- Over the past year, multiple Westinghouse Air Brake Technologies insiders, including CEO, President & Director Rafael Santana, sold a significant amount of shares, with US$9.8 million sold by Santana alone and total insider sales of US$7.1 million in the past three months.

- Insiders have not made any purchases over the last year, and while they still own substantial stakes in the company, the ongoing selling may signal hesitancy within management ranks.

- We will explore how this insider selling trend shapes investor confidence and potentially impacts Westinghouse Air Brake Technologies' longer-term positioning.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

Westinghouse Air Brake Technologies Investment Narrative Recap

To be a shareholder of Westinghouse Air Brake Technologies, one needs to believe in the long-term global demand for rail infrastructure and modernization, including the adoption of digital and green technologies. The recent insider selling, especially by leadership, does not materially change the primary near-term catalyst, global rail investment, but may increase focus on the key risk of a softened North American freight market outlook and its impact on revenue visibility.

Among recent company developments, management’s upward revision of its 2025 revenue guidance by US$200 million, following the acquisition of Evident Inspection Technologies Division, stands out. This move directly aligns with the company's stated growth catalysts, though it also contributes to the ongoing discussion about financial risk related to new acquisitions and their successful integration into existing operations.

In contrast, the implications of declining North American railcar demand for Wabtec’s revenue consistency are something investors should be mindful of...

Read the full narrative on Westinghouse Air Brake Technologies (it's free!)

Westinghouse Air Brake Technologies is projected to reach $13.0 billion in revenue and $1.8 billion in earnings by 2028. This outlook assumes a 7.1% annual revenue growth and an increase in earnings of $0.6 billion from the current $1.2 billion.

Uncover how Westinghouse Air Brake Technologies' forecasts yield a $230.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

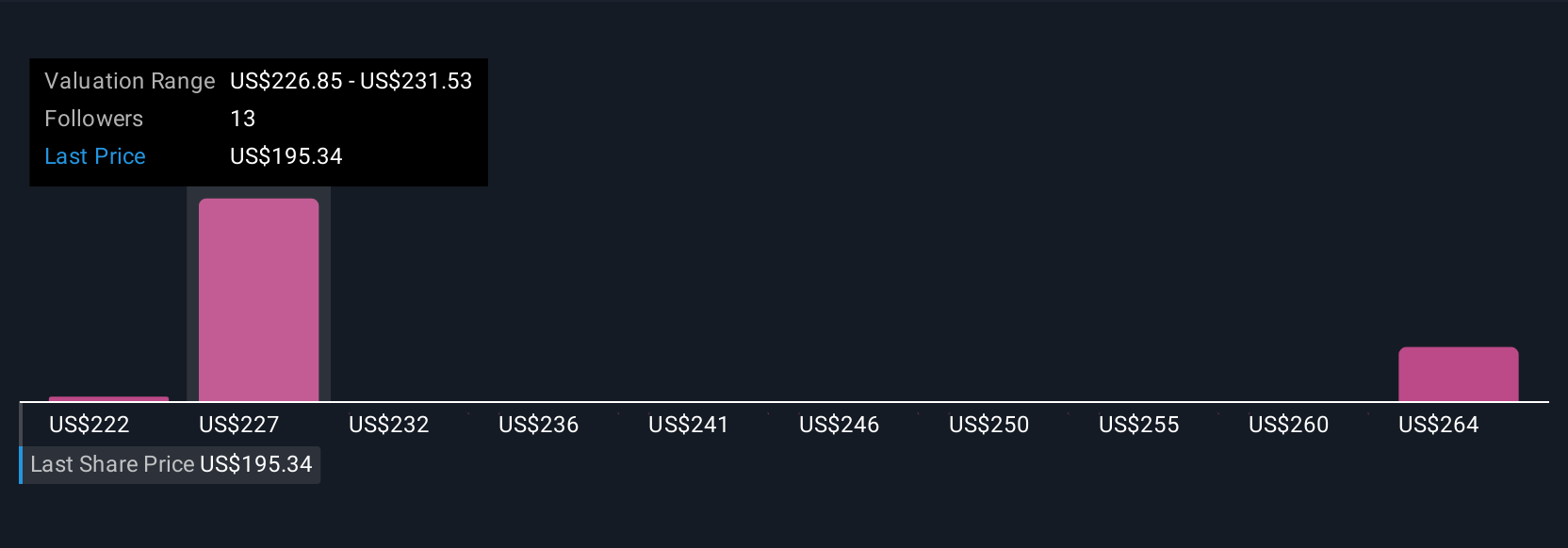

Simply Wall St Community members provided three fair value estimates for Wabtec, ranging from US$222.16 to US$268.88 per share. While opinions differ, keep in mind that reliance on acquisitions for growth comes with execution risks that could influence how the company’s future is viewed by the market.

Explore 3 other fair value estimates on Westinghouse Air Brake Technologies - why the stock might be worth as much as 38% more than the current price!

Build Your Own Westinghouse Air Brake Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Westinghouse Air Brake Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westinghouse Air Brake Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com