- TransAct Technologies recently announced it acquired a perpetual, royalty-free license to the BOHA! software source code from Avery Dennison for US$2.55 million, plus US$1.0 million in professional services for transition support.

- This agreement gives TransAct full rights to use, modify, sublicense, and distribute the technology, highlighting Avery Dennison's evolving approach to software and technology partnerships.

- We'll explore how Avery Dennison’s decision to license out core BOHA! software assets could impact its overall growth outlook and innovation strategy.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

Avery Dennison Investment Narrative Recap

To have conviction in Avery Dennison, investors must believe in the company’s ability to drive innovation and grow beyond its core exposures, especially as the Intelligent Labels platform faces muted demand in apparel and retail. The recent licensing of core BOHA! software to TransAct Technologies, while reflecting a flexible approach to non-core assets, does not materially impact near-term growth catalysts or alter the principal risk: continued weakness in sales from slow-growing retail and apparel markets.

The most relevant recent announcement is Avery Dennison’s Q2 2025 results, which showed net income growth despite slightly lower revenue. This underscores how the company is delivering operational resilience and margin gains, even as key legacy markets remain challenging. For investors, this track record ties closely to the current focus on expanding into higher-growth and more diversified segments outside of traditional retail.

Yet, with competitive threats from new digital tracking technologies intensifying, investors should be conscious of risks that...

Read the full narrative on Avery Dennison (it's free!)

Avery Dennison's narrative projects $9.8 billion revenue and $909.0 million earnings by 2028. This requires 4.0% yearly revenue growth and a $198 million earnings increase from current earnings of $711.0 million.

Uncover how Avery Dennison's forecasts yield a $195.25 fair value, a 9% upside to its current price.

Exploring Other Perspectives

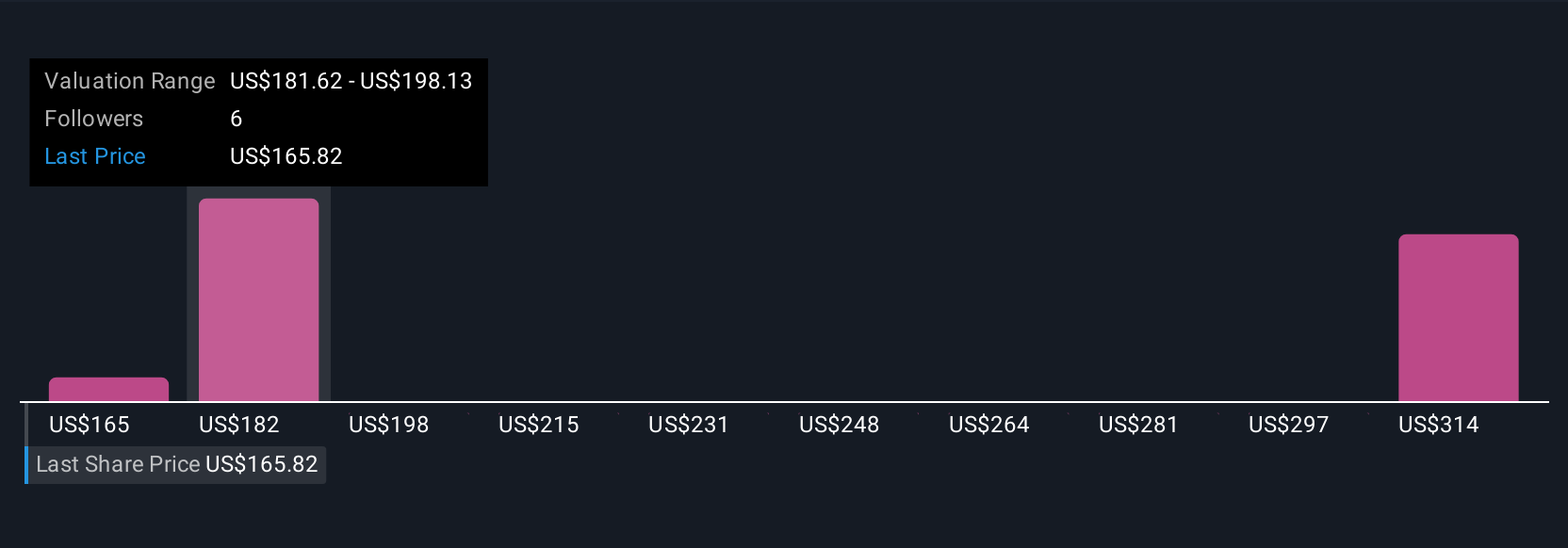

Three Simply Wall St Community valuations range from US$165.12 to US$307.04 per share. While some see substantial potential, others are more cautious given the Intelligent Labels platform’s heavy reliance on weaker retail channels.

Explore 3 other fair value estimates on Avery Dennison - why the stock might be worth as much as 71% more than the current price!

Build Your Own Avery Dennison Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avery Dennison research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Avery Dennison research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avery Dennison's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com