As the Dow Jones Industrial Average hits a new record high, buoyed by significant gains in healthcare stocks like UnitedHealth, investors are closely monitoring economic indicators and Federal Reserve policies that could influence future interest rate decisions. In this environment of mixed market performances, dividend stocks offering attractive yields can provide a measure of stability and income potential for investors seeking to navigate these dynamic conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.48% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.69% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.14% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| Employers Holdings (EIG) | 3.06% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.69% | ★★★★★☆ |

| Dillard's (DDS) | 5.21% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.51% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.77% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.44% | ★★★★★☆ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

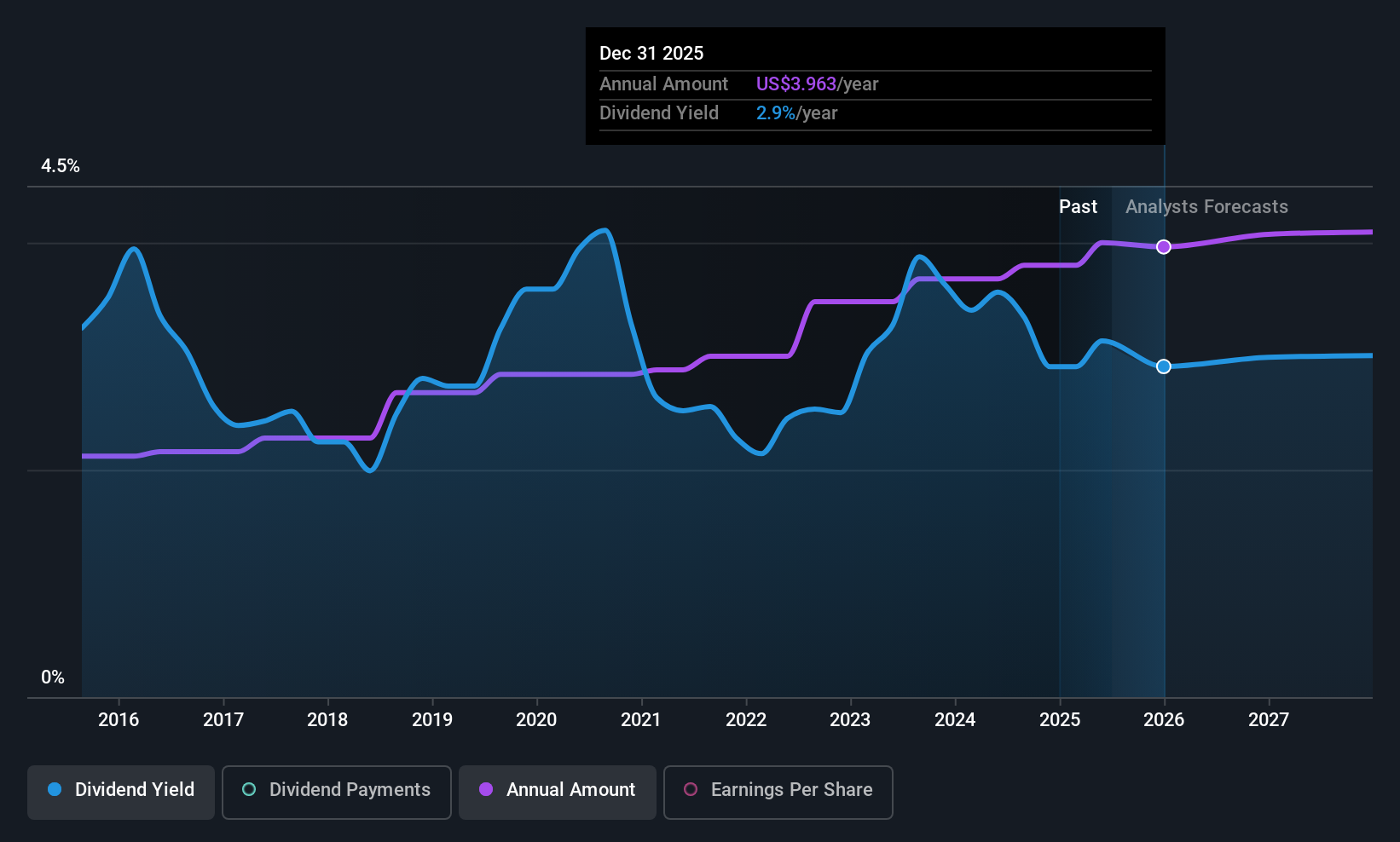

Cullen/Frost Bankers (CFR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cullen/Frost Bankers, Inc. is the bank holding company for Frost Bank, offering commercial and consumer banking services in Texas with a market cap of $8.07 billion.

Operations: Cullen/Frost Bankers, Inc. generates revenue through its primary segments: Banking ($1.88 billion) and Frost Wealth Advisors ($211.47 million).

Dividend Yield: 3.2%

Cullen/Frost Bankers offers a stable dividend profile, with payments growing steadily over the past decade and currently yielding 3.16%. Despite being below the top quartile of US dividend payers, its dividends are well-covered by earnings, maintaining a low payout ratio of 41.4%. Recent earnings growth supports its dividend sustainability. The company declared a third-quarter cash dividend of $1 per share, payable in September 2025, reinforcing its commitment to returning value to shareholders.

- Delve into the full analysis dividend report here for a deeper understanding of Cullen/Frost Bankers.

- Our valuation report here indicates Cullen/Frost Bankers may be overvalued.

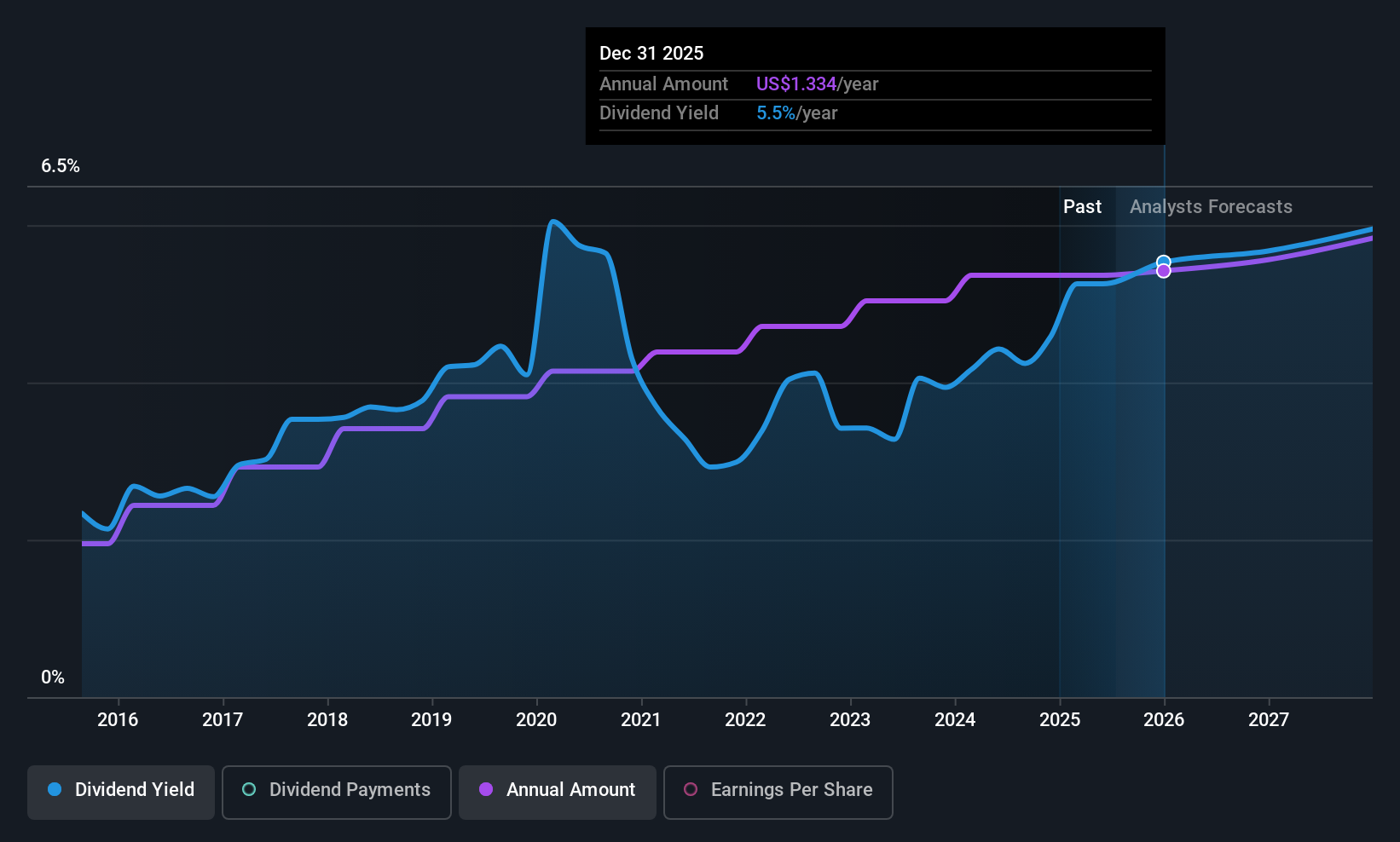

Interpublic Group of Companies (IPG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Interpublic Group of Companies, Inc. is a global provider of advertising and marketing services with a market cap of approximately $9.60 billion.

Operations: Interpublic Group of Companies generates revenue through three main segments: Media, Data & Engagement Solutions ($4.03 billion), Integrated Advertising & Creativity Led ($3.39 billion), and Specialized Communications & Experiential Solutions ($1.43 billion).

Dividend Yield: 5.1%

Interpublic Group's dividend yield of 5.11% ranks in the top 25% among US dividend payers, but its sustainability is questionable due to a high payout ratio of 111.1%, not covered by earnings. However, dividends have been stable and growing over the past decade. Recent events include a quarterly dividend declaration of $0.33 per share and Omnicom's pending acquisition, with debt restructuring efforts underway to facilitate this merger, impacting future financial strategies.

- Navigate through the intricacies of Interpublic Group of Companies with our comprehensive dividend report here.

- Our expertly prepared valuation report Interpublic Group of Companies implies its share price may be lower than expected.

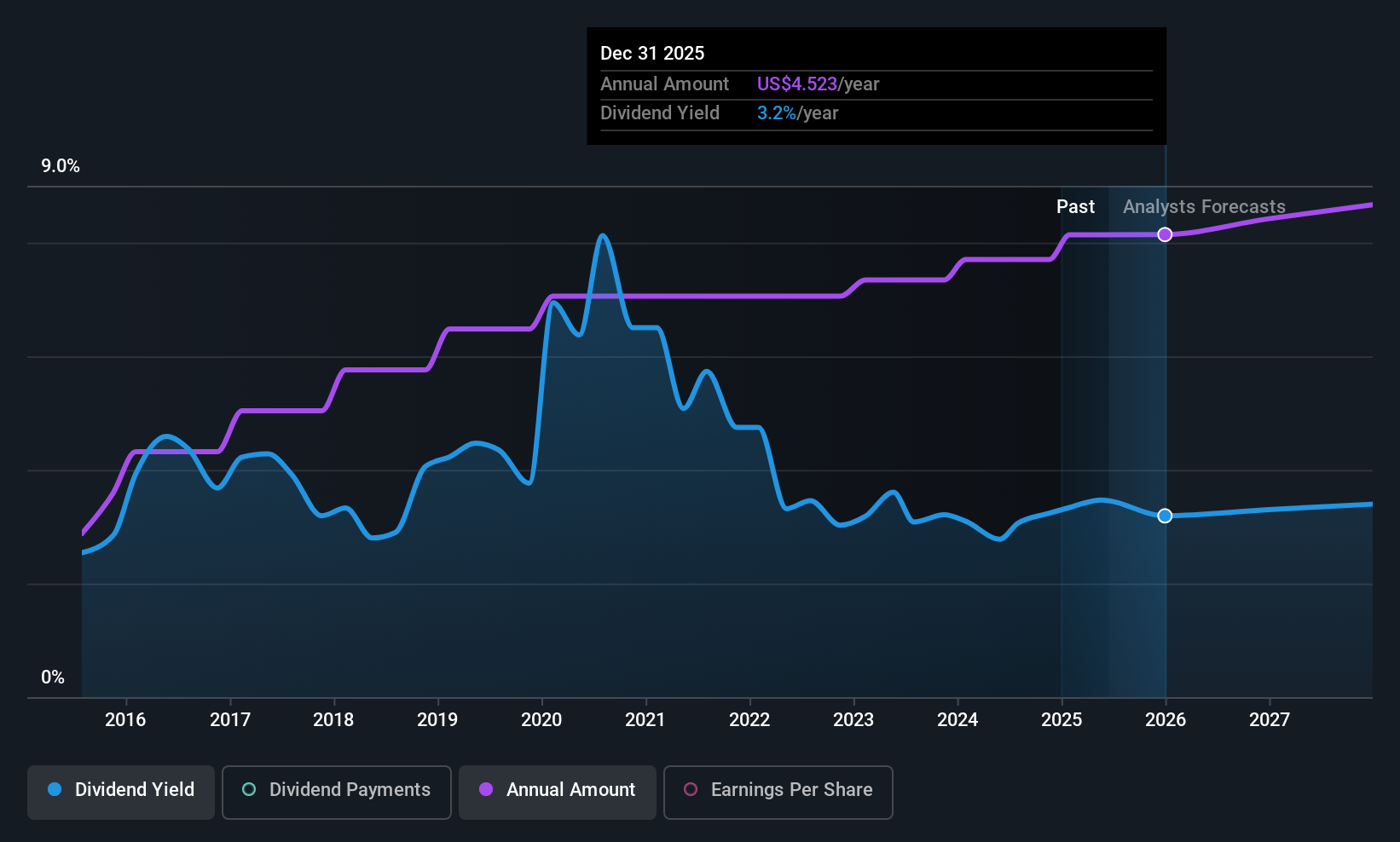

Valero Energy (VLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valero Energy Corporation manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products across various regions including the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally with a market cap of approximately $42.30 billion.

Operations: Valero Energy's revenue is primarily derived from its Refining segment at $117.76 billion, followed by Ethanol at $4.69 billion and Renewable Diesel at $4.47 billion.

Dividend Yield: 3.3%

Valero Energy's dividend yield of 3.33% is below the top 25% of US dividend payers, with dividends stable and increasing over the past decade. However, a high payout ratio of 182.4% indicates dividends are not covered by earnings, though cash flows support them better with a cash payout ratio at 42%. Recent events include share buybacks totaling $3.65 billion and ongoing discussions about selling its Benicia refinery amid California's energy policy challenges.

- Click to explore a detailed breakdown of our findings in Valero Energy's dividend report.

- Our valuation report unveils the possibility Valero Energy's shares may be trading at a premium.

Key Takeaways

- Take a closer look at our Top US Dividend Stocks list of 133 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com