- Cummins Inc. recently reported its second quarter 2025 results, revealing quarterly sales of US$8.64 billion, a slight decline from the prior year, alongside an increase in net income to US$890 million.

- While sales for both the quarter and first half of the year declined, improved quarterly net income and earnings per share highlighted efforts to maintain profitability despite softer demand.

- We'll explore how Cummins' improved second-quarter profitability, even with lower sales, may influence its investment outlook and margin assumptions.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cummins Investment Narrative Recap

To be a Cummins shareholder, you need confidence in the company’s ability to defend profit margins, despite headwinds in core North American truck markets and ongoing regulatory and competitive pressure in power systems and zero-emissions businesses. The most recent financial results do not materially impact the near-term outlook: while second quarter sales declined, profitability held firm, suggesting active cost management still provides some stability. The biggest immediate catalyst remains the performance and margin resilience of the diversified Power Systems segment, while the main risk continues to be prolonged demand weakness in Cummins’ traditional engine markets.

Among the recent announcements, Cummins’ completion of a multi-year share buyback, without additional repurchases in the latest quarter, catches my attention. With repurchases paused for now, shareholders may shift their focus more squarely to operational execution and near-term earnings performance, as margin resilience in challenging conditions takes on greater importance.

Yet, as earnings steadied, there’s still the question of what happens if North American truck demand remains weak for longer than anticipated, something every investor should be aware of...

Read the full narrative on Cummins (it's free!)

Cummins' outlook anticipates $40.6 billion in revenue and $4.3 billion in earnings by 2028. This scenario is based on a 6.3% annual revenue growth rate and a $1.4 billion earnings increase from the current $2.9 billion.

Uncover how Cummins' forecasts yield a $407.18 fair value, in line with its current price.

Exploring Other Perspectives

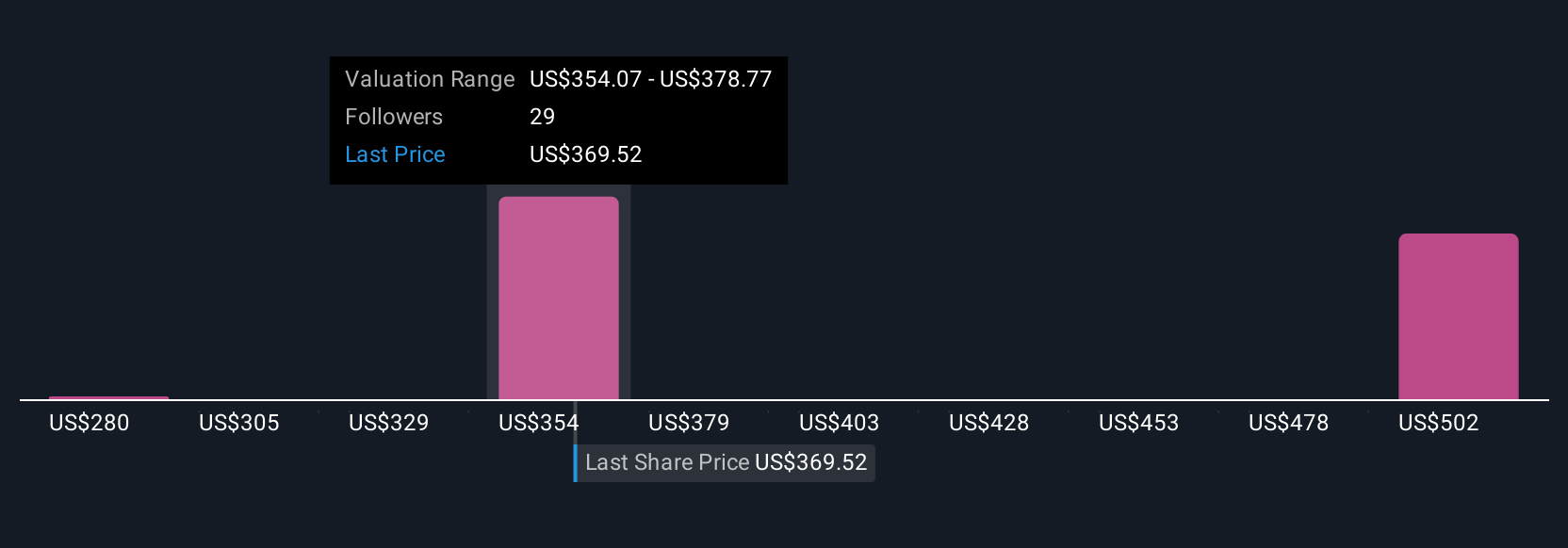

Our Simply Wall St Community contributors estimate fair values ranging from US$280 to US$640 for Cummins, across four perspectives. With Power Systems margin resilience seen as a key catalyst, this diversity of views underscores why you’ll want to explore several analyses before making your own call.

Explore 4 other fair value estimates on Cummins - why the stock might be worth 31% less than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com