- Earlier this month, New Oriental Education & Technology Group Inc. filed a shelf registration to offer 10,000,000 American Depositary Shares, raising up to US$458.8 million as part of an ESOP-related initiative.

- This filing points to both the potential for new capital flexibility and the company's focus on employee incentive alignment during a period of ongoing expansion.

- We'll explore how this sizeable ESOP-related share offering could influence New Oriental's growth trajectory and future shareholder value.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

New Oriental Education & Technology Group Investment Narrative Recap

To be a shareholder in New Oriental Education & Technology Group, you need to believe in the expansion of premium education offerings and the company's ability to drive innovation despite regulatory and competitive pressure. The recent shelf registration to offer up to 10,000,000 American Depositary Shares for an ESOP initiative adds capital flexibility but has little immediate effect on the primary short-term catalyst of product innovation, or the main risk of intensifying competition putting pressure on margins and market share.

The share repurchase program, which saw 14,400,000 shares bought back for US$695.5 million so far, is particularly relevant here. This demonstrates ongoing shareholder return initiatives and may balance any shareholder dilution risk linked to the new ESOP-related share offering by supporting earnings per share and reinforcing commitment to capital returns.

In contrast, investors should also be mindful of intensifying competition in the K-12 and non-academic segments and the impact it may have on future profitability, especially as...

Read the full narrative on New Oriental Education & Technology Group (it's free!)

New Oriental Education & Technology Group's outlook anticipates $6.5 billion in revenue and $628.5 million in earnings by 2028. This scenario assumes 9.7% annual revenue growth and a $256.8 million increase in earnings from the current $371.7 million.

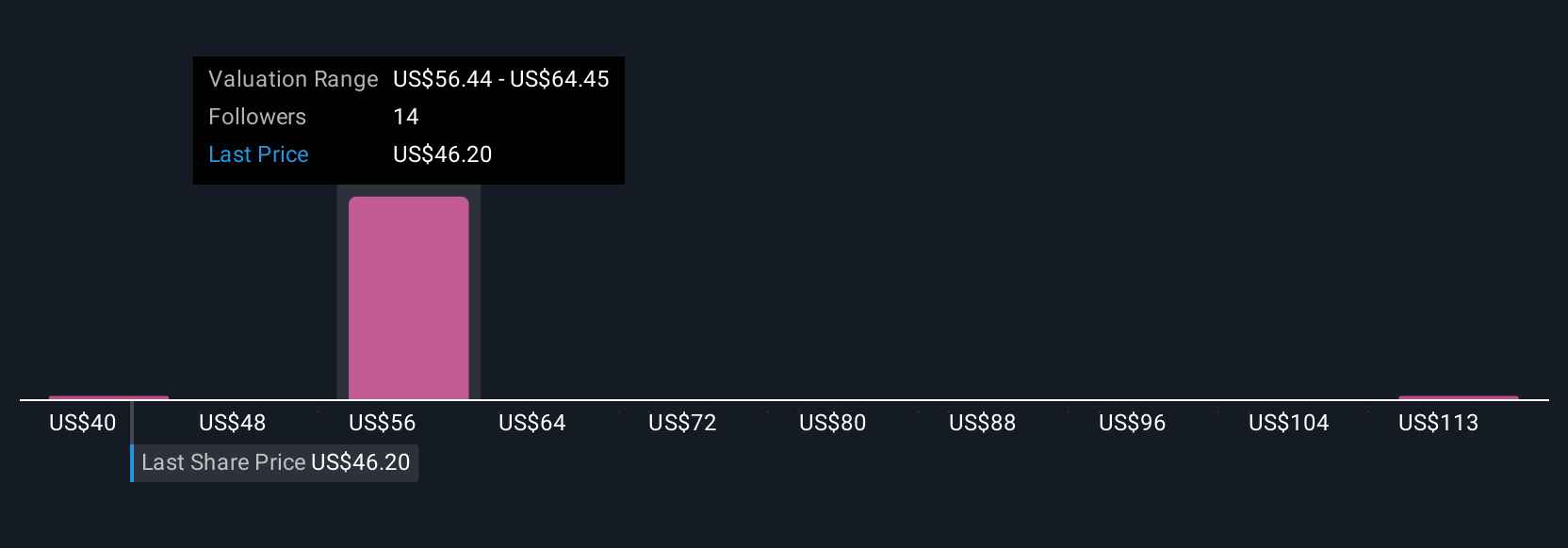

Uncover how New Oriental Education & Technology Group's forecasts yield a $57.61 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members assigned fair value estimates for New Oriental Education between US$40.42 and US$121.08 across three distinct analyses. While analyst consensus highlights continued pressure from competition on margins and market share, it is clear there are a range of views to consider when evaluating the company’s performance.

Explore 3 other fair value estimates on New Oriental Education & Technology Group - why the stock might be worth 14% less than the current price!

Build Your Own New Oriental Education & Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Oriental Education & Technology Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free New Oriental Education & Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Oriental Education & Technology Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com