Billionaire hedge fund manager Paul Tudor Jones has made several notable portfolio moves during the second quarter of 2025, with a slew of exits and a surprising bet on a retail favorite stock.

Surprising Bet On A “Meme Stock”

According to the 13F filings made by the Tudor Investment Corp. on Thursday, the fund has made a significant bet on iBuying platform, Opendoor Technologies Inc. (NASDAQ:OPEN), now holding 2.45 million shares in the company, an increase of 1,000% from the prior quarter.

See Also: Ken Griffin Explains What Sets Legendary Investors Apart From The Rest—And Looks To The Future

This comes amid the ongoing retail frenzy surrounding the stock, leading to an 874% rally over the past two months. After experiencing some volatility in recent weeks, the stock is still up 91% year-to-date.

While some have dubbed this a “meme stock,” its proponents, which include fund manager Eric Jackson, have pushed back against this tag, saying that “it’s a real business.”

Macro And Commodity Plays Get A Thumbs Up

Aside from this, Tudor has leaned into selective macro and commodity plays during the quarter, adding gold miners such as B2Gold Corp. (NYSEAMERICAN: BTG) and Coeur Mining Inc. (NYSE:CDE), alongside utilities such as PG&E Corp. (NYSE:PCG).

The renowned hedge fund has also expanded its use of options tied to the iShares Russell 2000 ETF (NYSE:IWM) and Invesco QQQ Trust (NASDAQ:QQQ), indicating a strategic positioning for deeper index exposure.

Exits And Trimmed Exposures

On the exit side, the hedge fund completely sold out of Walt Disney Co. (NYSE:DIS) and Broadcom Inc. (NASDAQ:AVGO), shedding high-profile names in both entertainment and semiconductors.

Tudor also walked away from several Chinese equity positions, including holdings in the iShares China Large-Cap ETF (NYSE:FXI), where both call and put positions were reduced significantly. The firm also trimmed its exposure to Bitcoin-linked assets, such as the Grayscale Bitcoin Trust (NYSE:GBTC) and other related vehicles.

In the tech space, a notable trimming down included Google-parent Alphabet Inc. (NASDAQ:GOOG), hinting at a cautious stance on AI as well as the “Mag 7” stocks.

| Stock | Q1 2025 Shares | Q2 2025 Shares |

|---|---|---|

| Broadcom Inc. (NASDAQ:AVGO) | 587,265 | 0 |

| B2Gold Corp. (NYSEAMERICAN: BTG) | 0 | 3,143,627 |

| Coeur Mining Inc. (NYSE:CDE) | 0 | 2,204,376 |

| Walt Disney Co. (NYSE:DIS) | 762,605 | 0 |

| iShares China Large-Cap ETF (NYSE:FXI) | 8,337,303 | 5,285,247 |

| Alphabet Inc. (NASDAQ:GOOG) | 628,215 | 81,572 |

| iShares China Large-Cap ETF (NYSE:FXI) | 3,736,913 | 213,440 |

| Opendoor Technologies Inc. (NASDAQ:OPEN) | 228,281 | 2,682,410 |

| PG&E Corp. (NYSE:PCG) | 500,000 | 4,942,608 |

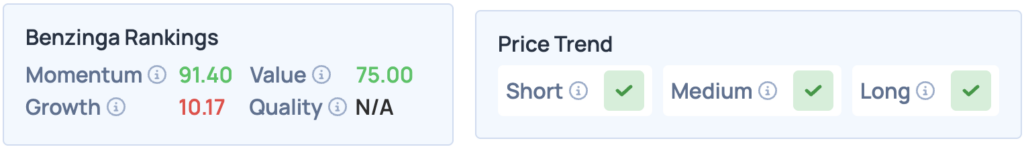

Shares of Opendoor rallied 25.62% on Thursday, closing at $3.04, and are up 1.32% after hours. The stock scores high on Momentum and Value in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, along with the others on this list.

Read More: