- Earlier this month, Global Partners LP reported second quarter 2025 results, highlighting sales of US$4.63 billion and net income of US$20.6 million, alongside a US$211,000 impairment charge and a cash distribution increase to US$0.75 per unit for the quarter.

- The company's recent Zacks Rank #1 (Strong Buy) upgrade, supported by an improving earnings outlook and attractive value metrics, further signals growing investor confidence in its financial trajectory.

- We'll examine how the recent analyst upgrade and upward earnings momentum influence Global Partners' overall investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

Global Partners Investment Narrative Recap

To be a shareholder in Global Partners, you need to believe in the resilience of large-scale fuel distribution and retail operations through industry shifts, even as demand trends and regulatory pressures evolve. The latest quarter’s minor asset impairment charge is not a material event and does little to change the near-term focus on volume growth and operating margin sustainability; however, risks from energy transition and tighter emissions rules remain highly relevant.

Among the recent announcements, the increase in the quarterly cash distribution to US$0.75 per unit stands out. While this move may offer near-term appeal to income-focused investors, it comes against the backdrop of a challenging margin environment and persistent questions about dividend sustainability as fuel dynamics evolve.

On the other hand, investors should be aware of potential long-term risks from tightening emissions regulations and rising compliance costs because...

Read the full narrative on Global Partners (it's free!)

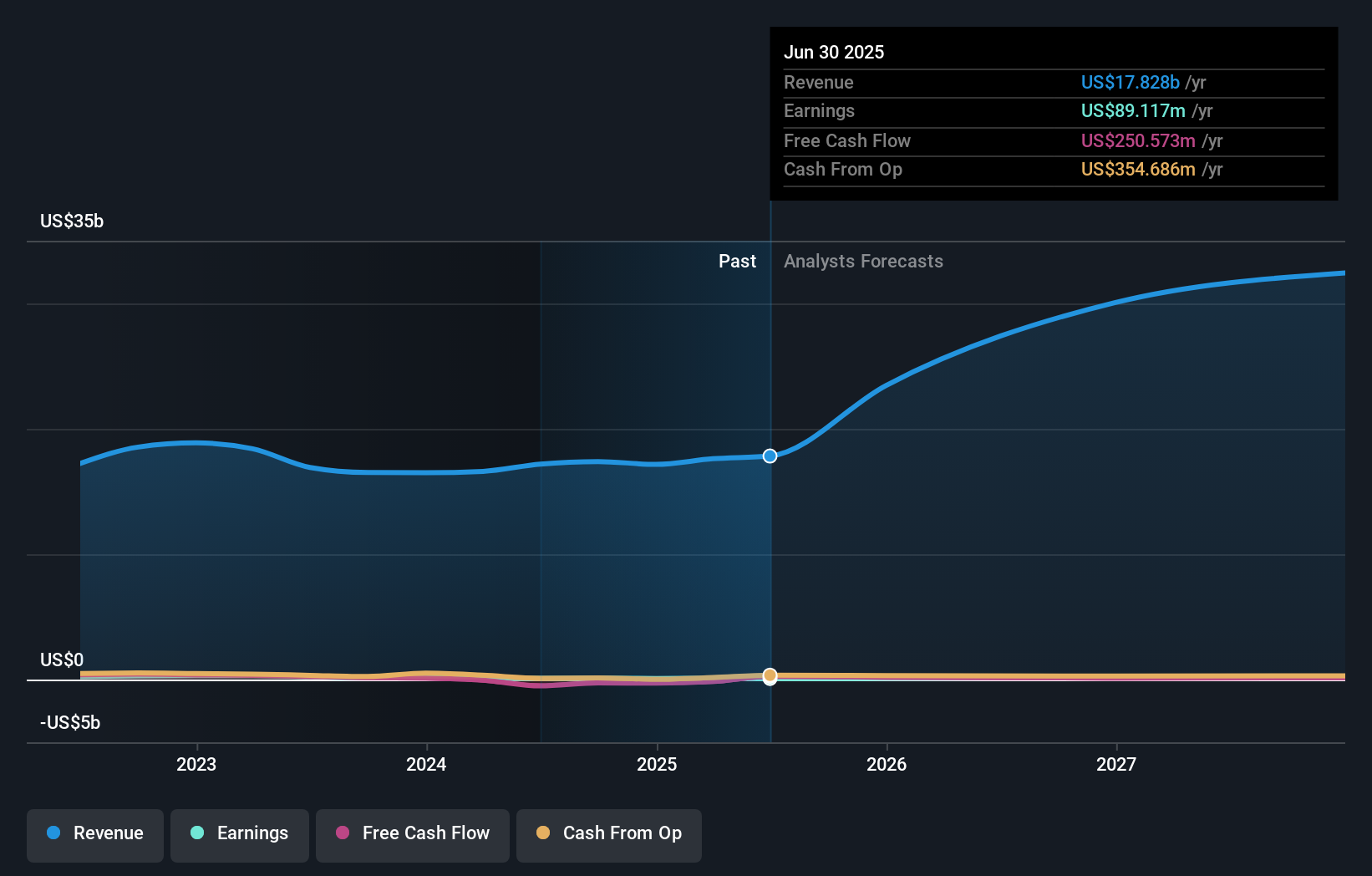

Global Partners' outlook anticipates $38.2 billion in revenue and $149.4 million in earnings by 2028. This scenario is based on annual revenue growth of 28.9% and a $60.3 million increase in earnings from the current $89.1 million.

Uncover how Global Partners' forecasts yield a $53.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Global Partners ranging from US$53 to US$68.51 per unit. Yet with ongoing regulatory risks threatening net margins, it is clear the range of opinion on the stock’s future is wide. Explore several viewpoints to better understand the range of possible outcomes for GLP.

Explore 2 other fair value estimates on Global Partners - why the stock might be worth just $53.00!

Build Your Own Global Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Partners' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com