- MP Materials Corp. recently reported its second quarter 2025 earnings, showing sales of US$57.39 million and a net loss of US$30.87 million, both improved compared to the same period last year.

- While revenues showed strong growth, losses narrowed only slightly, highlighting ongoing profitability challenges despite rising demand for rare earth materials.

- We’ll examine how the company’s improved sales but persistent losses influence the investment narrative and outlook for production gains.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

MP Materials Investment Narrative Recap

For investors in MP Materials, the core belief centers on the company's ability to build a profitable, U.S.-based supply chain for rare earth materials amid increasing global demand. While the Q2 2025 earnings showed strong year-over-year sales growth and a narrowing net loss, the results do not materially alter the most pressing short-term catalyst, proving that ramping production and margin initiatives can bring the company closer to sustained profitability. The principal risk remains: achieving profitable scale while navigating volatile pricing and ongoing process optimization challenges.

Among MP Materials' recent announcements, its new US$500 million partnership with Apple stands out as highly relevant. This long-term supply agreement for rare earth magnets underscores the demand backdrop supporting MP’s expansion, but given that deliveries are not expected until 2027, it has limited bearing on the immediate focus for investors: operational performance and margin progression in the near term.

However, investors should be aware that despite recent revenue gains, risks remain regarding production stability and margin variability, as...

Read the full narrative on MP Materials (it's free!)

MP Materials' outlook anticipates $655.9 million in revenue and $101.4 million in earnings by 2028. Achieving these targets implies a 47.6% annual revenue growth rate and a $166.8 million increase in earnings from the current -$65.4 million level.

Uncover how MP Materials' forecasts yield a $56.80 fair value, a 25% downside to its current price.

Exploring Other Perspectives

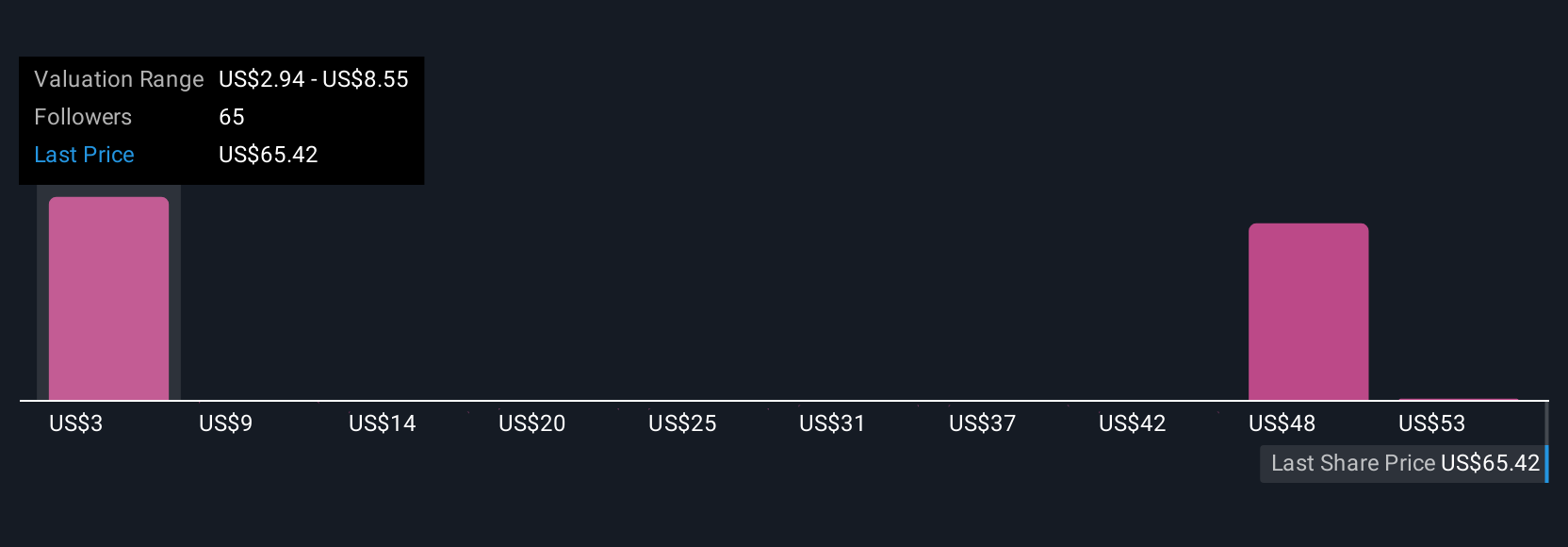

The Simply Wall St Community offers 18 unique fair value estimates for MP Materials, spanning US$2.64 to US$65.90 per share. As you consider these differing viewpoints, remember that recurring production and process risks could shape the company’s performance outcomes well beyond near-term sales growth.

Explore 18 other fair value estimates on MP Materials - why the stock might be worth less than half the current price!

Build Your Own MP Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MP Materials research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free MP Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MP Materials' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com