- Frontier Group Holdings recently announced its second quarter 2025 earnings, reporting revenue of US$929 million and a net loss of US$70 million, compared to a net income of US$31 million in the same period last year.

- This marks a significant reversal from last year’s profitability, highlighting a challenging period marked by declining revenue and a shift to negative earnings.

- To assess how a swing from profit to loss impacts Frontier’s investment outlook, we’ll review implications for its growth and margin expectations.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Frontier Group Holdings Investment Narrative Recap

Being a Frontier Group Holdings shareholder means believing in the business’s ability to rebound through demand recovery in its core leisure travel segments and effectively control costs, especially during periods of operational headwinds. The recent swing to a net loss underscores how weakened demand and persistent capacity oversupply can weigh down short-term catalysts such as margin improvement, while increasing the risk that unabsorbed fixed costs could keep profitability under pressure. However, the most significant risk, ongoing revenue pressures if capacity normalization is delayed, remains as relevant as ever in light of these results.

Of the recent announcements, customer experience enhancements like the rollout of First Class seating and new loyalty benefits stand out. These changes aim to engage higher-yield travelers and boost ancillary revenues, aligning Frontier’s product strategy with the need to offset pricing and demand challenges while supporting its long-term growth catalysts.

Yet, in contrast to product improvements, investors should be aware that significant fixed costs from surplus staffing and underutilized aircraft may…

Read the full narrative on Frontier Group Holdings (it's free!)

Frontier Group Holdings' outlook anticipates $4.9 billion in revenue and $253.5 million in earnings by 2028. This scenario requires 9.4% annual revenue growth and a $287.5 million earnings increase from current earnings of -$34.0 million.

Uncover how Frontier Group Holdings' forecasts yield a $4.72 fair value, in line with its current price.

Exploring Other Perspectives

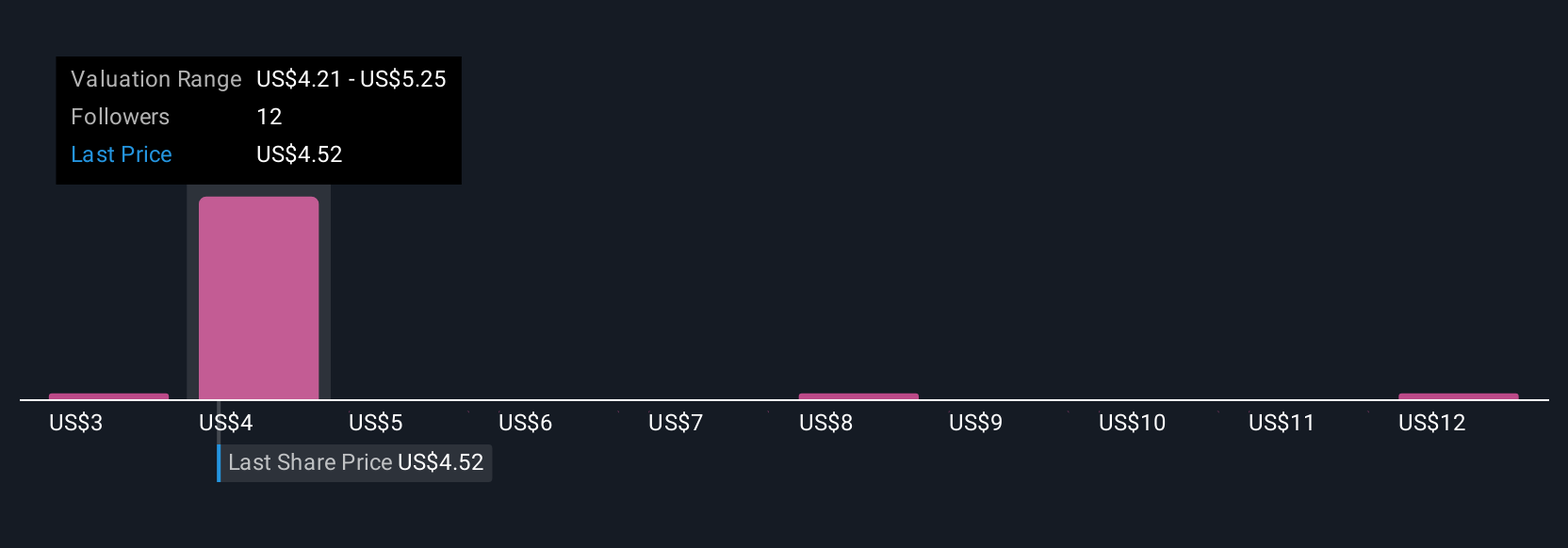

Simply Wall St Community members provided four fair value estimates for Frontier stock, from US$3.18 to US$13.52 per share. While many see upside, the company’s reliance on leisure demand amid ongoing industry oversupply shows why opinions differ so widely.

Explore 4 other fair value estimates on Frontier Group Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Frontier Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontier Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Frontier Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontier Group Holdings' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com