- Main Street Capital Corporation recently reported strong second-quarter and first-half 2025 earnings, with revenue increasing to US$143.97 million and net income rising to US$122.53 million for the quarter compared to the prior year.

- The company also announced a 4.1% increase in regular monthly dividends for the fourth quarter of 2025 and a supplemental cash dividend of US$0.30 per share, reflecting ongoing emphasis on shareholder returns.

- With strong earnings and increased regular dividends, we'll examine how Main Street Capital’s dividend policy shapes its investment narrative now.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Main Street Capital Investment Narrative Recap

To own Main Street Capital, one must have confidence in its ability to consistently generate income through diversified lending and equity investments, distributing that income as reliable dividends. The latest earnings and increased dividend announcements reinforce short-term optimism, but do not diminish the primary catalyst: sustained growth in high-quality lower middle market investments. At the same time, the biggest risk, potential instability from a less diversified investment base as the middle market portfolio declines, remains unchanged by recent news.

Of the recent announcements, the 4.1% increase in regular monthly dividends stands out, reflecting Main Street Capital’s ongoing commitment to steady shareholder payouts despite ongoing changes in its portfolio mix. This decision to raise dividends supports the positive catalyst of continued deal flow in the lower middle market, which may underpin regular returns moving forward.

However, investors should be alert to the risk that as focus shifts away from the middle market, income stability could come under pressure if...

Read the full narrative on Main Street Capital (it's free!)

Main Street Capital's narrative projects $611.1 million in revenue and $227.4 million in earnings by 2028. This requires 4.9% yearly revenue growth and a $245.5 million decrease in earnings from $472.9 million currently.

Uncover how Main Street Capital's forecasts yield a $56.25 fair value, a 17% downside to its current price.

Exploring Other Perspectives

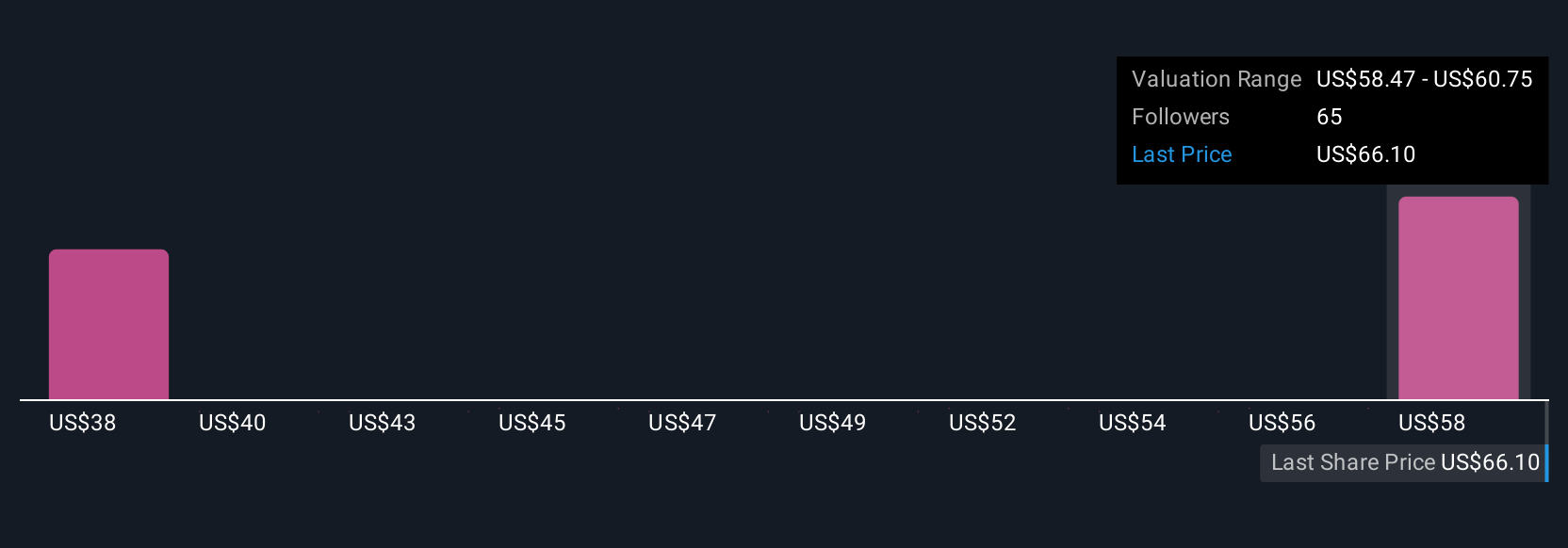

Seven community members on Simply Wall St pegged Main Street Capital’s fair value as low as US$37.97 and as high as US$59.75. These varying opinions frame ongoing debate, especially as the company’s evolving investment mix could impact earnings stability going forward.

Explore 7 other fair value estimates on Main Street Capital - why the stock might be worth 44% less than the current price!

Build Your Own Main Street Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Main Street Capital research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Main Street Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Main Street Capital's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com