- Heidrick & Struggles International recently reported second quarter 2025 results, showing revenues of US$321.91 million and net income of US$21.07 million, marking a significant turnaround from a net loss a year prior, and confirmed a US$0.15 per share dividend payable in August 2025.

- The company also provided third quarter revenue guidance and acknowledged that ongoing macroeconomic and geopolitical factors may impact its outlook, highlighting both operational resilience and external risks.

- We'll examine how Heidrick & Struggles' return to profitability and dividend affirmation shape the company's updated investment narrative.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Heidrick & Struggles International Investment Narrative Recap

To be a shareholder in Heidrick & Struggles International, you have to believe that structural demand for executive search and consulting services will persist, even as the industry faces ongoing digital disruption and global macroeconomic shifts. The company’s Q2 2025 return to profitability supports near-term optimism, but management’s Q3 guidance and commentary reinforce that fluctuating client demand tied to economic or geopolitical events remains the most significant risk in the short term, a factor not fundamentally changed by the latest earnings report.

Among recent announcements, the affirmation of a US$0.15 per share quarterly dividend stands out. This not only reflects financial confidence following an improved earnings period but also acts as a touchstone for investors seeking income stability amid sector headwinds and potential revenue volatility, sustaining one of the stock’s most observable short-term catalysts. In contrast, investors should also be aware of the persistent risk that unpredictable client behavior during periods of macroeconomic uncertainty can bring to Heidrick & Struggles’ performance, especially when...

Read the full narrative on Heidrick & Struggles International (it's free!)

Heidrick & Struggles International's outlook anticipates $1.3 billion in revenue and $95.9 million in earnings by 2028. This is based on an expected annual revenue growth rate of 3.9% and a $61.7 million increase in earnings from the current $34.2 million.

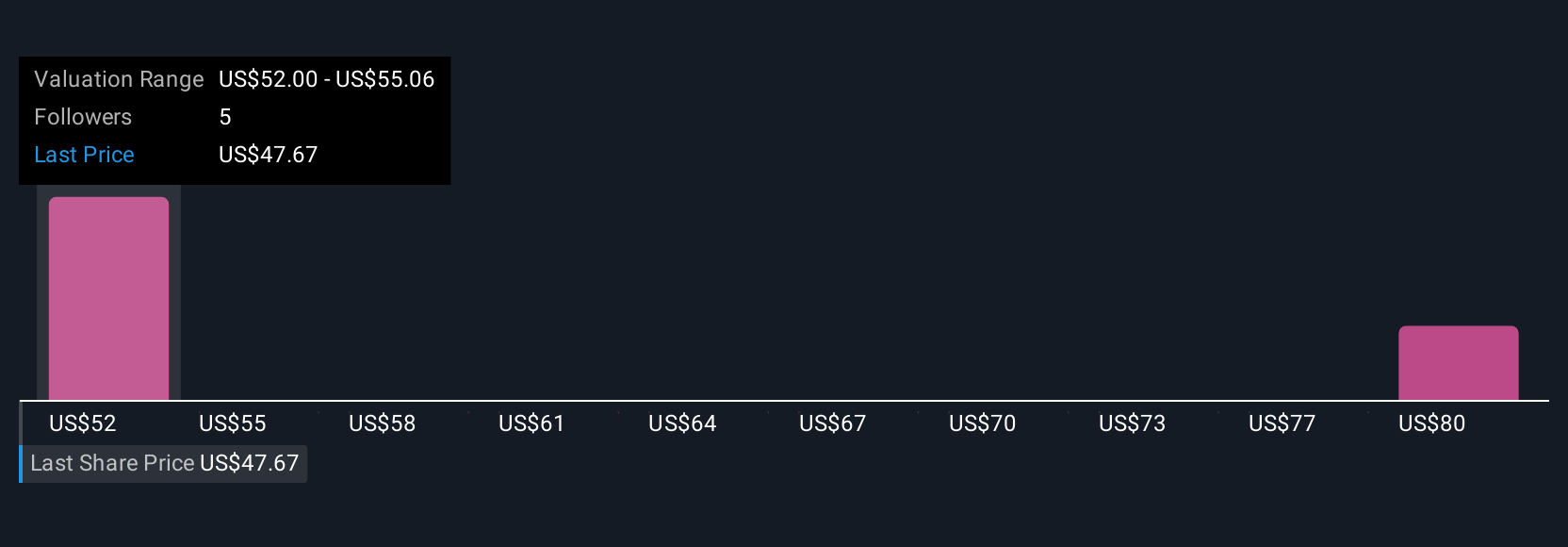

Uncover how Heidrick & Struggles International's forecasts yield a $52.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range between US$52.00 and US$82.87 per share. While some see significant upside, others remain cautious as ongoing revenue volatility from shifting client demand continues to shape the outlook for Heidrick & Struggles.

Explore 2 other fair value estimates on Heidrick & Struggles International - why the stock might be worth as much as 67% more than the current price!

Build Your Own Heidrick & Struggles International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heidrick & Struggles International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Heidrick & Struggles International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heidrick & Struggles International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com