- Aptiv recently reported its second-quarter 2025 results, showing a year-over-year rise in sales to US$5.21 billion, though net income and earnings per share declined substantially compared to a year ago, and the company issued updated financial guidance for the third quarter and full year.

- During the same period, Aptiv completed a significant share repurchase worth US$377.08 million, retiring 2.73% of its outstanding shares as part of a broader buyback program.

- We’ll now consider how Aptiv’s significantly lower net income and updated guidance may influence the company’s long-term investment story.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Aptiv Investment Narrative Recap

At its core, the investment case for Aptiv rests on the belief that demand for advanced vehicle electronics and electrification solutions will continue to drive solid revenue growth, powered by industry shifts toward electric vehicles and ADAS adoption. While Aptiv’s latest results show revenue resilience, the substantial drop in net income, coupled with softer full-year guidance, brings earnings visibility and margin recovery into sharper focus, both crucial for near-term sentiment. Notably, slow progress or negative news on earnings remain the biggest risk right now, but this quarter’s news only modestly influences the narrative, keeping core catalysts and risks largely intact.

Among recent developments, Aptiv’s substantial US$377.08 million share repurchase stands out, reflecting continued company commitment to returning value to shareholders. This move retires 2.73% of outstanding shares and comes at a time when management is also tightening expense discipline and updating guidance, both of which may contribute to stabilizing confidence amid margin pressures and earnings volatility.

However, against management’s positive actions, margin pressures linked to commodity price volatility still present a challenge investors should be keenly aware of...

Read the full narrative on Aptiv (it's free!)

Aptiv's narrative projects $23.3 billion revenue and $1.9 billion earnings by 2028. This requires 5.6% yearly revenue growth and a $0.9 billion earnings increase from $1.0 billion currently.

Uncover how Aptiv's forecasts yield a $83.25 fair value, a 11% upside to its current price.

Exploring Other Perspectives

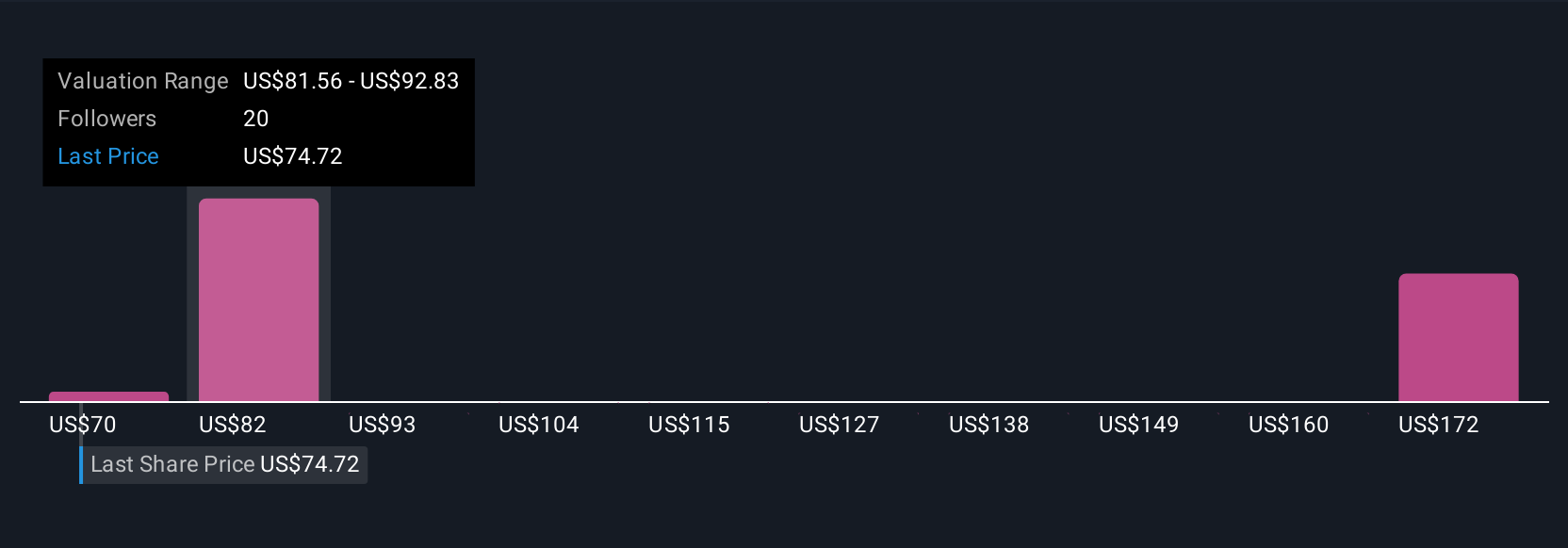

Over six individual fair value views from the Simply Wall St Community, Aptiv’s estimates range from US$70.29 to US$182.98 per share. While you weigh these widely differing opinions, keep in mind that ongoing margin headwinds could influence not just near-term results but also longer-range outlooks for the business.

Explore 6 other fair value estimates on Aptiv - why the stock might be worth over 2x more than the current price!

Build Your Own Aptiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aptiv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aptiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aptiv's overall financial health at a glance.

No Opportunity In Aptiv?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com