- Builders FirstSource, Inc. recently reported second quarter 2025 results, revealing year-over-year declines in sales to US$4.23 billion and net income to US$185.03 million, while also providing updated full-year sales guidance and announcing the completion of a major share repurchase program.

- Company leadership emphasized plans to continue inorganic growth through acquisitions and technology integration, signaling a focus on long-term efficiency and operational improvements amid current market softness.

- We'll examine how Builders FirstSource's softer earnings and ongoing acquisition strategy reshape its investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Builders FirstSource Investment Narrative Recap

To be a shareholder of Builders FirstSource, you need to believe in the company's ability to drive long-term value through operational excellence, digital investment, and acquisitions, even as the core housing and repair markets remain under pressure. The latest results, which showed softer sales and profit, did little to shift the focus from ongoing housing market weakness as the most important near-term catalyst and risk, and the impact of recent announcements is not material enough to alter these dynamics.

Among the company’s recent actions, the completed US$908.35 million share repurchase program stands out; this direct return of capital to shareholders is particularly relevant as it signals confidence in the company's financial strength during a period of subdued earnings and demand softness. This move complements Builders FirstSource’s efforts to maintain flexibility for both growth investments and capital returns, two levers that remain crucial with market headwinds persisting.

By contrast, it is important for investors to keep in mind the company’s high exposure to commodity price volatility, especially since...

Read the full narrative on Builders FirstSource (it's free!)

Builders FirstSource's outlook forecasts $16.4 billion in revenue and $684.5 million in earnings by 2028. This is based on a -0.9% annual revenue decline and an earnings decrease of $71.9 million from current earnings of $756.4 million.

Uncover how Builders FirstSource's forecasts yield a $139.00 fair value, a 4% downside to its current price.

Exploring Other Perspectives

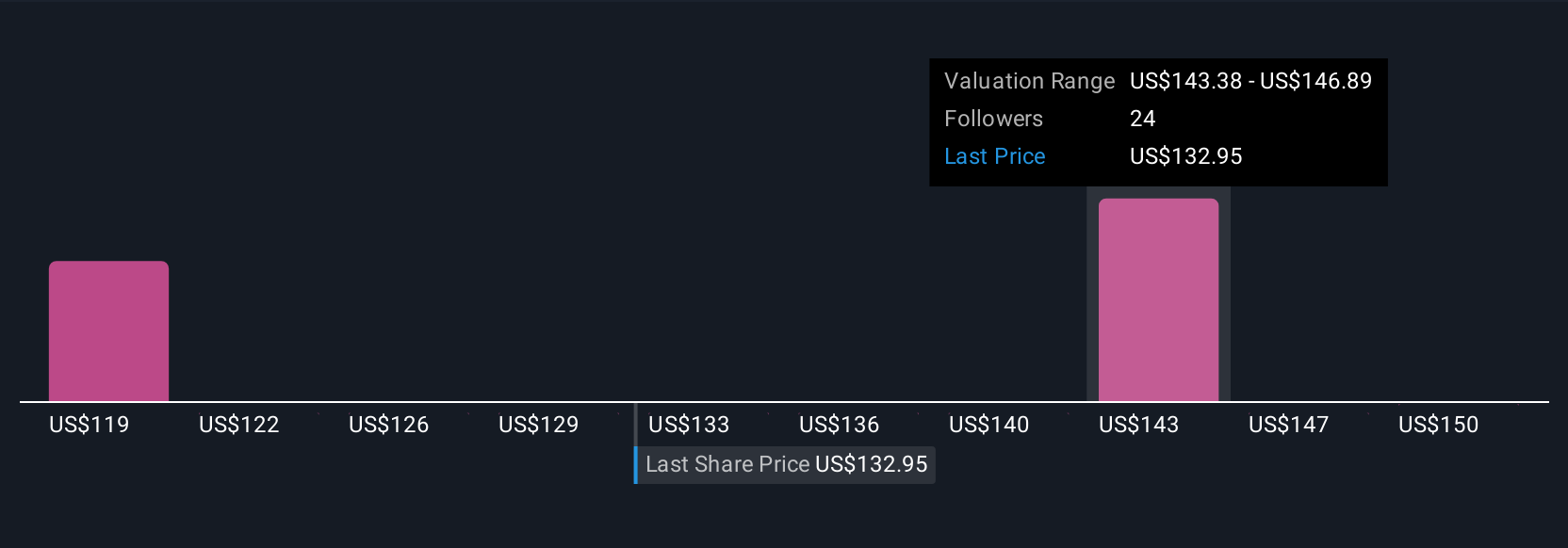

Simply Wall St Community members estimate Builders FirstSource’s fair value between US$119.90 and US$153.90 across three opinions, showcasing wide variation. As you consider these viewpoints, remember that persistent softness in housing starts remains a key risk shaping future results.

Explore 3 other fair value estimates on Builders FirstSource - why the stock might be worth as much as 7% more than the current price!

Build Your Own Builders FirstSource Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Builders FirstSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Builders FirstSource research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Builders FirstSource's overall financial health at a glance.

No Opportunity In Builders FirstSource?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com