- Alexandria Real Estate Equities recently announced its largest-ever lease agreement, securing a 466,000 square foot deal and reporting positive second quarter 2025 results with 2.0% cash same-property NOI growth and a 90.8% North American occupancy rate.

- This historic lease not only marks a key operational milestone for the life science REIT but also highlights its success in attracting major tenants amid changing industry demand.

- We'll consider how signing the company's largest lease may bolster Alexandria's investment case as a premier provider of specialized lab space.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alexandria Real Estate Equities Investment Narrative Recap

Owning Alexandria Real Estate Equities means believing in the enduring need for specialized lab space within core innovation hubs, and that the business can maintain attractive occupancy and NOI growth even as the sector faces headwinds. While the record-breaking lease should help shore up near-term leasing velocity and bolster confidence in Alexandria’s cluster-focused model, it does not fully resolve the biggest current risk: tenant decision delays and pressure on occupancy tied to capital markets uncertainty and high interest rates.

The newly announced 16-year, 466,000 square foot lease with a multinational pharmaceutical tenant in San Diego is directly relevant here, offering long-term cash flow visibility and potentially easing margin worries. Signing a lease of this size during a period of softer transaction volumes underscores the resilience of Alexandria’s assets in key markets and may reinforce the company’s positioning as a go-to landlord for industry leaders in life sciences real estate.

However, investors should also consider that even strong leasing wins can’t fully insulate Alexandria from...

Read the full narrative on Alexandria Real Estate Equities (it's free!)

Alexandria Real Estate Equities' narrative projects $3.2 billion revenue and $311.7 million earnings by 2028. This requires a 0.8% yearly revenue decline and a $333.2 million earnings increase from current earnings of -$21.5 million.

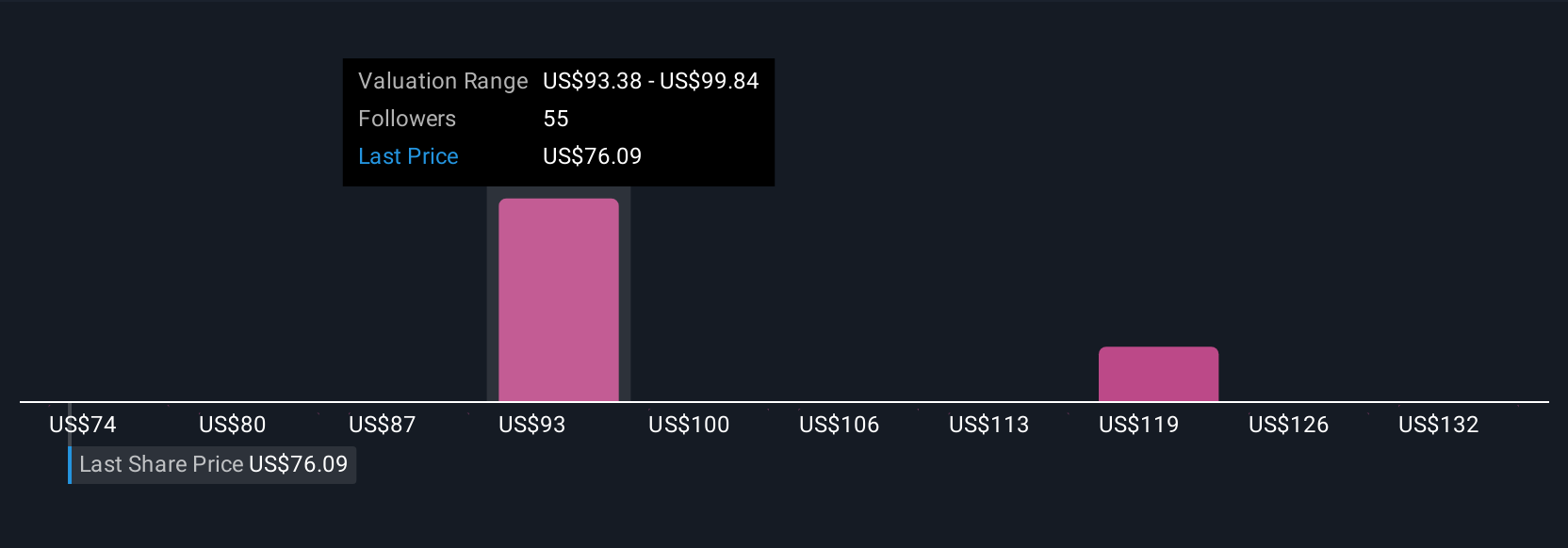

Uncover how Alexandria Real Estate Equities' forecasts yield a $98.83 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Seven Community members place fair value between US$74 and US$138.59, showing wide differences in outlook. Yet with slower forecast revenue growth, your expectations about sector recovery could shape your own assessment.

Explore 7 other fair value estimates on Alexandria Real Estate Equities - why the stock might be worth just $74.00!

Build Your Own Alexandria Real Estate Equities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexandria Real Estate Equities research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alexandria Real Estate Equities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexandria Real Estate Equities' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com