- In recent news, United States Lime & Minerals reported very large earnings per share gains, continuing revenue growth, and a 7.0 percentage point rise in EBIT margins to 41% over the past year.

- This performance is further underscored by substantial insider ownership, indicating management's strong confidence and alignment with shareholders' interests.

- With this backdrop of substantial margin expansion, we'll consider what these developments mean for United States Lime & Minerals' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is United States Lime & Minerals' Investment Narrative?

For anyone considering United States Lime & Minerals, the investment story often centers around strong earnings momentum, solid insider alignment, and high returns on equity. The recent surge in earnings per share and sharp margin gains, paired with a fast-rising share price, stand out as short-term catalysts that could shape sentiment going forward. However, this momentum does seem to have been priced in quickly, and some previous risks, such as index exclusions and premium valuation relative to peers, may now be more relevant as investor expectations reset. The improved EBIT margins help strengthen the fundamental case, but the price-to-earnings ratio remains well above the industry average, so valuation risk is hard to ignore. As these developments play out, the question is whether the growth trajectory can be maintained at such elevated levels.

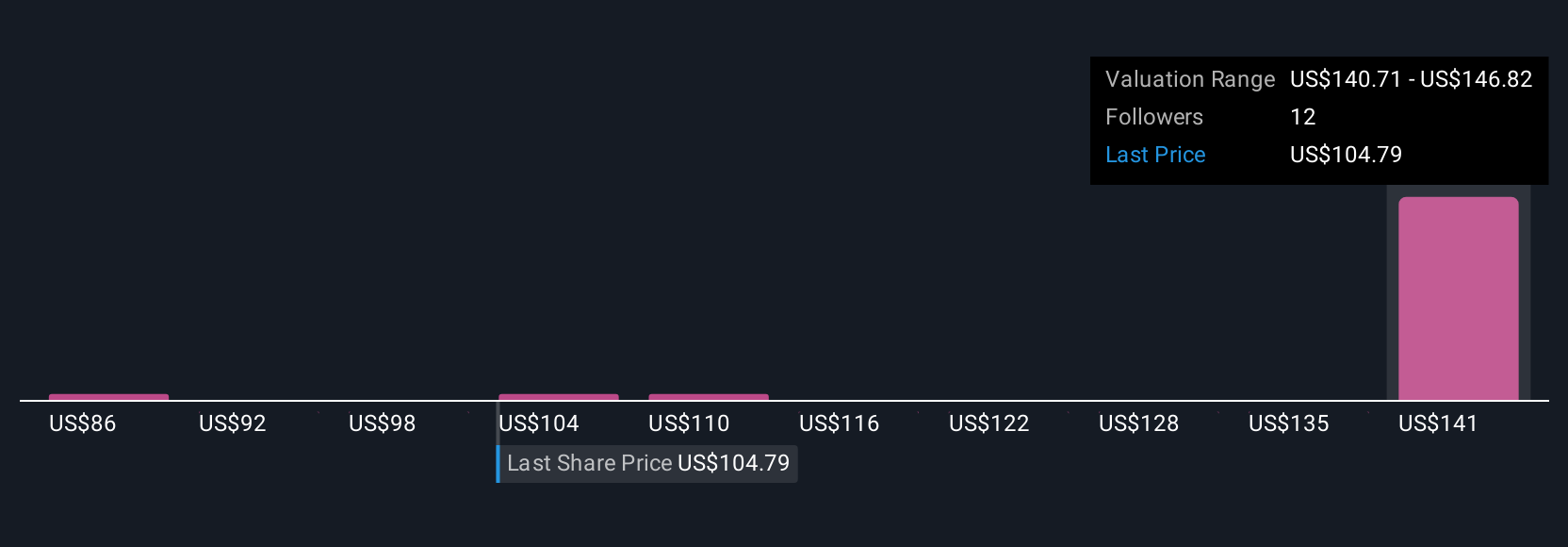

But despite strong profit growth, the stock’s valuation premium is something investors should keep in mind. United States Lime & Minerals' shares have been on the rise but are still potentially undervalued by 9%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on United States Lime & Minerals - why the stock might be worth as much as 9% more than the current price!

Build Your Own United States Lime & Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United States Lime & Minerals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free United States Lime & Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United States Lime & Minerals' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com