- Chord Energy Corporation recently reported a net loss of US$389.91 million and a year-over-year decline in revenue to US$1.18 billion for the second quarter ended June 30, 2025, while announcing updated production guidance, a new US$1 billion share repurchase program, and a maintained US$1.30 per share dividend.

- Despite weaker earnings, the company’s decision to authorize a significant buyback and uphold its dividend highlights a commitment to returning capital to shareholders during a challenging period.

- We'll examine how the weaker-than-expected earnings and new US$1 billion buyback initiative influence Chord Energy's investment narrative going forward.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Chord Energy Investment Narrative Recap

To be a Chord Energy shareholder, you need to believe in management's ability to generate consistent free cash flow and return capital, even in volatile markets and during periods of one-off losses. The recent Q2 2025 report, with a net loss and weaker revenue, does not materially alter the short-term catalyst: improving operational efficiency using longer laterals and advanced analytics remains key, while rapid production decline rates in unconventional wells continue to be the most immediate risk.

Among the latest announcements, the new US$1 billion share repurchase program stands out. In light of recent losses, the move to initiate a fresh buyback program alongside sustained dividends highlights the company's focus on capital returns despite ongoing margin and efficiency pressures, reinforcing shareholder value as a central theme amidst current headwinds.

However, what may concern investors most is that, despite capital returns, the underlying challenge of high production decline rates remains a key issue to watch in coming quarters...

Read the full narrative on Chord Energy (it's free!)

Chord Energy's outlook anticipates $4.5 billion in revenue and $958.3 million in earnings by 2028. This implies a 3.1% annual revenue decline and an increase in earnings of $692.6 million from the current $265.7 million.

Uncover how Chord Energy's forecasts yield a $133.47 fair value, a 32% upside to its current price.

Exploring Other Perspectives

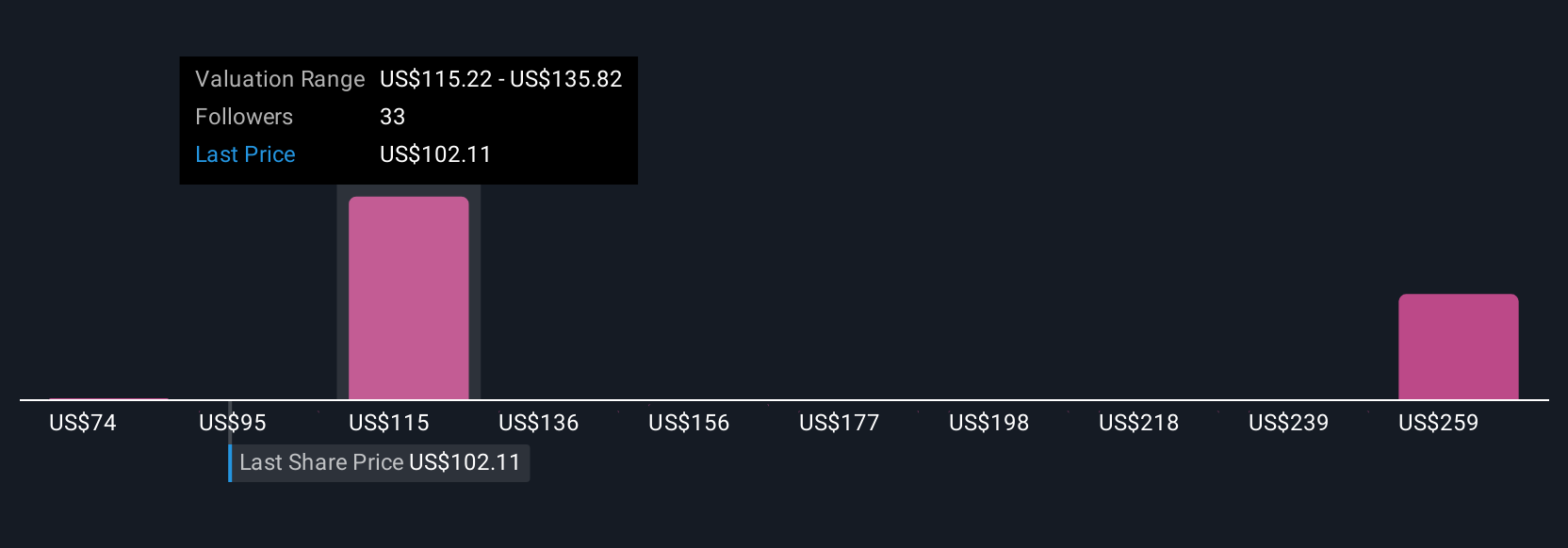

The Simply Wall St Community supplied five fair value estimates for Chord Energy that range from US$74 to just under US$284 per share, offering widely varying views on current pricing. Opinions differ sharply on the outlook, with many still weighing how persistent drilling risks may impact future returns and capital allocation, explore the full set of perspectives to see where you fit in.

Explore 5 other fair value estimates on Chord Energy - why the stock might be worth 27% less than the current price!

Build Your Own Chord Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chord Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Chord Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chord Energy's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com