Southwest Airlines Co. (NYSE:LUV) will pay a dividend of $0.18 on the 24th of September. This payment means that the dividend yield will be 2.3%, which is around the industry average.

Southwest Airlines' Payment Could Potentially Have Solid Earnings Coverage

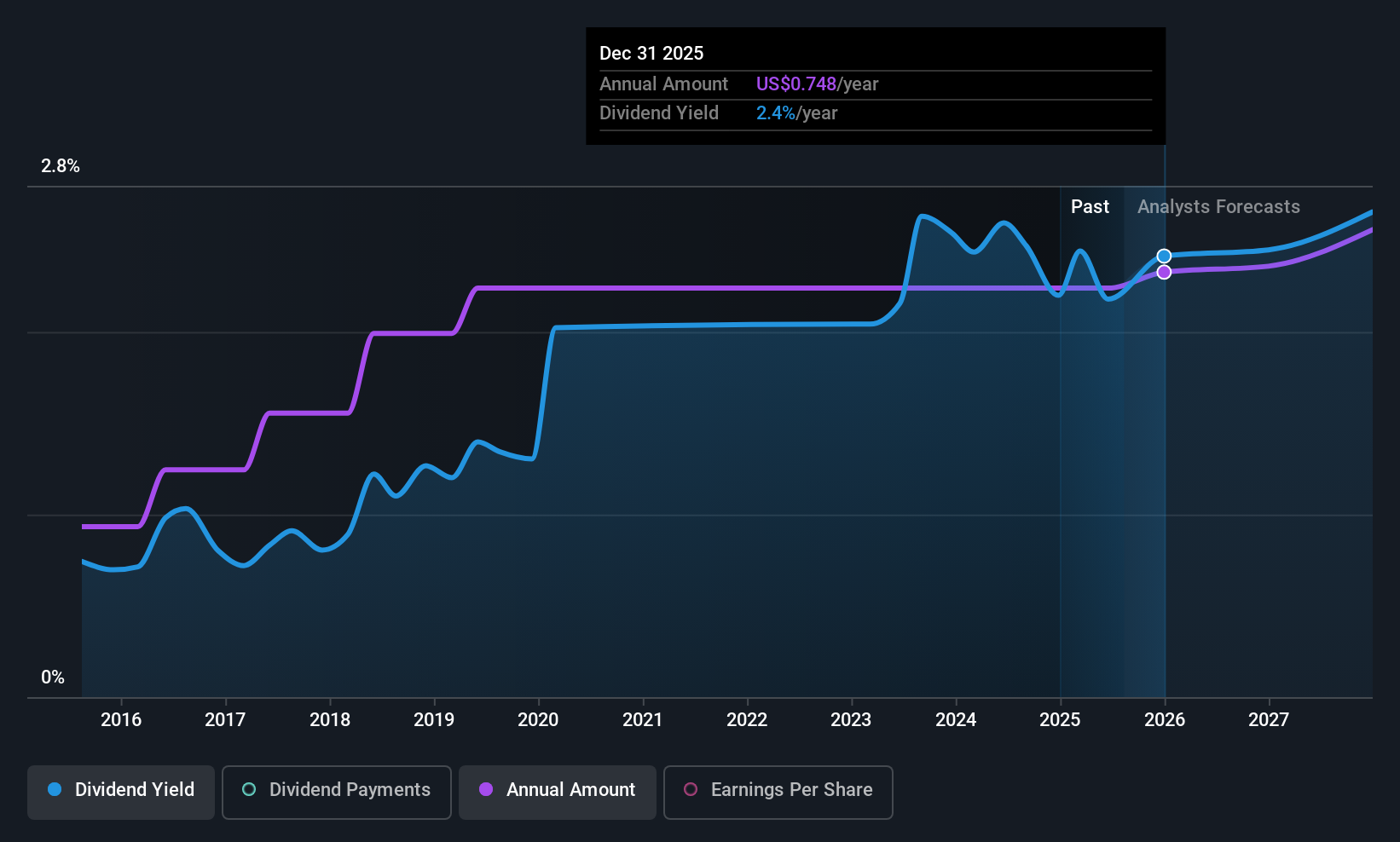

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

Analysts expect a massive rise in earnings per share in the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 16% which is fairly sustainable.

View our latest analysis for Southwest Airlines

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the annual payment back then was $0.24, compared to the most recent full-year payment of $0.72. This works out to be a compound annual growth rate (CAGR) of approximately 12% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Dividend Growth Could Be Constrained

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that Southwest Airlines has been growing its earnings per share at 20% a year over the past five years. Although per-share earnings are growing at a credible rate, the massive payout ratio may limit growth in the company's future dividend payments.

Southwest Airlines' Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Southwest Airlines' payments, as there could be some issues with sustaining them into the future. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Southwest Airlines that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.