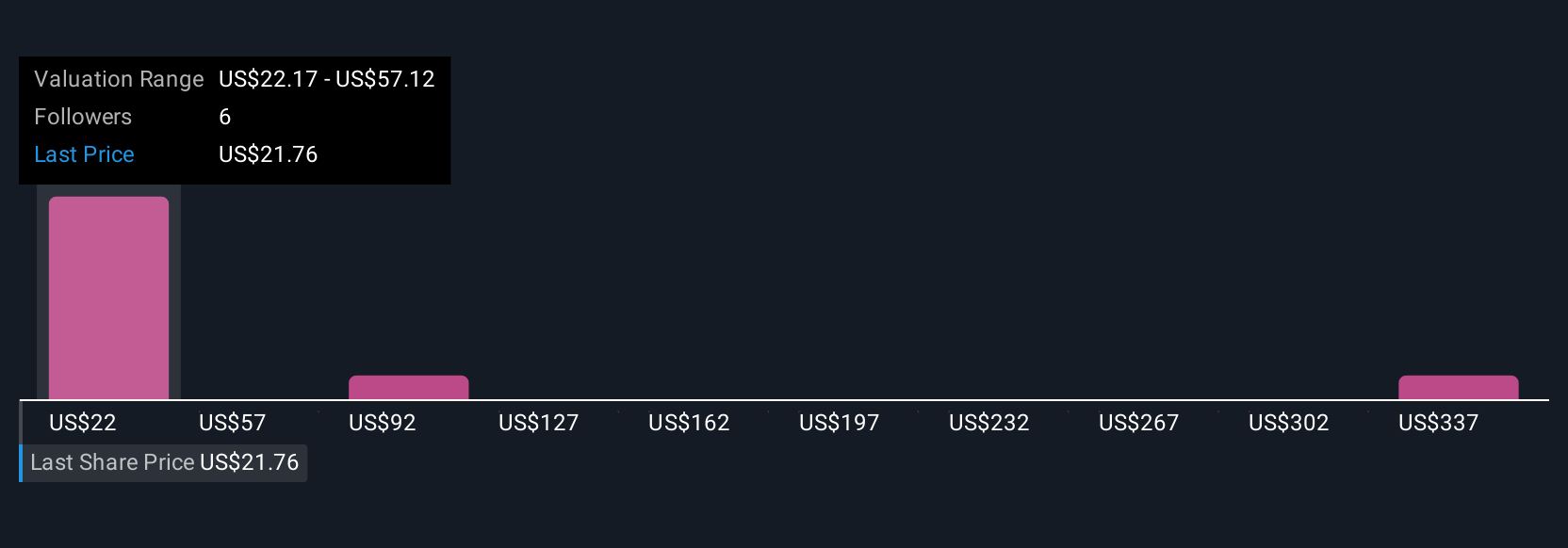

Uncover how Delek US Holdings' forecasts yield a $22.17 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members offered four independent fair value estimates for Delek shares, ranging from US$22.17 to US$371.71. While views are widely dispersed, recent financial results have increased scrutiny on the company’s ability to realize the operational gains underpinning more optimistic projections.

Explore 4 other fair value estimates on Delek US Holdings - why the stock might be a potential multi-bagger!

Build Your Own Delek US Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delek US Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Delek US Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delek US Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com