- PBF Energy recently reported a narrowed quarterly net loss for the second quarter of 2025, confirmed a quarterly dividend of US$0.275 per share payable on August 28, and updated its production guidance for the third quarter across its refinery network.

- The company's continued commitment to shareholder returns via dividends and operational updates comes as it prepares to present at Citi’s 2025 Natural Resources Conference in Las Vegas.

- We'll explore how PBF Energy's reinforced dividend and updated production targets shape its investment narrative and future outlook.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

PBF Energy Investment Narrative Recap

To be a shareholder in PBF Energy today, you need to believe in a tight refining market supporting improved utilization and margins for efficient US operators, amidst regional regulatory risks and the need for ongoing capital investment in aging assets. The recent Q2 results, showing narrowed net loss and reinforced dividend, do not appear to materially alter the biggest near-term catalyst, which is the full restart and stable operation of the Martinez refinery. The key risk remains prolonged operational or regulatory setbacks at core refineries, particularly in California.

The company’s dividend affirmation of US$0.275 per share, despite ongoing losses, is a point of interest. It signals an intent to uphold shareholder returns, even as sustainable earnings remain out of reach and operational throughput is subject to headline risks from the Martinez facility.

However, investors should be aware that any surprises related to Martinez or California regulation could quickly shift the outlook and ...

Read the full narrative on PBF Energy (it's free!)

PBF Energy's outlook projects $33.5 billion in revenue and $71.3 million in earnings by 2028. This requires 3.4% annual revenue growth and an earnings increase of $1,053.6 million from current earnings of -$982.3 million.

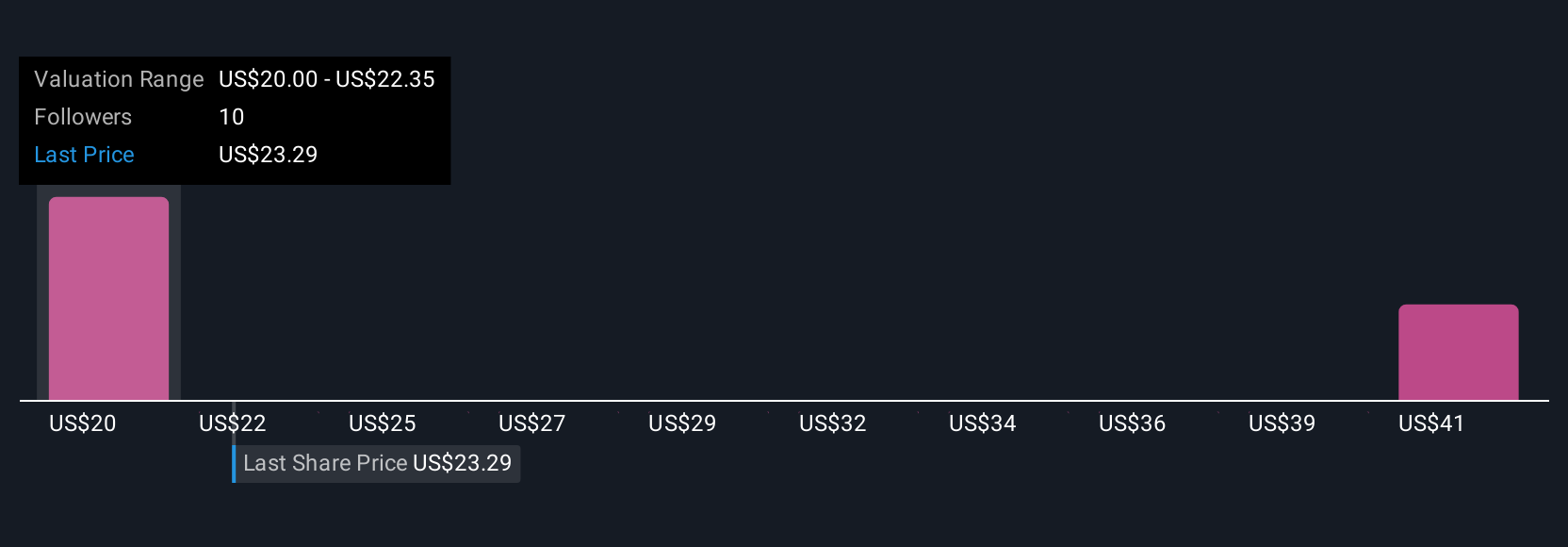

Uncover how PBF Energy's forecasts yield a $22.00 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members peg PBF Energy’s fair value from US$20.00 to US$42.67 per share. With regulatory and operational risks still overshadowing steady execution, your outlook may differ widely.

Explore 4 other fair value estimates on PBF Energy - why the stock might be worth 13% less than the current price!

Build Your Own PBF Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PBF Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PBF Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PBF Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com