- Earlier this month, Allegiant Travel Company announced the launch of five new nonstop routes connecting eight cities, including new service to Huntsville, Alabama, supported by introductory one-way fares as low as US$39.

- This expansion arrives alongside recent quarterly results that highlighted higher passenger volumes but continued net losses, as well as updated earnings guidance reflecting ongoing operational and financial pressures.

- We'll explore how Allegiant's network expansion, paired with updated earnings guidance, shapes its investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Allegiant Travel Investment Narrative Recap

To be a shareholder of Allegiant Travel, you need to believe that value-focused leisure travel demand in mid-sized cities can support profitable growth, despite operational volatility. The recent announcement of five new low-fare nonstop routes could help strengthen passenger momentum, but near-term catalysts still hinge on shifting travel demand and the company's ability to manage persistent loss-making quarters; short-term risks remain, especially around profitability and the timely return of consumer discretionary spending. At this stage, the impact of new route launches on immediate earnings, while positive for competitive positioning, does not materially change the core risk of uneven demand and continued net losses.

Among the latest announcements, the updated third-quarter and full-year earnings guidance is most relevant, as it directly outlines management's view on profitability amid ongoing cost pressures and the transition away from Sunseeker Resort. While airline-only earnings are expected to be positive for 2025, consolidated guidance still factors in losses, reinforcing the importance of operational execution in the face of rising costs and uncertain demand recovery.

Yet, even as Allegiant expands its route network, investors should be aware of the unpredictability around…

Read the full narrative on Allegiant Travel (it's free!)

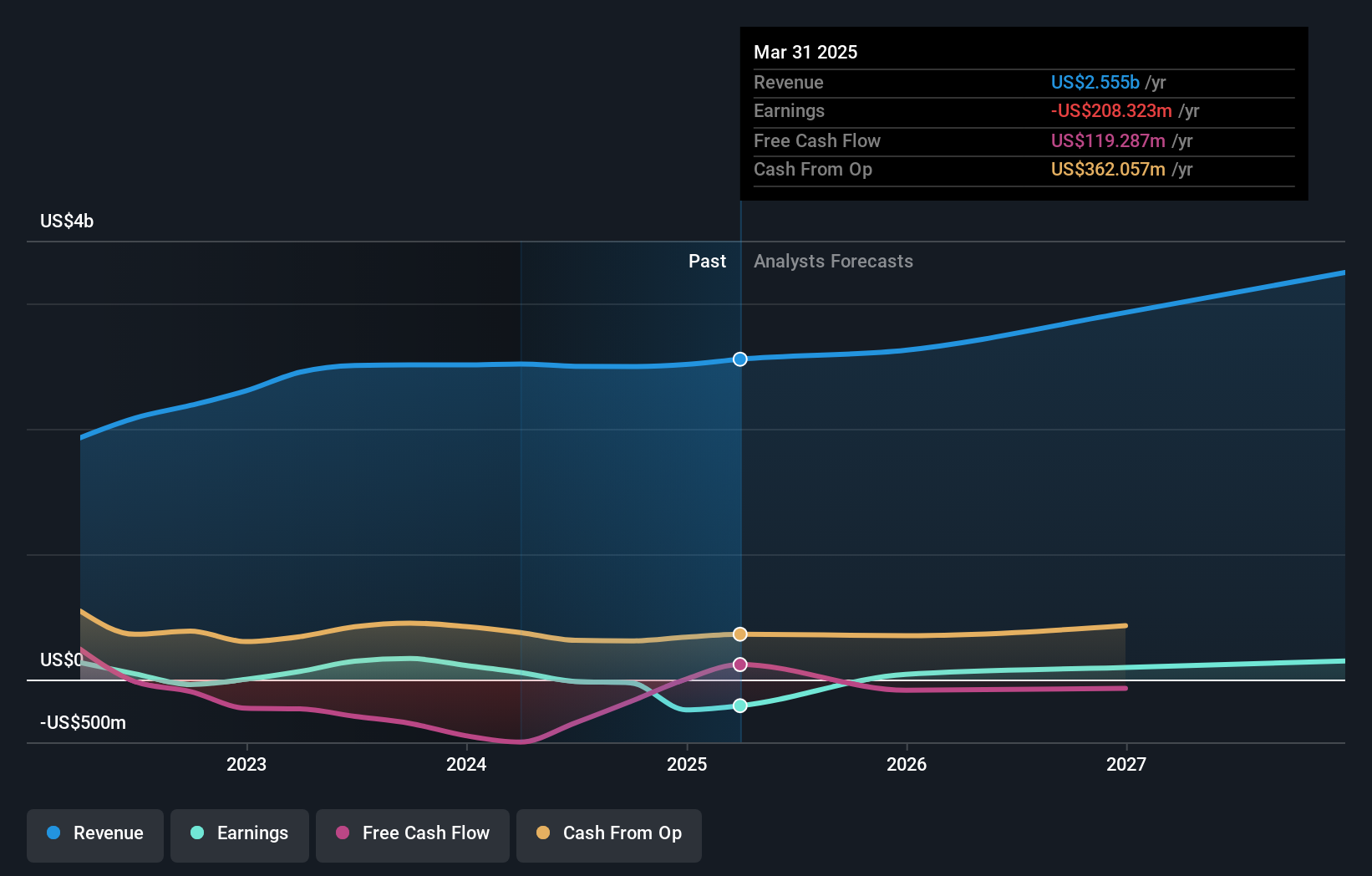

Allegiant Travel's outlook anticipates $3.2 billion in revenue and $263.8 million in earnings by 2028. This scenario requires 7.0% annual revenue growth and a $549.9 million increase in earnings from the current $-286.1 million.

Uncover how Allegiant Travel's forecasts yield a $60.92 fair value, in line with its current price.

Exploring Other Perspectives

Three estimates from the Simply Wall St Community put Allegiant's fair value anywhere from US$3.92 to US$100 per share. With new low-fare routes announced, questions remain about whether travel demand can recover quickly enough to support profitability and more optimistic investor outlooks.

Explore 3 other fair value estimates on Allegiant Travel - why the stock might be worth less than half the current price!

Build Your Own Allegiant Travel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allegiant Travel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allegiant Travel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allegiant Travel's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com