BIT Mining Ltd. (NASDAQ:BTCM) stock plunged 8% in Thursday's after-hours trading after the cryptocurrency mining company's half-yearly earnings disappointed investors.

BTCM shares are retreating from recent levels. Watch the momentum here.

Revenue Tanks 43%, Costs Shoot Up

The company reported a loss of $0.87 per American Depositary Share for the six months ending June 30, significantly wider than the $0.05 expected by analysts. Note that each American Depositary Share represents 100 Class A ordinary shares of the company.

The revenue tanked 43% year-over-year to $19.4 million, while operating costs and expenses rose 12%.

BIT Mining attributed the revenue loss primarily to increased difficulty in cryptocurrency mining activities and machine shutdowns caused by the drop in the value of Dogecoin (CRYPTO: DOGE) and Litecoin (CRYPTO: LTC) during April and May.

The firm reported holding cryptocurrency assets worth $3.6 million, including 7.3 BTC, 808 Ethereum (CRYPTO: ETH) and 1.8 million DOGE.

See Also: 180 Life Sciences Stock Slides After-Hours As Ethereum’s Decline Triggers Massive Sell-Off

Price Action: Bit Mining shares plummeted 8.01% in after-hours trading after closing 11.78% lower at $3.370. The stock was up nearly 30% in a week.

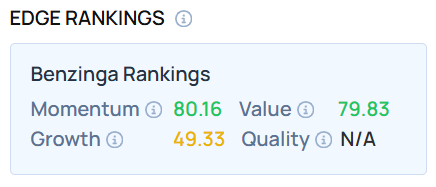

As of this writing, the stock ranked higher on the Momentum and Value indicators. Visit Benzinga Edge Stock Rankings to check how it compares with other cryptocurrency mining-related stocks.

Read Next:

Shutterstock/CKA