- In the past quarter, Southern Copper reported a 2% rise in net income despite a 2% fall in sales, attributed to a 3% drop in operating costs and a 17% decrease in cash cost per pound of copper, while also launching a major capital investment program in Peru that could add 156,000 tons to copper production capacity.

- An interesting takeaway is that, despite no recent share repurchases, Southern Copper completed buying back over 119 million shares since 2008, reducing its share count and potentially enhancing long-term shareholder value.

- We will now examine how Southern Copper’s improved cost structure and planned production expansion could reshape its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Southern Copper Investment Narrative Recap

To be a shareholder in Southern Copper, you need to believe in the long-term gains from expanding copper production, cost efficiency, and disciplined capital management in a global market often shaped by trade tensions and shifting commodity prices. The recent completion of the share buyback program does not materially change the main short-term catalyst, the ramp-up of new production in Peru, nor does it affect the biggest risk, which remains potential disruptions from tariffs or commercial conflicts impacting copper demand.

Out of the latest updates, the most relevant to this news is Southern Copper’s recently authorized quarterly dividend increase to US$0.80 per share. While this reflects ongoing financial health and commitment to returning value, the primary short-term catalyst still hinges on new capacity coming online efficiently, while broader commercial risks continue to warrant close attention.

However, even as Southern Copper enhances production and cost controls, investors should also consider the ongoing uncertainty around US-China trade relations and how...

Read the full narrative on Southern Copper (it's free!)

Southern Copper's narrative projects $13.0 billion revenue and $4.3 billion earnings by 2028. This requires 3.0% yearly revenue growth and a $0.7 billion earnings increase from $3.6 billion today.

Uncover how Southern Copper's forecasts yield a $95.70 fair value, a 4% downside to its current price.

Exploring Other Perspectives

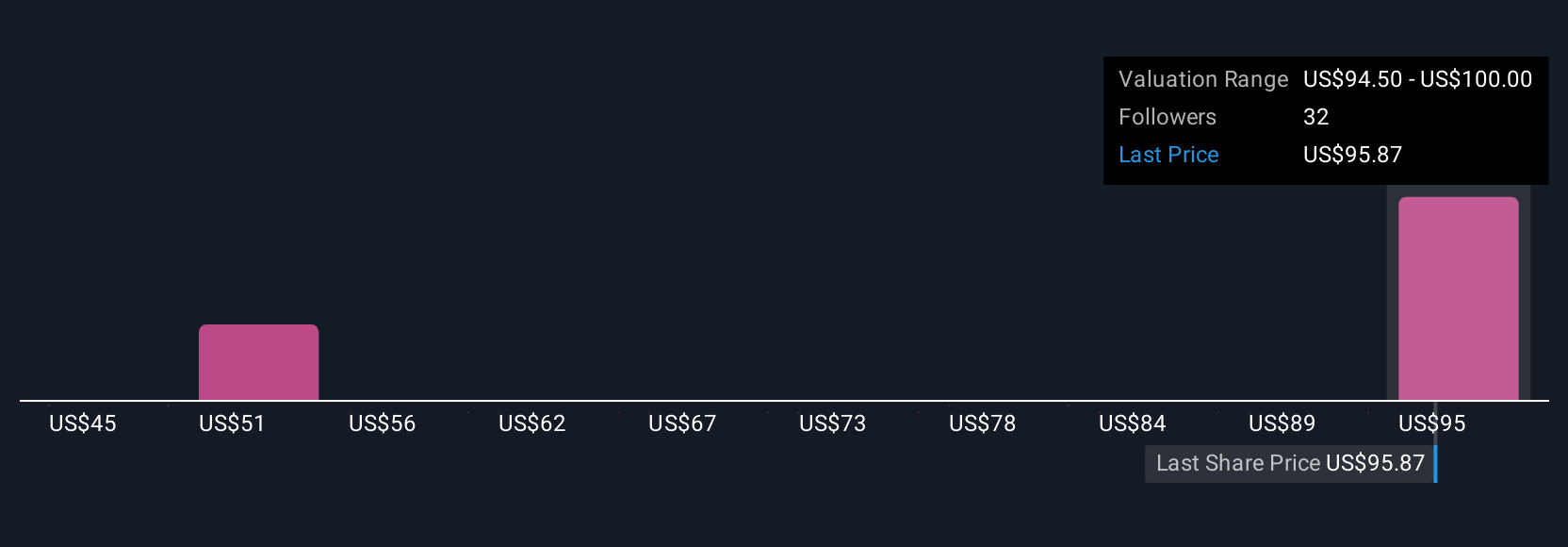

Simply Wall St Community members see fair value ranging from US$45 to US$100 per share based on five separate estimates. With this broad span in mind, keep in view how global trade tensions remain a key risk affecting Southern Copper’s future performance and investor confidence.

Explore 5 other fair value estimates on Southern Copper - why the stock might be worth less than half the current price!

Build Your Own Southern Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com