MP Materials (MP) recently announced a long-term agreement with Apple to supply recycled rare earth magnets, signaling their commitment to sustainable supply chains. This, alongside a completed $650 million equity offering, likely influenced the impressive 254% share price surge over the last quarter. The company's Q2 results showed sales growth, albeit with ongoing net losses. In a broader market context, where all sectors rose and the market grew by 1.9% in recent days, MP's strategic actions to secure funding and partnerships provided significant weight to its remarkable stock performance, reflected against a backdrop of improving financial health.

Be aware that MP Materials is showing 1 weakness in our investment analysis.

MP Materials' recent agreement with Apple to supply recycled rare earth magnets is poised to significantly shape the company narrative by aligning with broader trends in sustainability and solidifying partnerships, potentially leading to increased demand. This collaboration, along with a $650 million equity offering, has played a crucial role in MP's share price movement, resulting in a very large increase over the last quarter.

Over the longer-term, MP's shares showcased a remarkable total return of very large percentage over the past year. In comparison to the industry, MP outperformed the US Metals and Mining industry, which returned 24.3% over the same period, marking a significant divergence that highlights the company's distinct market position.

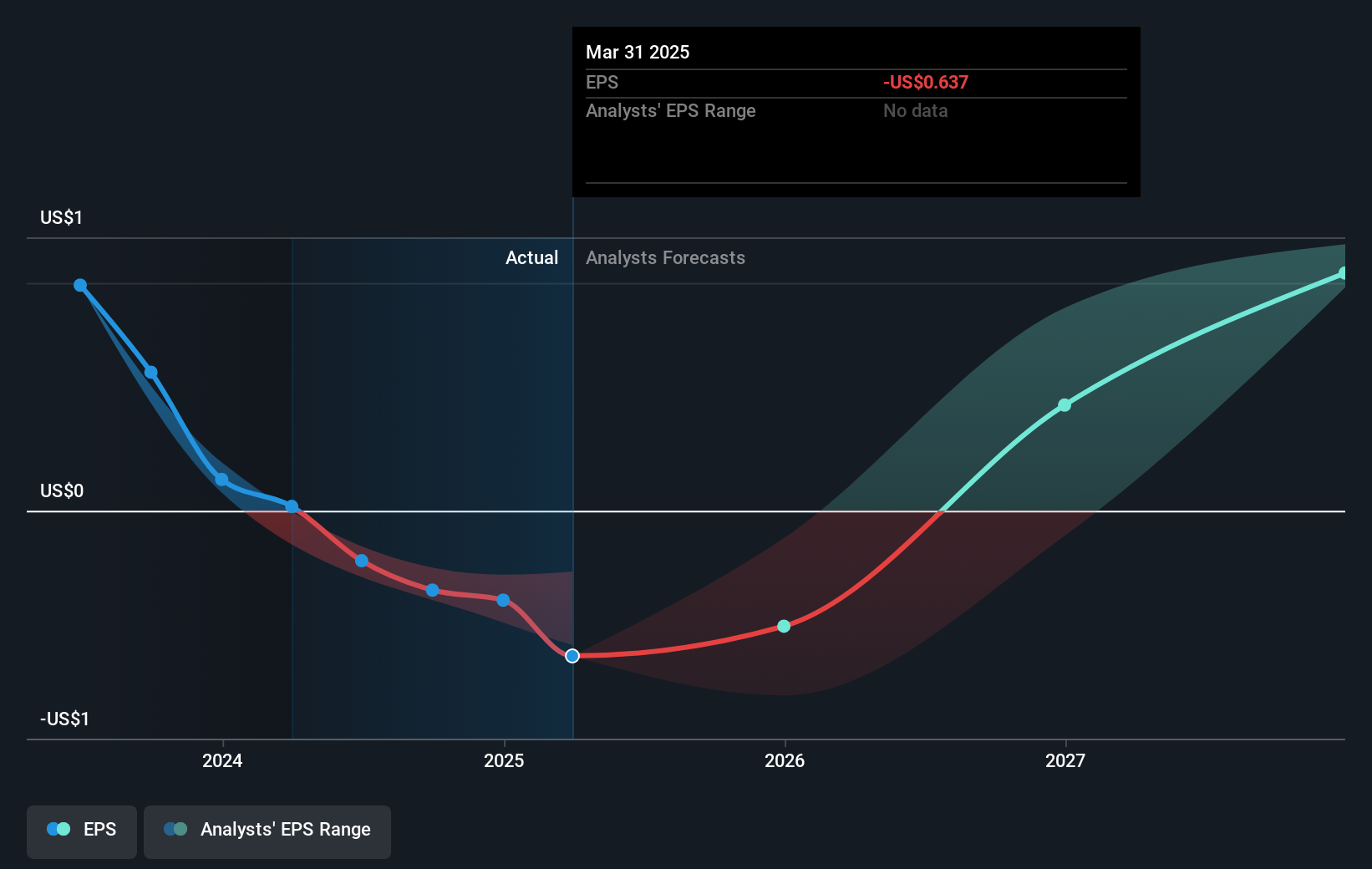

The renewed partnerships and financial influx are likely to have a positive impact on revenue and earnings forecasts. Analysts predict MP's earnings will be bolstered by the expansion into ex-China markets, leveraging new equipment and processes to drive growth. With these advancements, the consensus price target stands at US$65.90, slightly below the current share price of US$75.40, suggesting that MP's recent price movement may indicate that the market has already priced in some of these positive expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com