Martin Marietta Materials (MLM) recently announced an increase in its quarterly dividend, a move that reflects the company's strong commitment to shareholder value. This development, combined with strong second-quarter earnings showing sales of $1,811 million, seems to have positively influenced its share price, which rose 12% last month. Despite the broader market experiencing a mixed performance, MLM's dividend increase and raised earnings guidance for 2025 likely supported its share price gain, aligning with the optimistic market sentiment. Meanwhile, major indices like the Dow Jones hit record highs, providing a favorable environment for MLM's share performance.

We've spotted 2 risks for Martin Marietta Materials you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent announcement of Martin Marietta Materials increasing its quarterly dividend underscores the company's dedication to enhancing shareholder value. This, in conjunction with robust earnings and sales growth, augurs well for the company's narrative of sustained infrastructure investment and demographic trends driving aggregate demand. The company's share price, at $612.50, closely approaches the analyst price target of $641.13, with a modest 3.3% upside, reflecting a market view that it is near fair value.

Looking at longer-term performance, Martin Marietta's total return, including dividends, stands at 202.75% over the past five years. During this period, the share price increased significantly, contrasting with weaker one-year returns where the company underperformed both the US market, which advanced 19.4%, and the US Basic Materials industry, which rose 26.7%. This mixed performance highlights the complexities facing the construction materials sector but also showcases the company's capacity for substantial returns over extended periods.

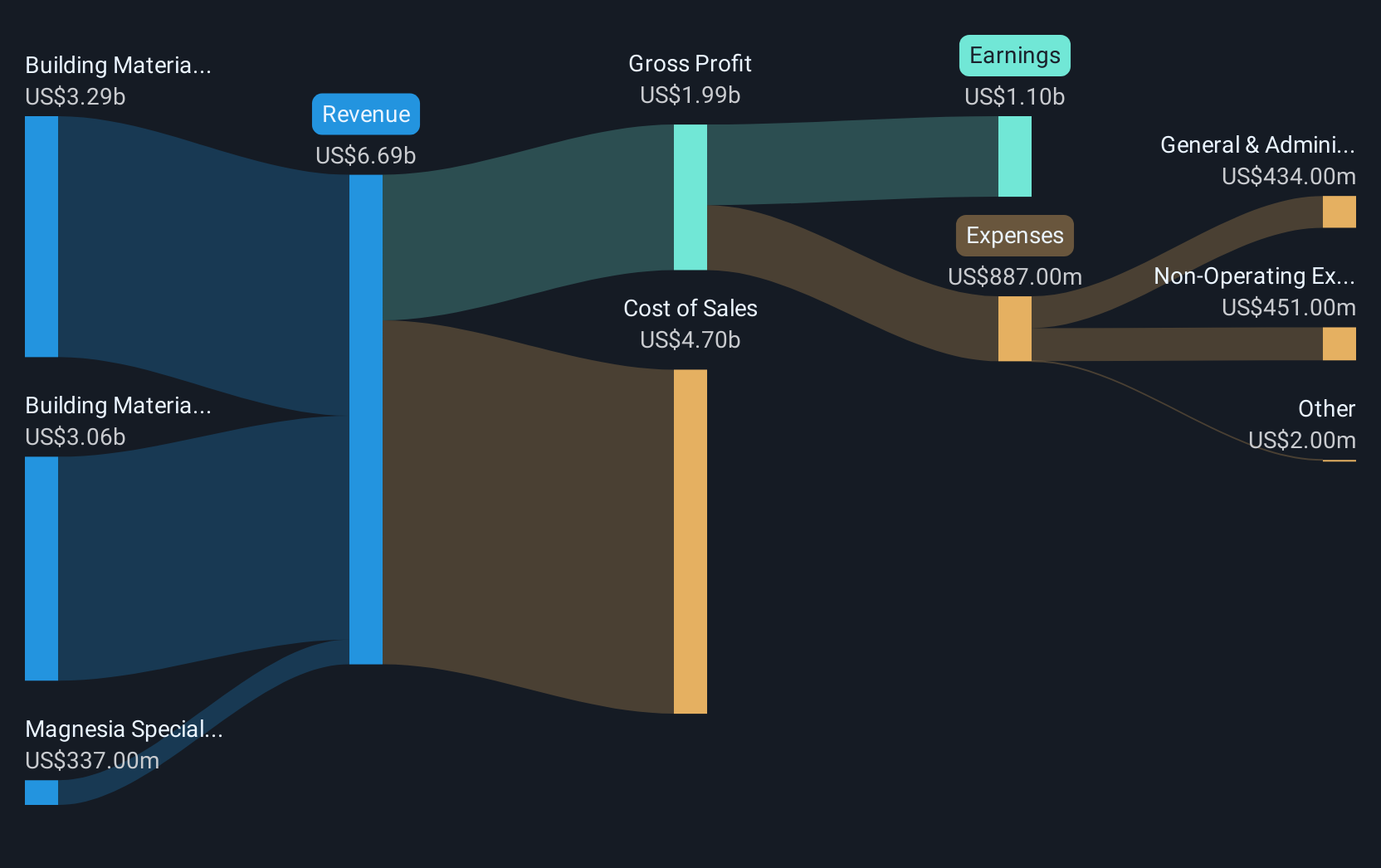

The dividend increase and strong earnings could bolster revenue and earnings forecasts, aligning with the company's expectation of growth through strategic asset positioning and operational efficiencies. Analysts estimate earnings to reach US$1.6 billion by 2028, with margins anticipated to rise from 16.5% to 18.5%. However, potential risks remain, such as affordability and regulatory challenges, which could affect future growth. Currently priced above its estimated fair value of US$589.03, Martin Marietta's stock suggests a premium valuation reflective of its growth potential and commitment to shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com