- In late July 2025, Dolby Laboratories reported third quarter earnings showing year-over-year revenue growth to US$315.55 million and net income rising to US$46.07 million, while also affirming a US$0.33 per share dividend and updating on its share buyback program.

- Alongside its performance update, Dolby issued new earnings guidance for both the fourth quarter and the full fiscal year 2025, setting clear expectations for investors amid ongoing share repurchases.

- We'll explore how Dolby's updated full-year outlook helps shape its investment narrative and what it means for future growth prospects.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

Dolby Laboratories Investment Narrative Recap

To invest in Dolby Laboratories, you need confidence in the company’s ability to stay essential in premium audio and visual technology, especially as it expands into vehicles and streaming, all while managing risks like commoditization of consumer electronics and global competition. The recent Q3 earnings report and updated full-year guidance reinforce the company’s near-term expectations but do not appear to significantly shift the most important short-term catalyst, the ongoing adoption of Dolby Atmos and Vision in new markets, or alleviate the key risk of shrinking addressable hardware markets.

Among the recent announcements, Dolby’s affirmation of its $0.33 per share dividend stands out, highlighting management’s confidence in cash flow stability and the business’s ability to reward shareholders, even as growth in its foundational segments faces headwinds. While this stability may reassure investors looking for income, the sustainability of future dividends will remain closely tied to the company’s success at driving adoption in automotive and emerging direct-to-consumer offerings.

Yet, despite recent momentum, the risk for investors lies in ongoing commoditization across TVs and mobile devices, an area every shareholder should keep in mind as...

Read the full narrative on Dolby Laboratories (it's free!)

Dolby Laboratories' narrative projects $1.5 billion revenue and $327.9 million earnings by 2028. This requires 4.3% yearly revenue growth and a $63.6 million earnings increase from the current $264.3 million.

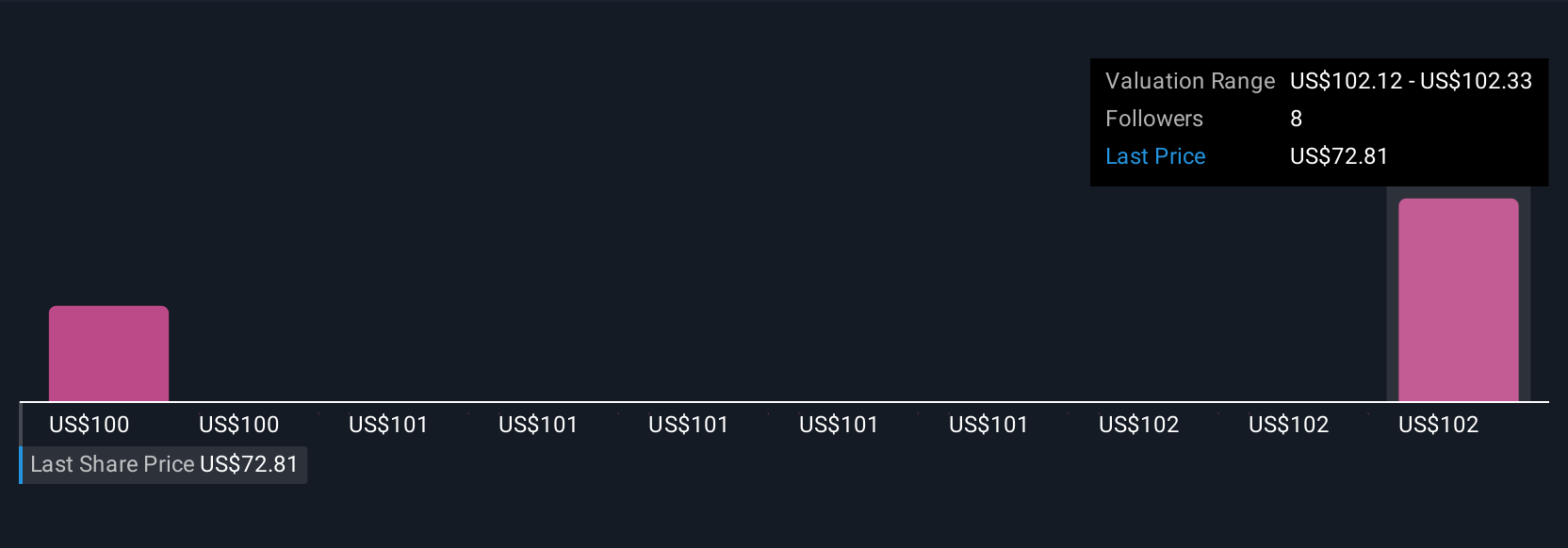

Uncover how Dolby Laboratories' forecasts yield a $102.33 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate Dolby's fair value between US$99.88 and US$102.33. Investors are split, and with ongoing competition in global device markets, your own outlook could point in a very different direction.

Explore 2 other fair value estimates on Dolby Laboratories - why the stock might be worth just $99.88!

Build Your Own Dolby Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dolby Laboratories research is our analysis highlighting 6 key rewards that could impact your investment decision.

- Our free Dolby Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dolby Laboratories' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com