- In August 2025, the U.S. Department of Justice supported revoking antitrust immunity for Delta Air Lines' joint venture with Grupo Aeroméxico, opening the door for Delta to seek alternative Latin American partnerships and greater operational flexibility.

- This regulatory development is seen as a potential advantage for Delta, as it removes prior constraints and allows the airline to more actively pursue high-value routes across the region while mitigating political risks.

- We'll explore how this regulatory change may influence Delta's investment narrative, particularly regarding its competitive positioning in key international markets.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Delta Air Lines Investment Narrative Recap

Delta Air Lines' investment case hinges on its ability to deliver stable cash flow by controlling costs and capitalizing on premium travel and international expansion. The recent move by regulators to revoke antitrust immunity for Delta's joint venture with Grupo Aeroméxico could support the company's short-term catalyst, access to more lucrative Latin American routes, but does not eliminate core risks like pressure on main cabin demand or exposure to economic uncertainty.

Among recent updates, Delta's Q2 2025 earnings report showed resilient net income of US$2,130 million and steady revenue year over year. This underlines the airline's focus on margin control, which directly supports the narrative that operational flexibility, such as that offered by the regulatory change, may help offset near-term demand volatility.

By contrast, investors should be aware that even with greater route flexibility, persistent weakness in key travel segments such as corporate or main cabin could limit...

Read the full narrative on Delta Air Lines (it's free!)

Delta Air Lines' narrative projects $68.3 billion revenue and $4.6 billion earnings by 2028. This requires 3.3% yearly revenue growth and a $0.1 billion earnings increase from $4.5 billion today.

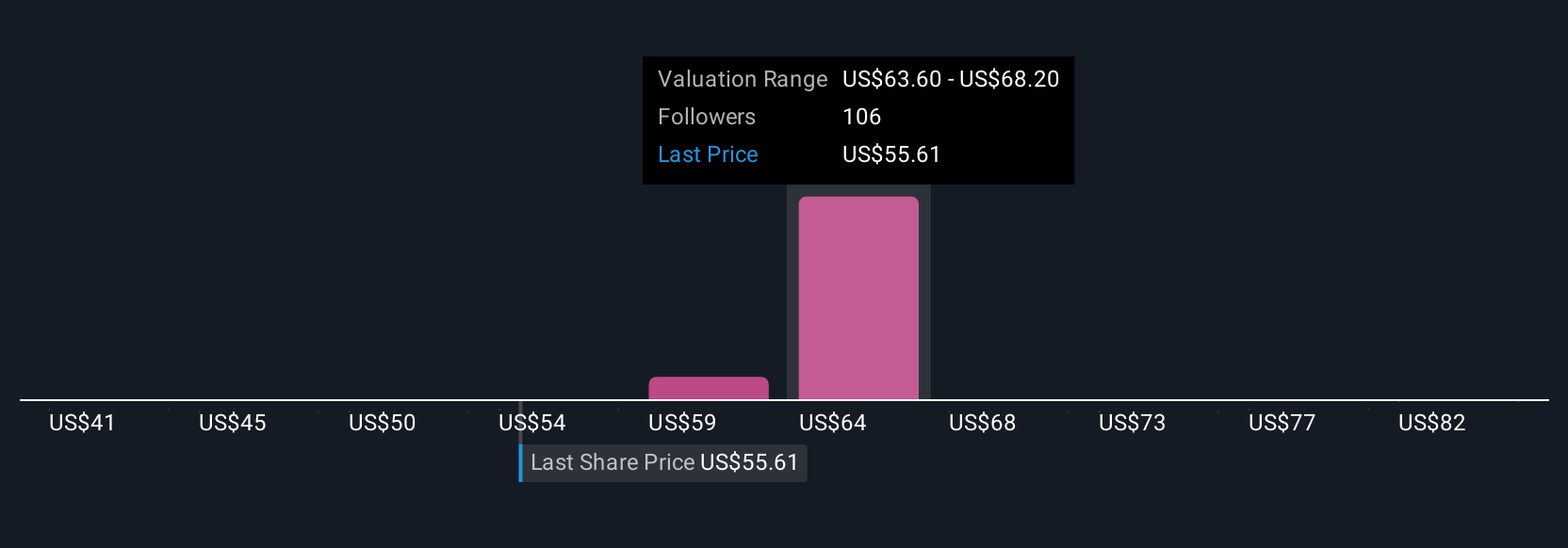

Uncover how Delta Air Lines' forecasts yield a $65.87 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Eight community members on Simply Wall St estimated Delta's fair value between US$39.88 and US$85.48. While some anticipate gains tied to international growth potential, others flag risks like economic uncertainty and shifts in travel demand. Explore how your view compares.

Explore 8 other fair value estimates on Delta Air Lines - why the stock might be worth 33% less than the current price!

Build Your Own Delta Air Lines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delta Air Lines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Delta Air Lines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delta Air Lines' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com