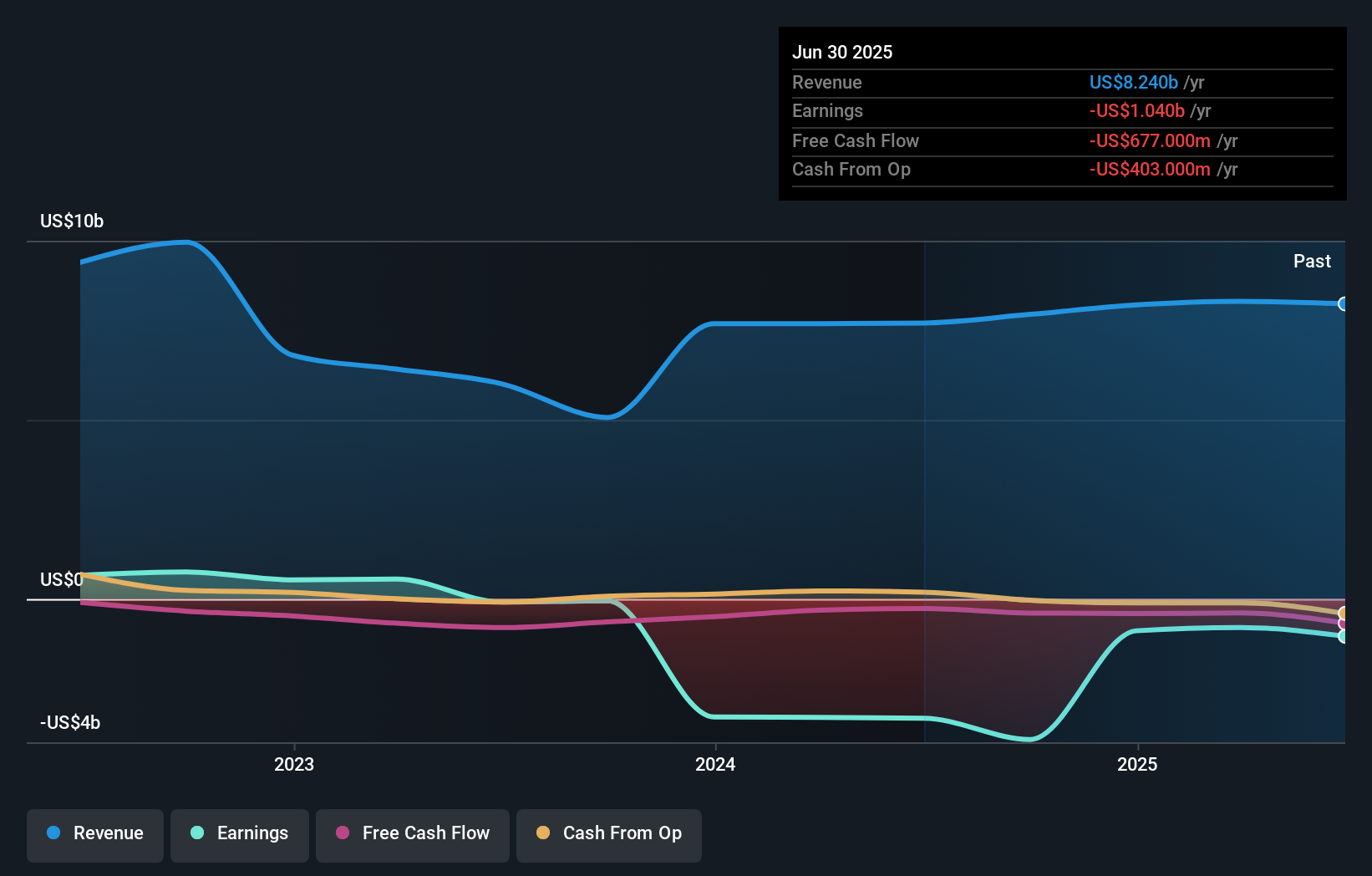

- Brookfield Business Corporation recently reported its earnings for the second quarter ended June 30, 2025, posting sales of US$1,860 million and a net loss of US$120 million, alongside a quarterly dividend declaration of US$0.0625 per share.

- Compared to the previous year, the company swung from profitability to a quarterly loss, reflecting both declining sales and broader financial challenges in the period.

- We’ll examine how Brookfield Business Corporation’s shift to a net loss during the quarter shapes its current investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Brookfield Business' Investment Narrative?

To back Brookfield Business Corporation as a shareholder right now, you’d need to see an eventual path back to profitability, despite the challenging string of losses highlighted by its recent earnings. This quarter’s swing from profit to a US$120 million loss aligns with a year of rising losses, yet steady revenue and ongoing dividends show the company hasn’t made abrupt shifts in policy. For most short-term catalysts, such as share buybacks and index inclusions, the latest earnings setback is a red flag but not an immediate disruption: price moves remain relatively steady and repurchase activity continues. However, the compounding net losses and widening negative return on equity now pose a bigger risk to the thesis, as they add pressure on the company’s cash position and ability to sustain dividends longer term. The story for investors has shifted, there’s a sharper focus on the risks of prolonged unprofitability and declining sales momentum. But with these larger and more sustained losses, cash runway concerns might intensify, investors should be watchful for shifts on that front.

Brookfield Business' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Brookfield Business - why the stock might be worth less than half the current price!

Build Your Own Brookfield Business Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Business research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Brookfield Business research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Business' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com