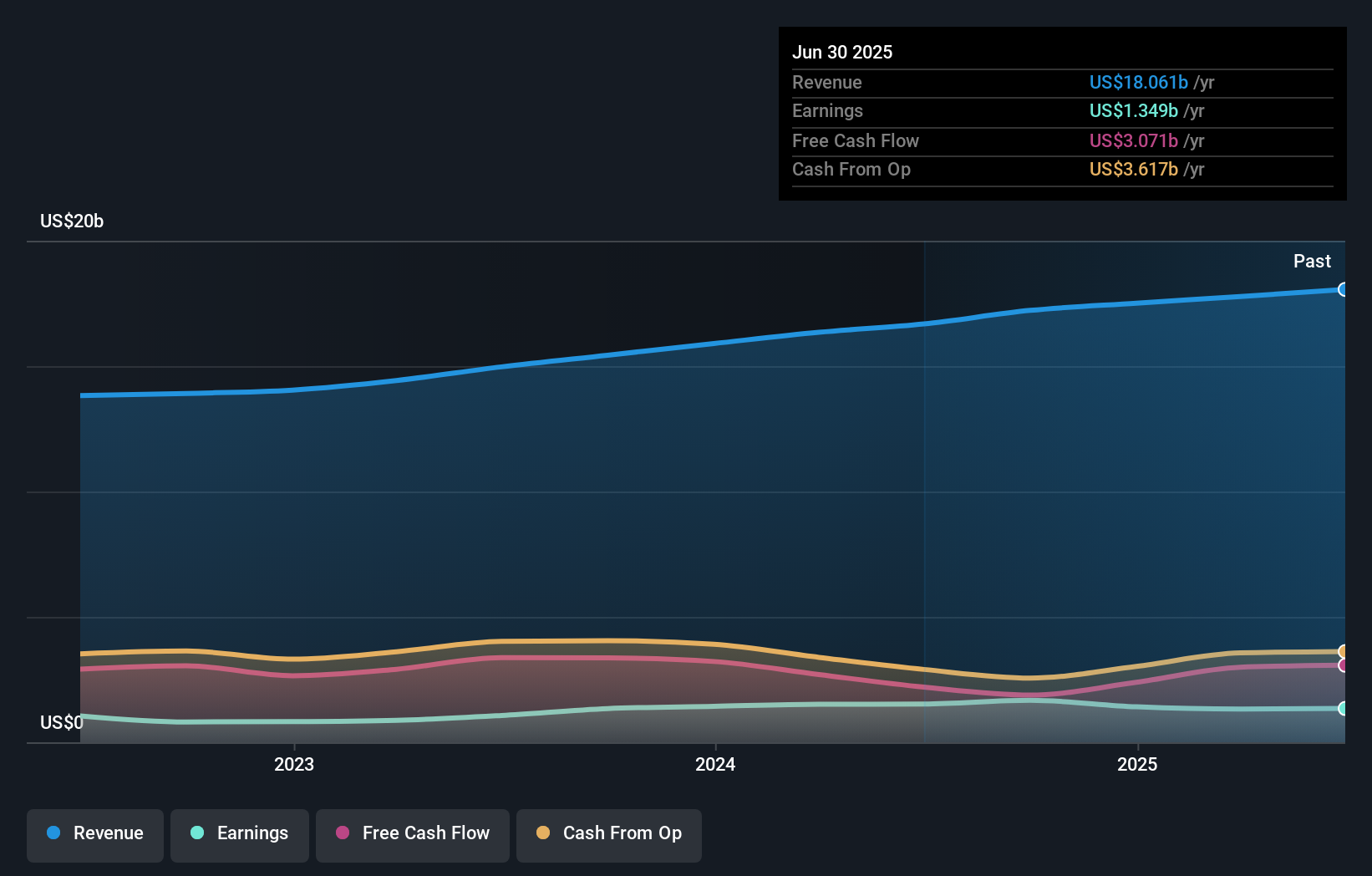

- Loews Corporation recently announced that its Board of Directors expanded to 11 members with the appointment of Jennifer VanBelle, alongside releasing second-quarter results showing increased revenue of US$4.56 billion and net income of US$391 million versus the prior year.

- The addition of an executive with deep financial leadership, coupled with continued dividend affirmations and ongoing share repurchases, highlights Loews' focus on governance and shareholder returns.

- We’ll explore how the combination of robust quarterly earnings and boardroom expertise shapes the ongoing investment narrative for Loews.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Loews' Investment Narrative?

For Loews shareholders, the investment thesis often rests on stability, conservative capital allocation, and a focus on long-term value creation through cycles. The recent appointment of Jennifer VanBelle to the board, with her deep background in finance and governance, brings added expertise, potentially supporting future risk oversight. Combined with increased quarterly revenue, steady dividend declarations, and ongoing share buybacks, these signals reinforce a commitment to shareholder value. Despite these positives, short-term catalysts remain unchanged: earnings consistency, capital management, and sector headwinds are still front and center. The boardroom change is unlikely to fundamentally reshape near-term risks, but in a shifting economic backdrop, access to seasoned leadership can add an extra layer of confidence. Larger structural challenges, like low return on equity and recent earnings declines, still warrant careful attention.

But, despite recent board enhancements, pressure on profit margins is a risk that should not be ignored. Loews' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Loews - why the stock might be worth as much as $98.35!

Build Your Own Loews Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loews research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Loews research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loews' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com