- In the past week, Marathon Petroleum announced an expansion of its equity buyback authorization by US$1 billion to a total of US$51.1 billion and released second-quarter earnings reporting declines in sales, revenue, net income, and earnings per share year-over-year. The company also completed a share repurchase tranche worth US$692.09 million during the quarter, retiring over 4.76 million shares, highlighting its focus on shareholder returns despite softer financial results.

- Marathon's sizeable increase to its buyback program comes at a time when core earnings and revenue are under pressure, signaling confidence in the company's long-term outlook and capital allocation strategy.

- We'll examine how the buyback expansion amid softer quarterly earnings influences Marathon Petroleum's investment narrative and future outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Marathon Petroleum Investment Narrative Recap

To be a Marathon Petroleum shareholder, you need conviction that resilient US fuel demand, margin discipline, and disciplined capital returns will keep offsetting pressures from weak earnings and energy transition risks. The recent buyback expansion, despite lower second-quarter revenue and profit, does not materially alter the short-term outlook, where margin trends and refiners’ utilization rates remain the main catalyst, and demand decline is the key risk.

The most relevant announcement is the company’s decision to raise its share buyback authorization to US$51.1 billion, which, alongside retiring nearly five million shares last quarter, reinforces its capital return priorities at a time when financial results softened, the intersection of shareholder payouts and near-term profitability continues to shape performance expectations.

On the other hand, investors should keep in mind that persistent revenue declines pose a...

Read the full narrative on Marathon Petroleum (it's free!)

Marathon Petroleum is projected to reach $123.8 billion in revenue and $4.2 billion in earnings by 2028. This outlook assumes a 2.6% annual revenue decline and a $2.1 billion increase in earnings from the current $2.1 billion.

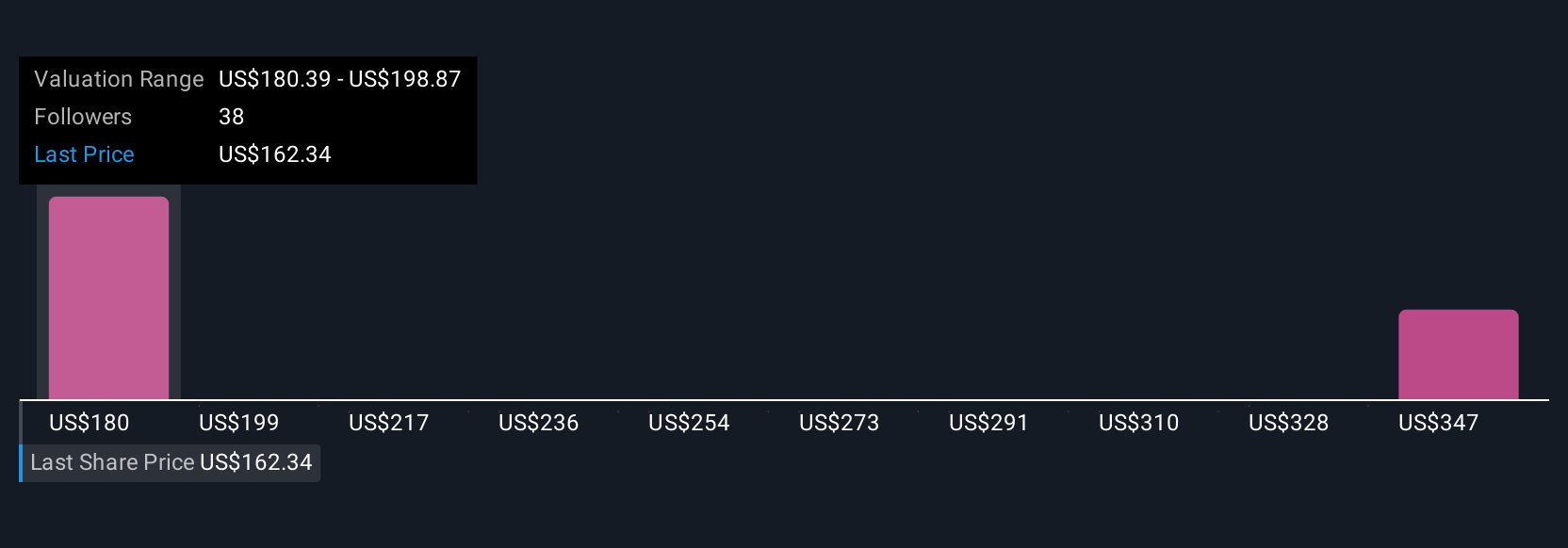

Uncover how Marathon Petroleum's forecasts yield a $180.39 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community valuations for Marathon Petroleum range widely from US$180.39 to US$363.53 per share. Some see continued share buybacks as a catalyst, but broader concerns about declining demand remain top of mind for many.

Explore 4 other fair value estimates on Marathon Petroleum - why the stock might be worth just $180.39!

Build Your Own Marathon Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marathon Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marathon Petroleum's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com